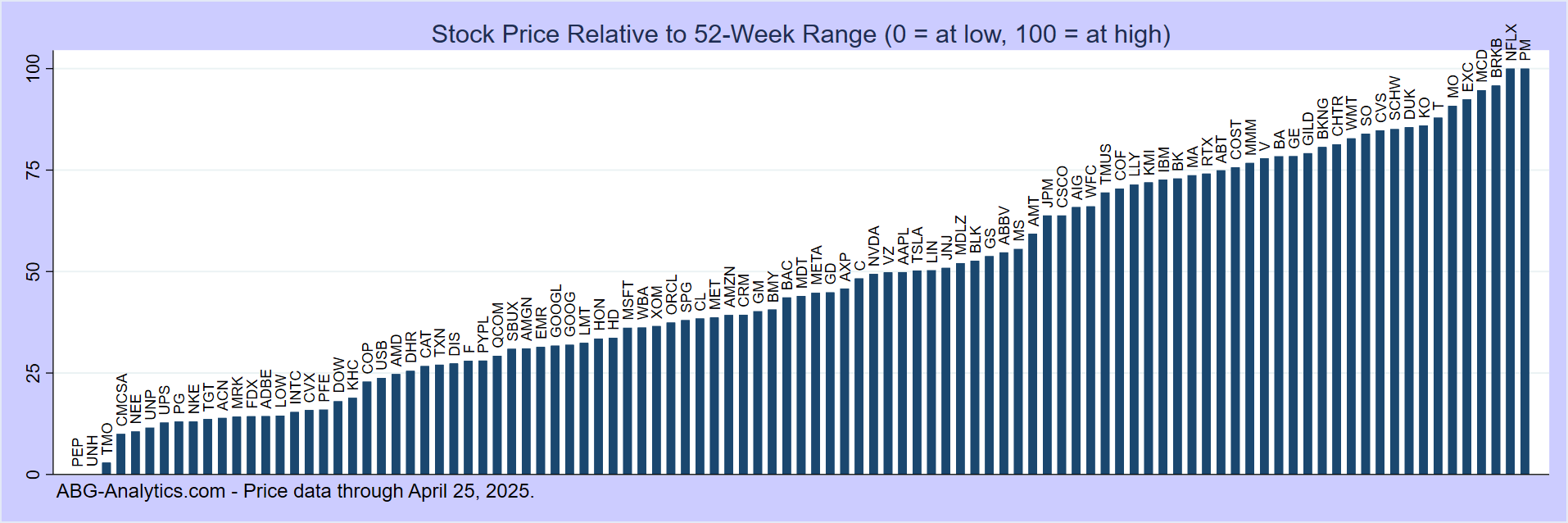

Stocks Trading Near 52-Week Highs and Lows

| Ticker - Company | Closing Price | 52-Week Low | 52-Week High | Price Relative to 52 Week Range (0 to 100%) |

|---|---|---|---|---|

| ConocoPhillips (NYSE:COP) | $117.07 | $82.66 | $118.52 | 97% |

| Chevron Corp (NYSE:CVX) | $189.94 | $133.73 | $189.94 | 100% |

| Duke Energy Corp (NYSE:DUK) | $132.50 | $112.46 | $132.50 | 100% |

| Exelon Corporation (NASDAQ:EXC) | $49.36 | $42.20 | $49.47 | 99% |

| General Dynamics Corp (NYSE:GD) | $363.49 | $247.68 | $368.69 | 96% |

| Kinder Morgan Inc (NYSE:KMI) | $33.58 | $25.21 | $33.96 | 96% |

| Lockheed Martin Corp (NYSE:LMT) | $671.77 | $410.74 | $676.70 | 99% |

| Pfizer Inc (NYSE:PFE) | $27.05 | $21.59 | $27.73 | 90% |

| RTX Corporation (NYSE:RTX) | $209.76 | $113.75 | $212.16 | 98% |

| Southern Company (NYSE:SO) | $97.48 | $84.08 | $99.72 | 87% |

| Target Corporation (NYSE:TGT) | $120.79 | $83.68 | $120.80 | 100% |

| Verizon Communications (NYSE:VZ) | $51.12 | $38.40 | $51.20 | 99% |

No stocks this week are near 52-week lows.

Methods

- Stocks are deemed to be near their 52-week high (low) if they are within 3 percent of the high (low) or they achieved a new high (low) within the 5 most recent market days.

- Price relative to 52-week range is calculated as [log(price)-log(low price)]/[log(high price)-log(low price)]*100%. Thus a stock with a current price of $4 with a 52-week high of $8 and a 52-week low of $2 will have price relative to range of 50%.