Stock Price Chart Gallery

Quickly review stock charts for stocks that comprise the S&P 100.

Stocks are ordered from hightest to lowest on their one year percent change in price (12-month momentum).

Stock prices updated through market close on 04/19/2024

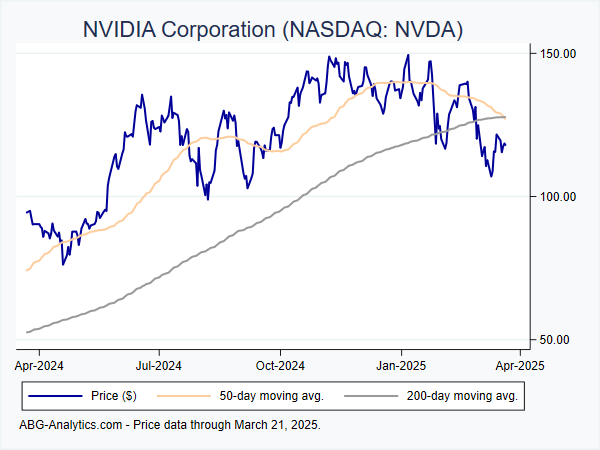

NVIDIA Corporation (NASDAQ:NVDA)

12-month return: 172.8%

12-month return: 172.8%

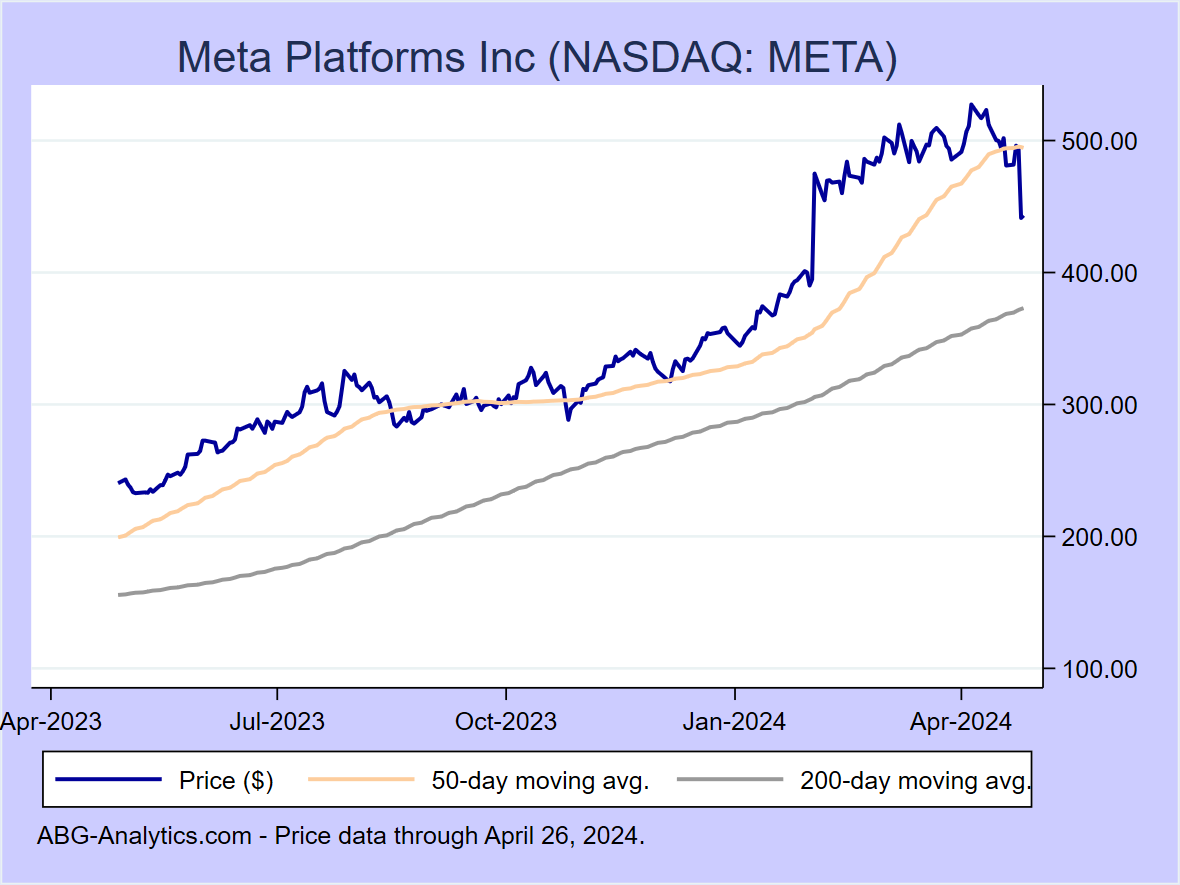

Meta Platforms Inc (NASDAQ:META)

12-month return: 123.0%

12-month return: 123.0%

Eli Lilly & Company (NYSE:LLY)

12-month return: 96.1%

12-month return: 96.1%

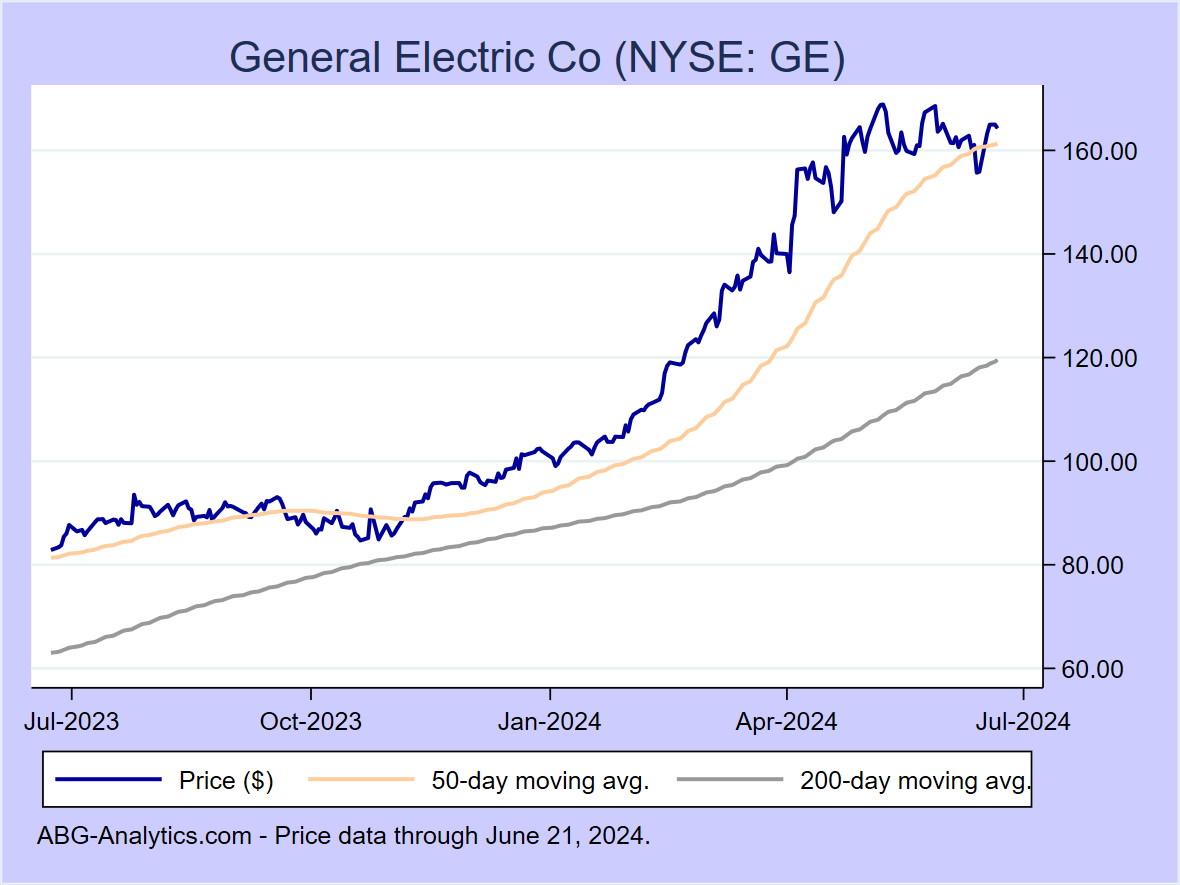

General Electric Co (NYSE:GE)

12-month return: 87.3%

12-month return: 87.3%

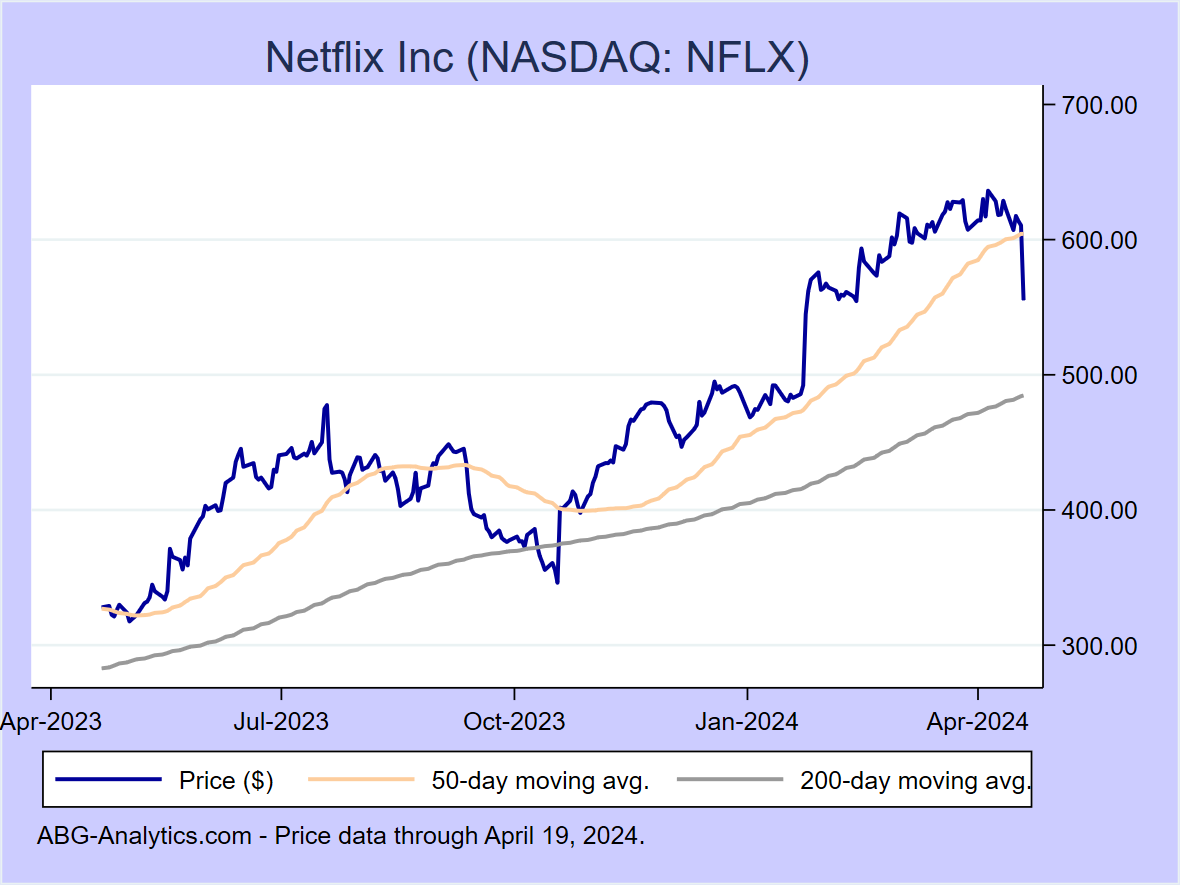

Netflix Inc (NASDAQ:NFLX)

12-month return: 71.8%

12-month return: 71.8%

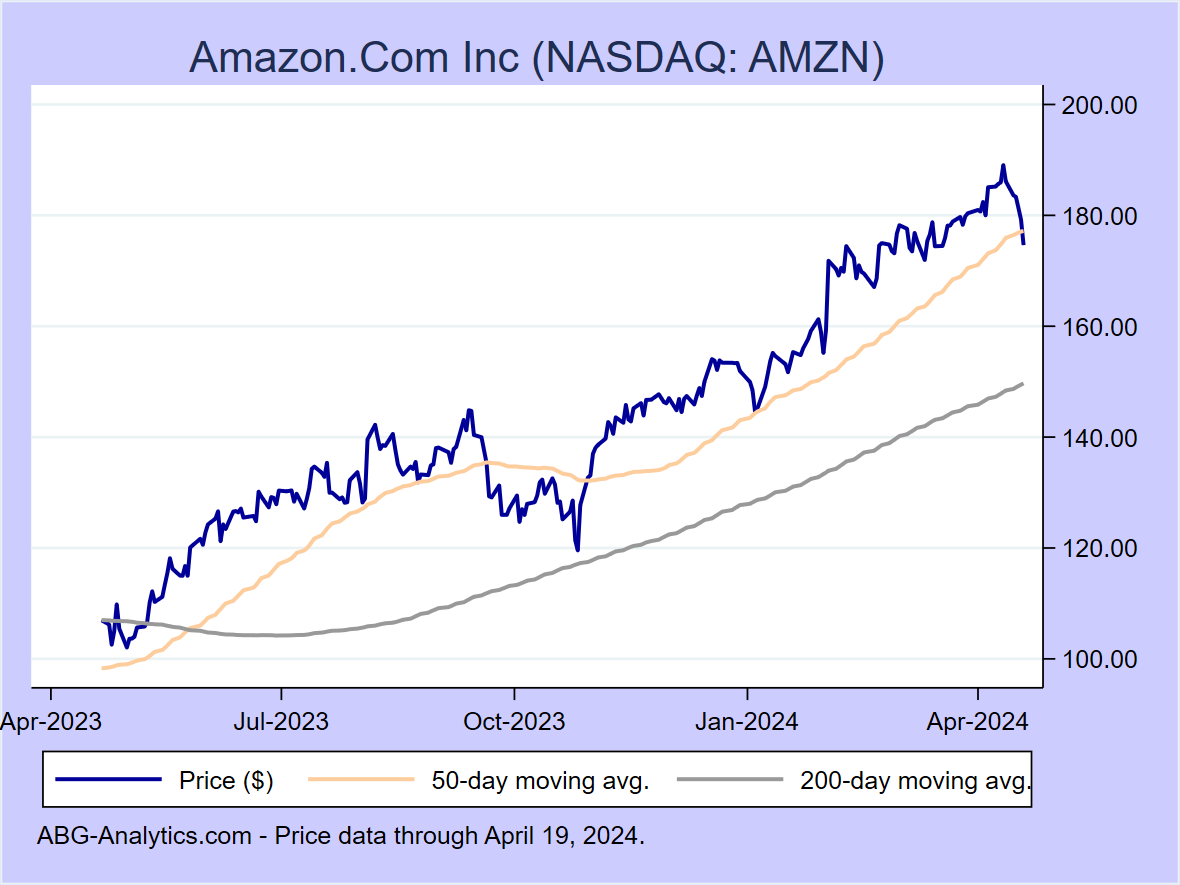

Amazon.Com Inc (NASDAQ:AMZN)

12-month return: 67.4%

12-month return: 67.4%

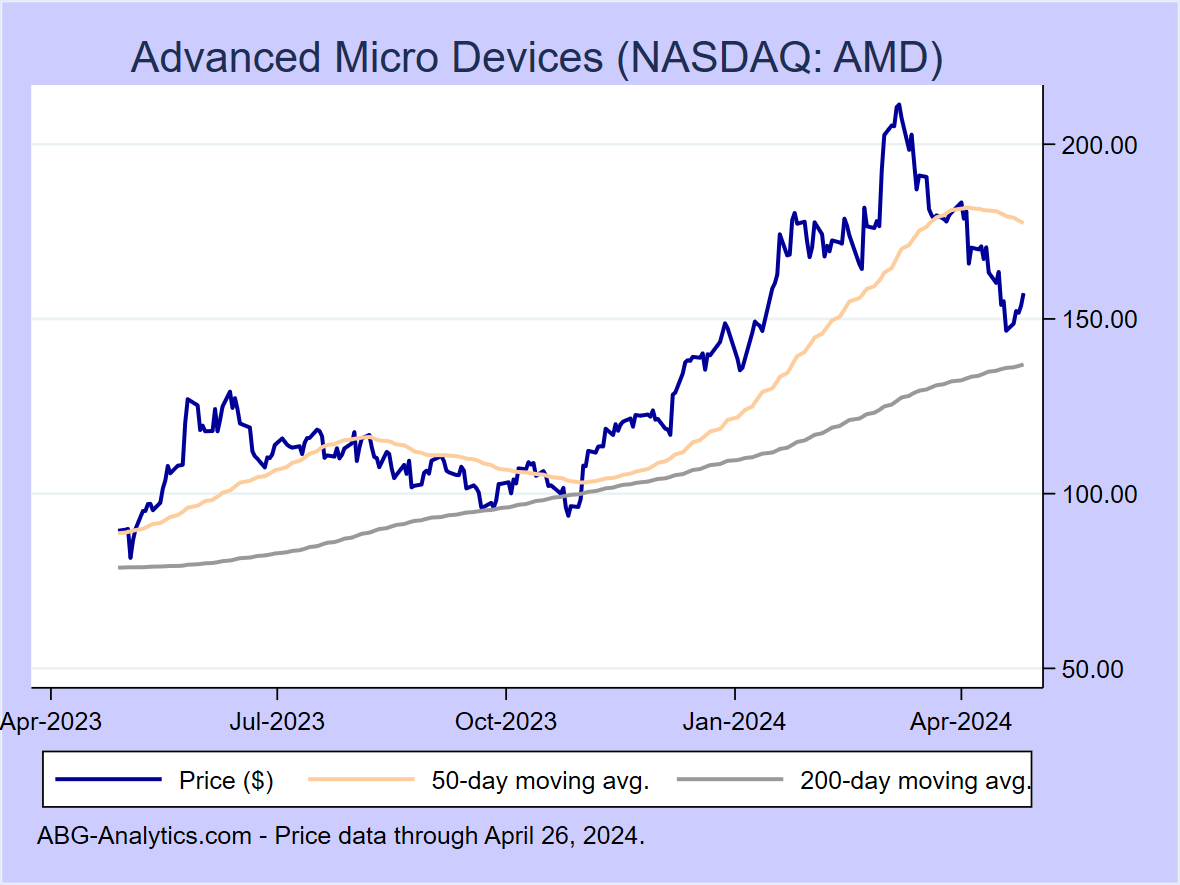

Advanced Micro Devices (NASDAQ:AMD)

12-month return: 63.0%

12-month return: 63.0%

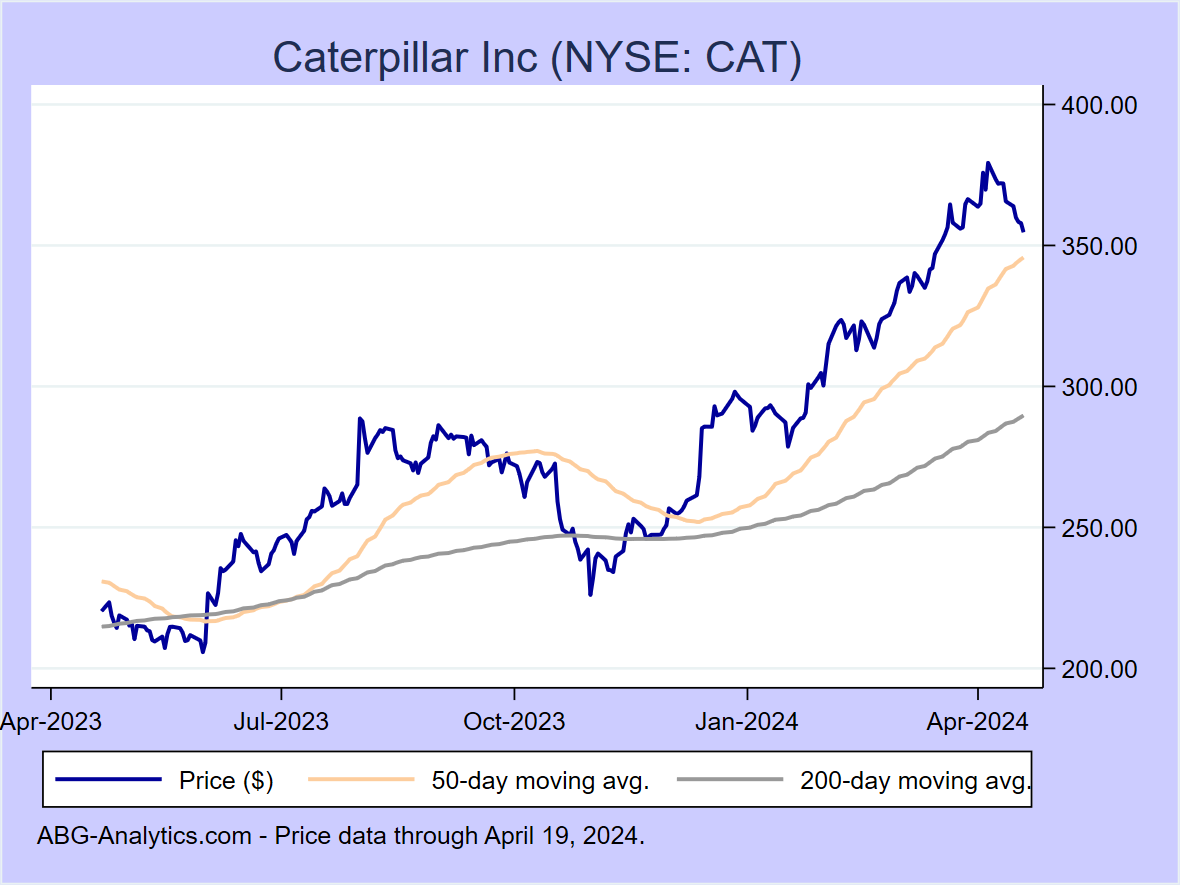

Caterpillar Inc (NYSE:CAT)

12-month return: 57.9%

12-month return: 57.9%

Alphabet Inc (NASDAQ:GOOG)

12-month return: 48.3%

12-month return: 48.3%

Alphabet Inc Class A (NASDAQ:GOOGL)

12-month return: 47.9%

12-month return: 47.9%

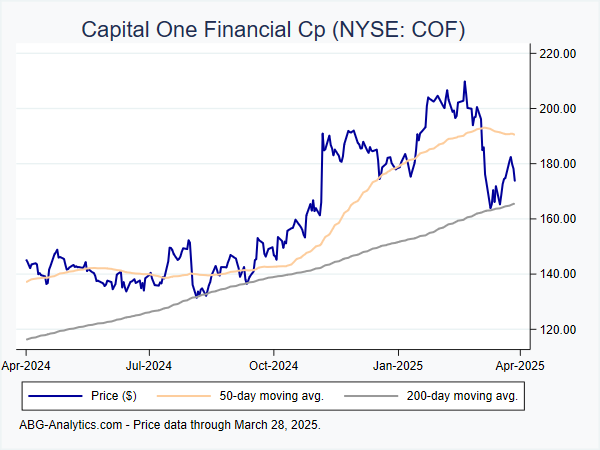

Capital One Financial Cp (NYSE:COF)

12-month return: 43.9%

12-month return: 43.9%

International Business Machines Corp (NYSE:IBM)

12-month return: 43.7%

12-month return: 43.7%

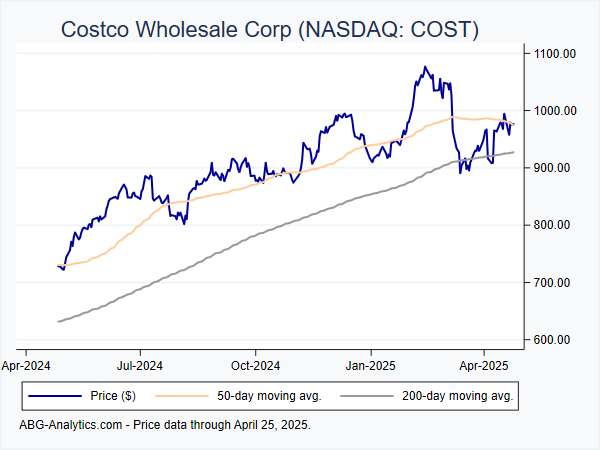

Costco Wholesale Corp (NASDAQ:COST)

12-month return: 43.0%

12-month return: 43.0%

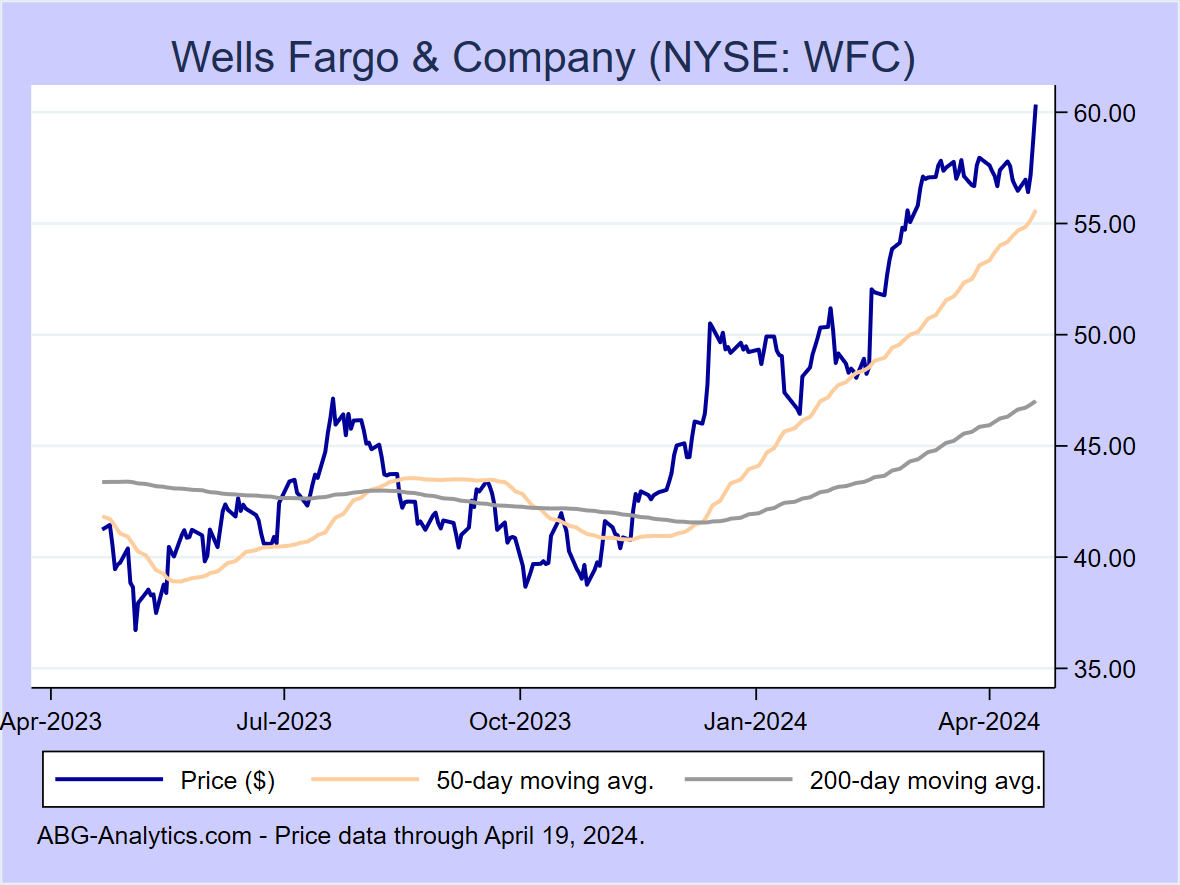

Wells Fargo & Company (NYSE:WFC)

12-month return: 42.9%

12-month return: 42.9%

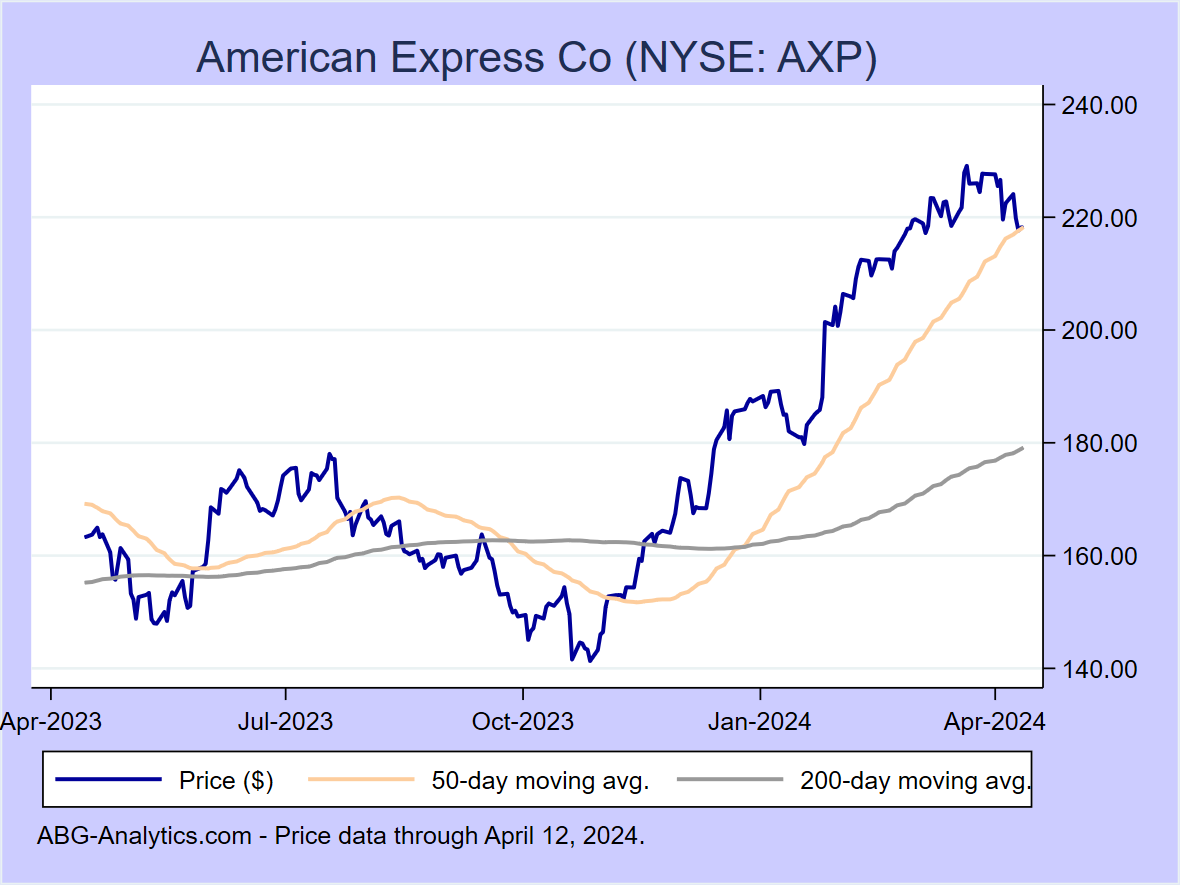

American Express Co (NYSE:AXP)

12-month return: 40.1%

12-month return: 40.1%

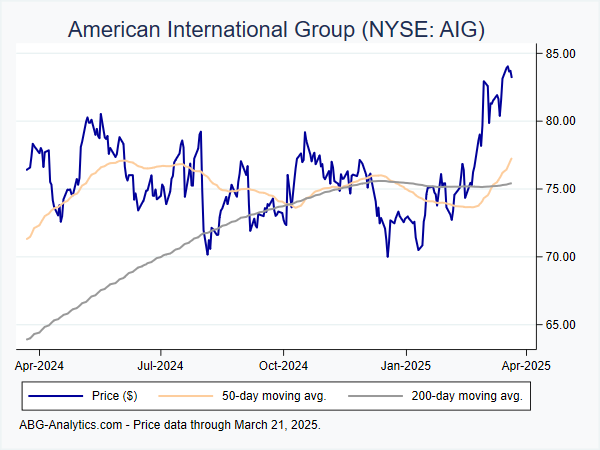

American International Group (NYSE:AIG)

12-month return: 39.6%

12-month return: 39.6%

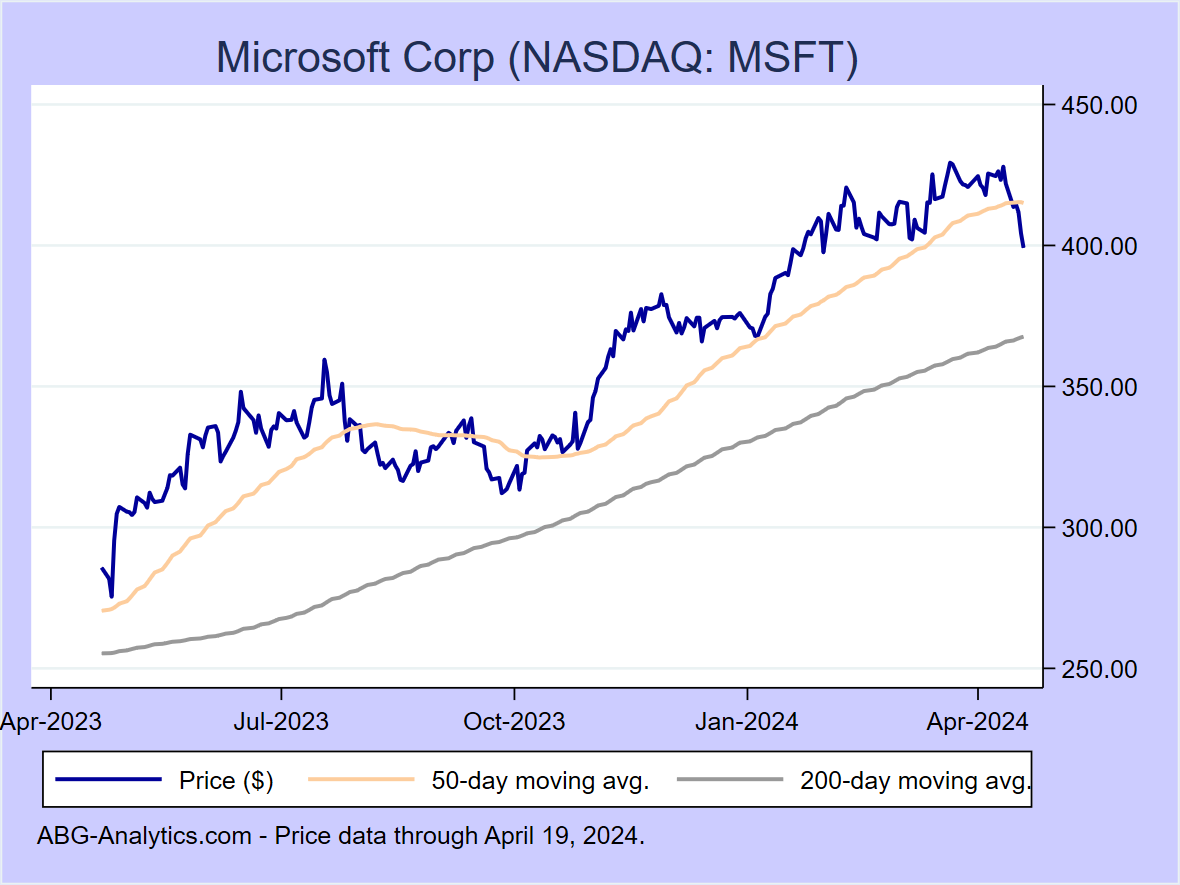

Microsoft Corp (NASDAQ:MSFT)

12-month return: 38.4%

12-month return: 38.4%

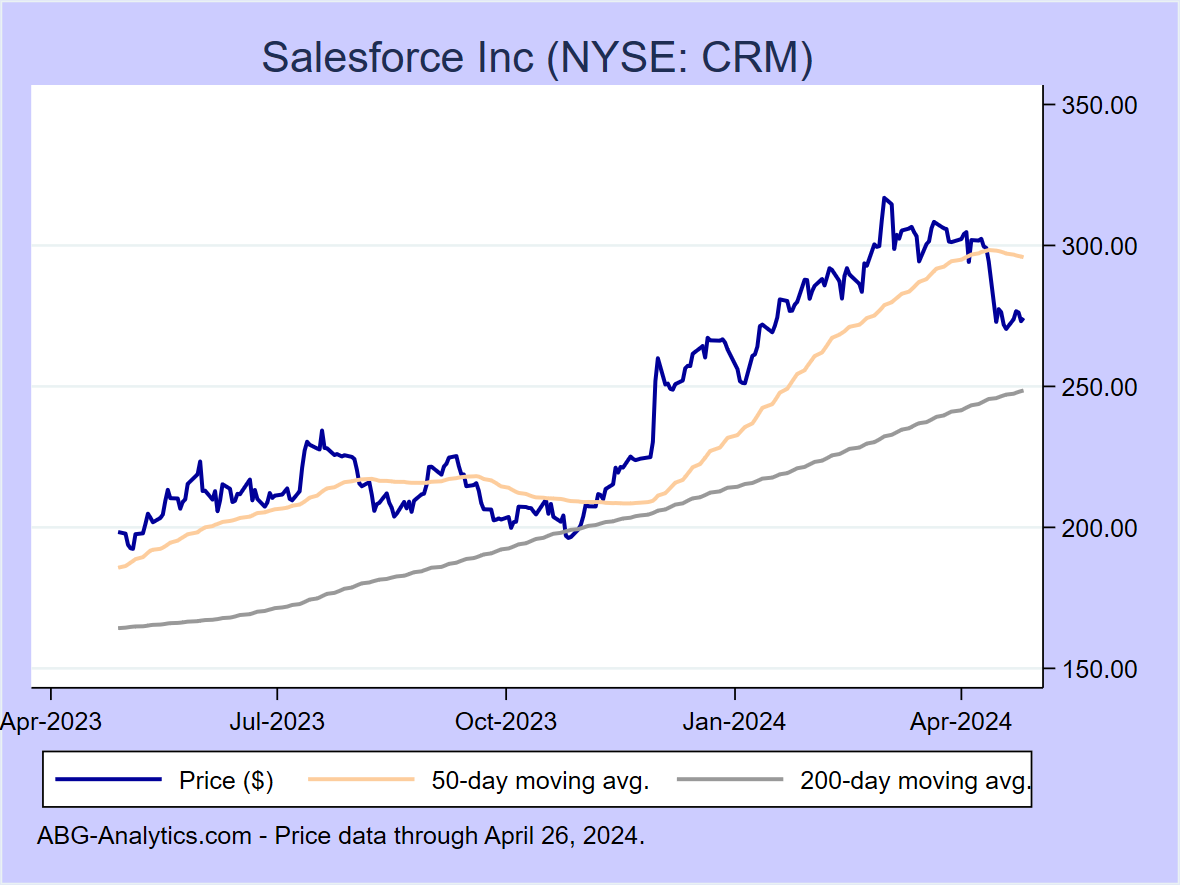

Salesforce Inc (NYSE:CRM)

12-month return: 35.9%

12-month return: 35.9%

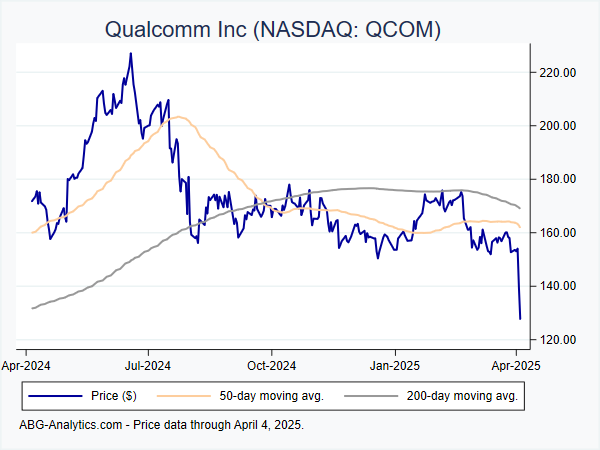

Qualcomm Inc (NASDAQ:QCOM)

12-month return: 33.0%

12-month return: 33.0%

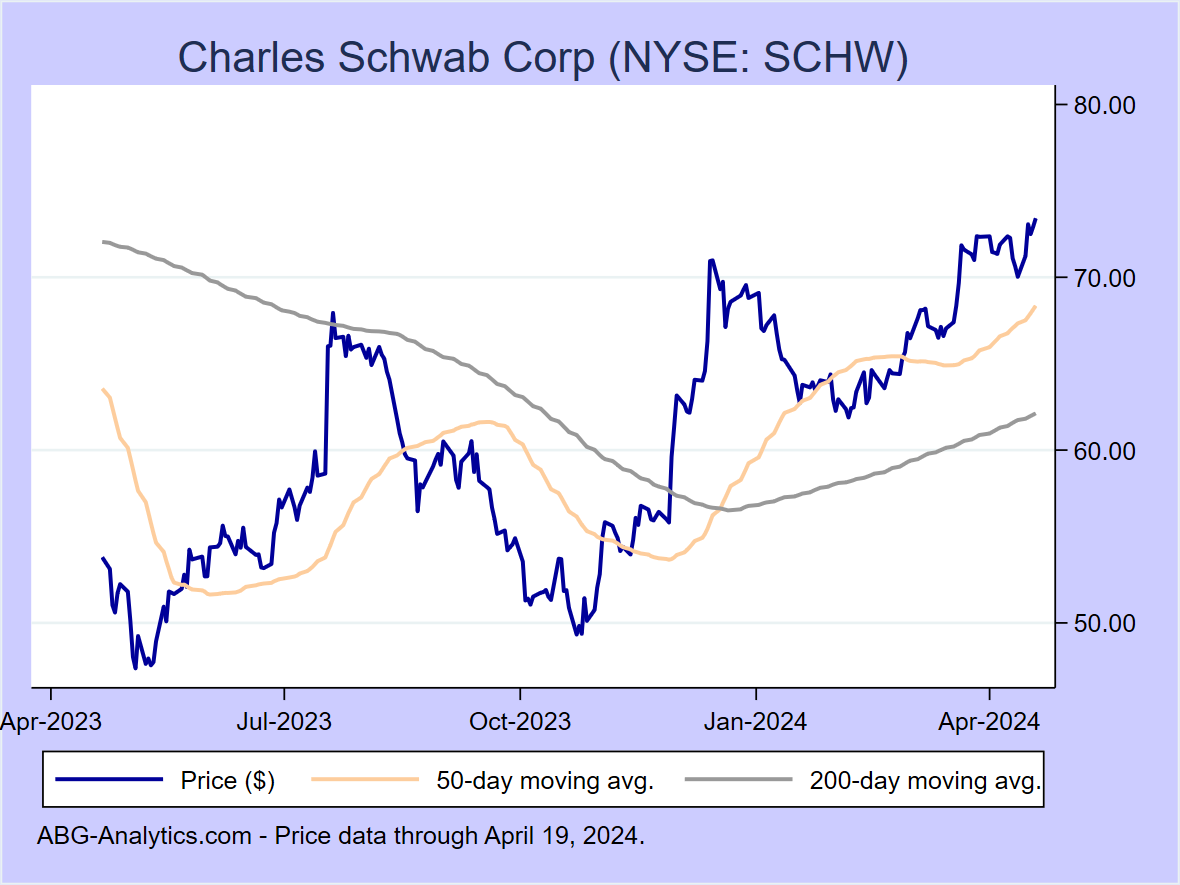

Charles Schwab Corp (NYSE:SCHW)

12-month return: 32.2%

12-month return: 32.2%

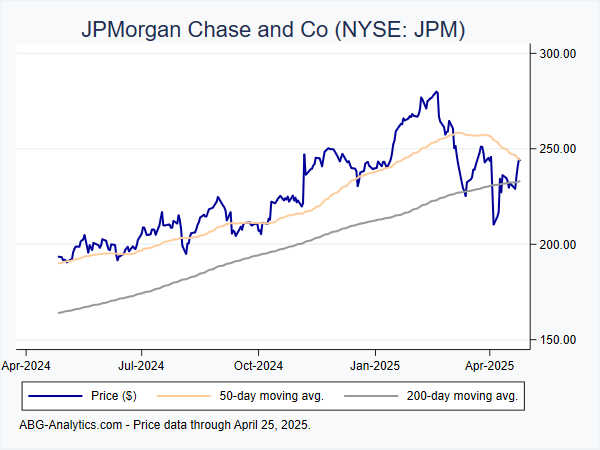

JPMorgan Chase and Co (NYSE:JPM)

12-month return: 31.6%

12-month return: 31.6%

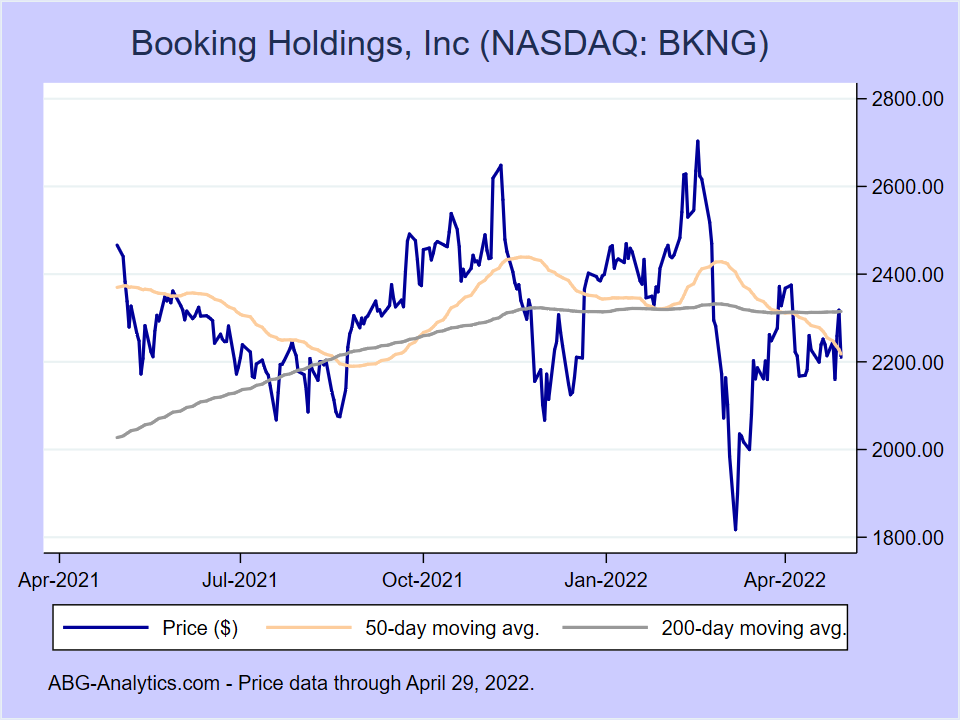

Booking Holdings Inc (NASDAQ:BKNG)

12-month return: 27.6%

12-month return: 27.6%

General Dynamics Corp (NYSE:GD)

12-month return: 26.1%

12-month return: 26.1%

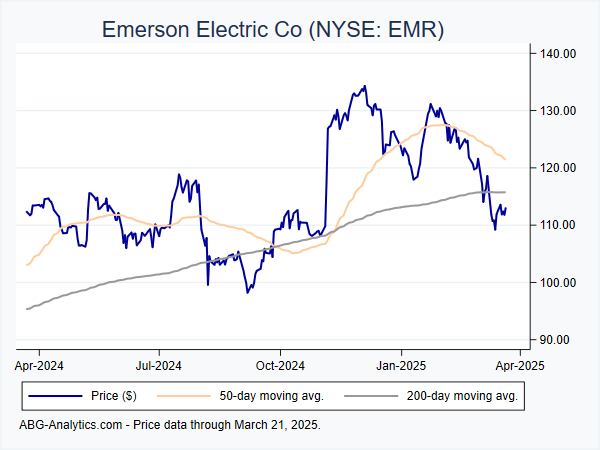

Emerson Electric Co (NYSE:EMR)

12-month return: 25.7%

12-month return: 25.7%

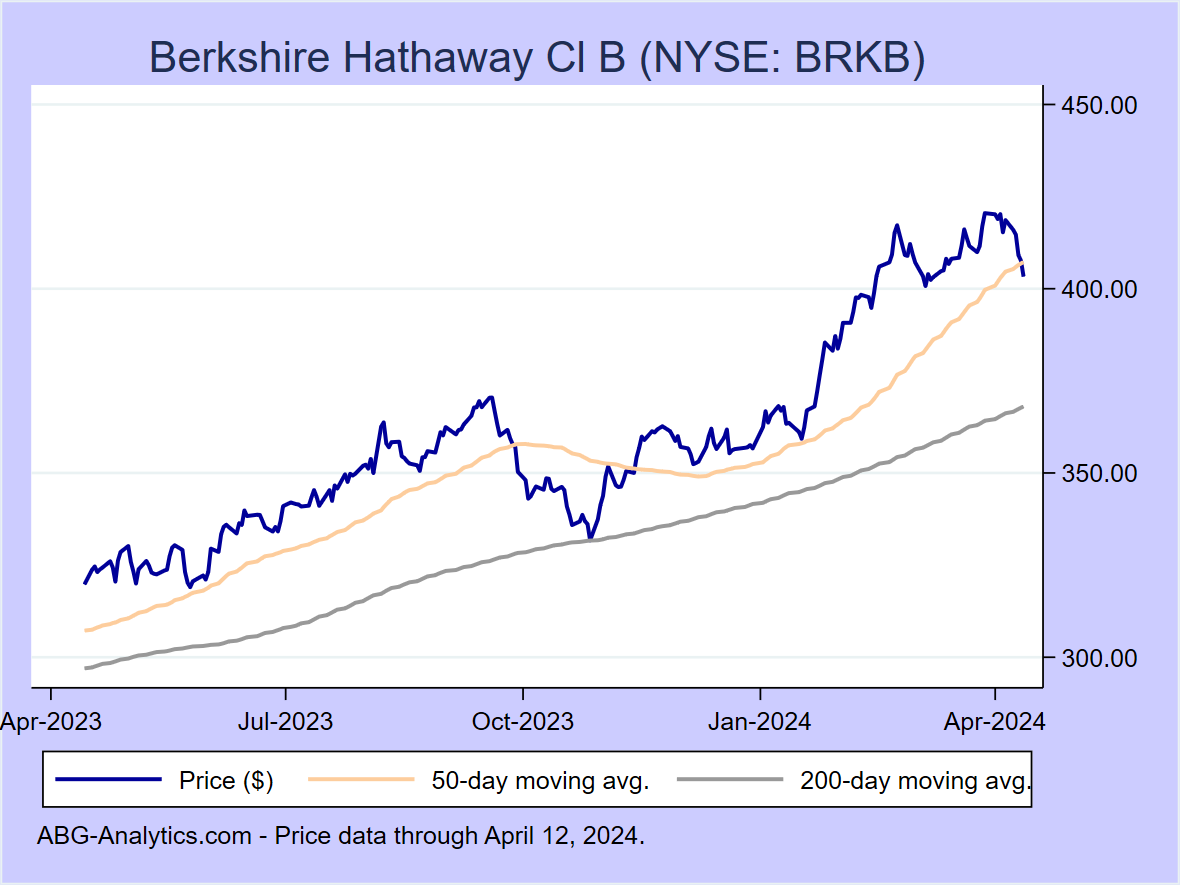

Berkshire Hathaway Cl B (NYSE:BRKB)

12-month return: 25.4%

12-month return: 25.4%

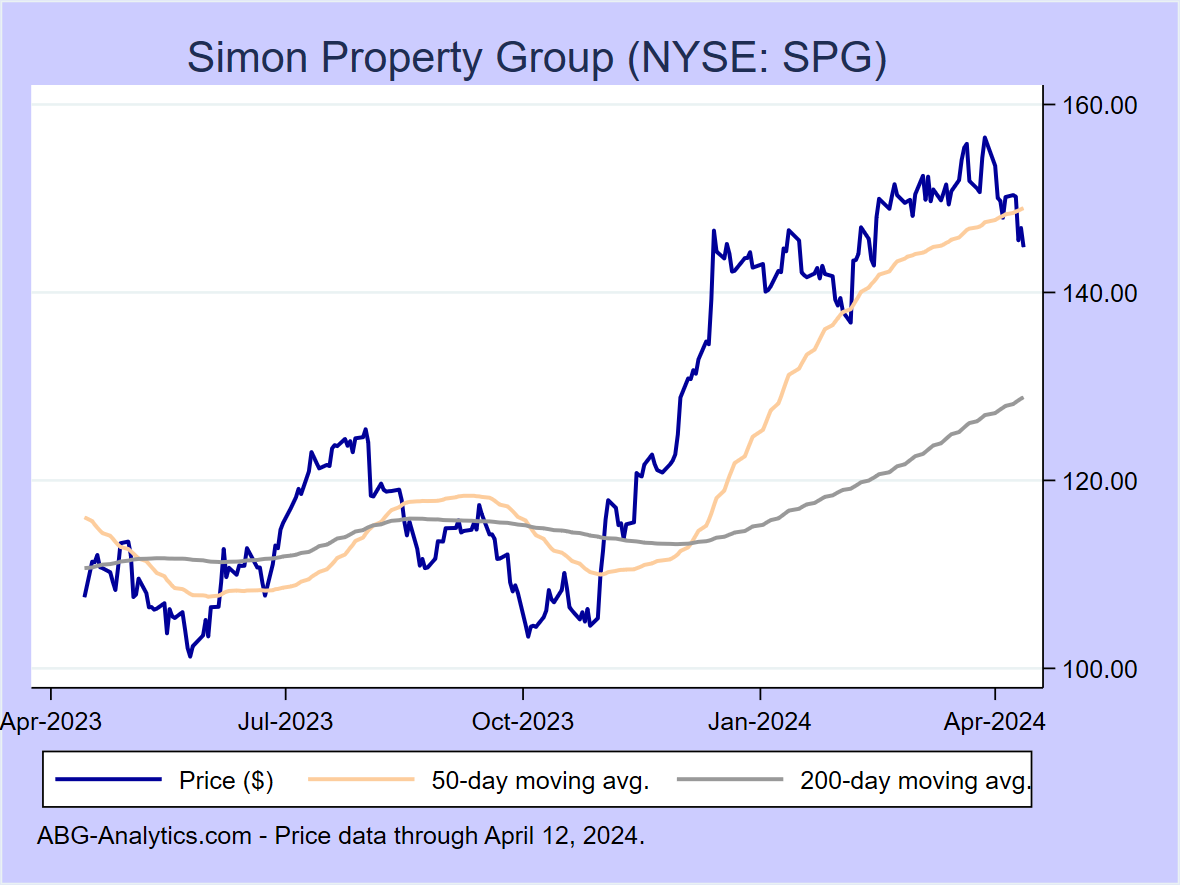

Simon Property Group (NYSE:SPG)

12-month return: 25.3%

12-month return: 25.3%

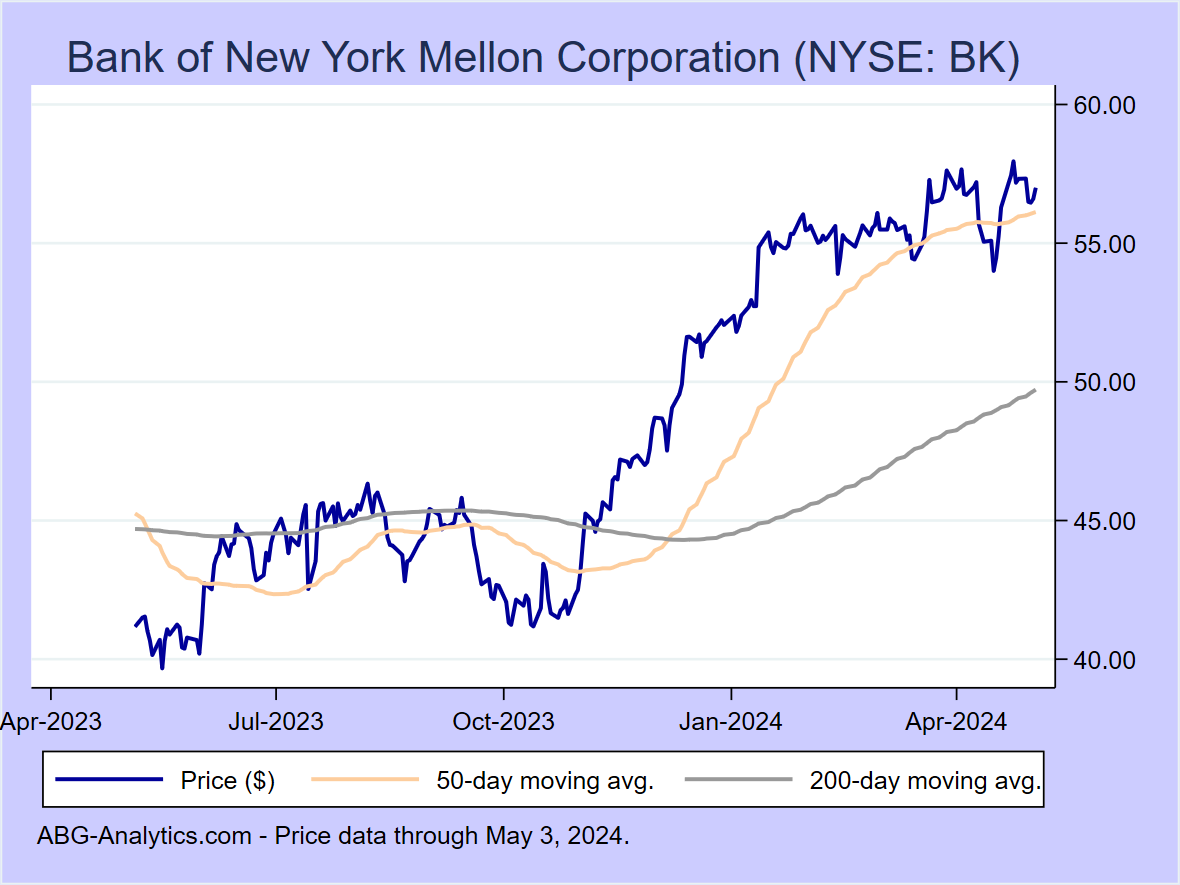

Bank of New York Mellon Corporation (NYSE:BK)

12-month return: 24.4%

12-month return: 24.4%

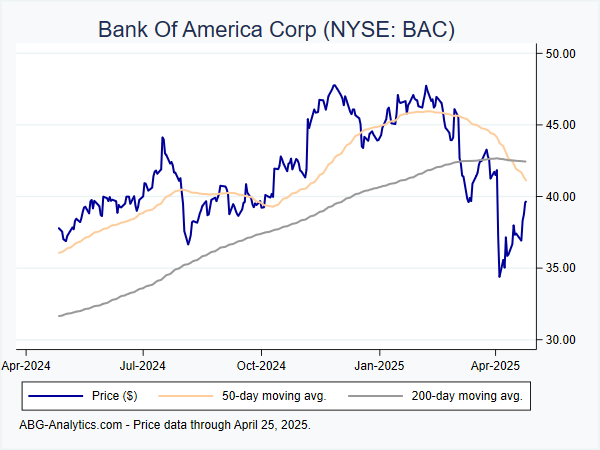

Bank Of America Corp (NYSE:BAC)

12-month return: 23.0%

12-month return: 23.0%

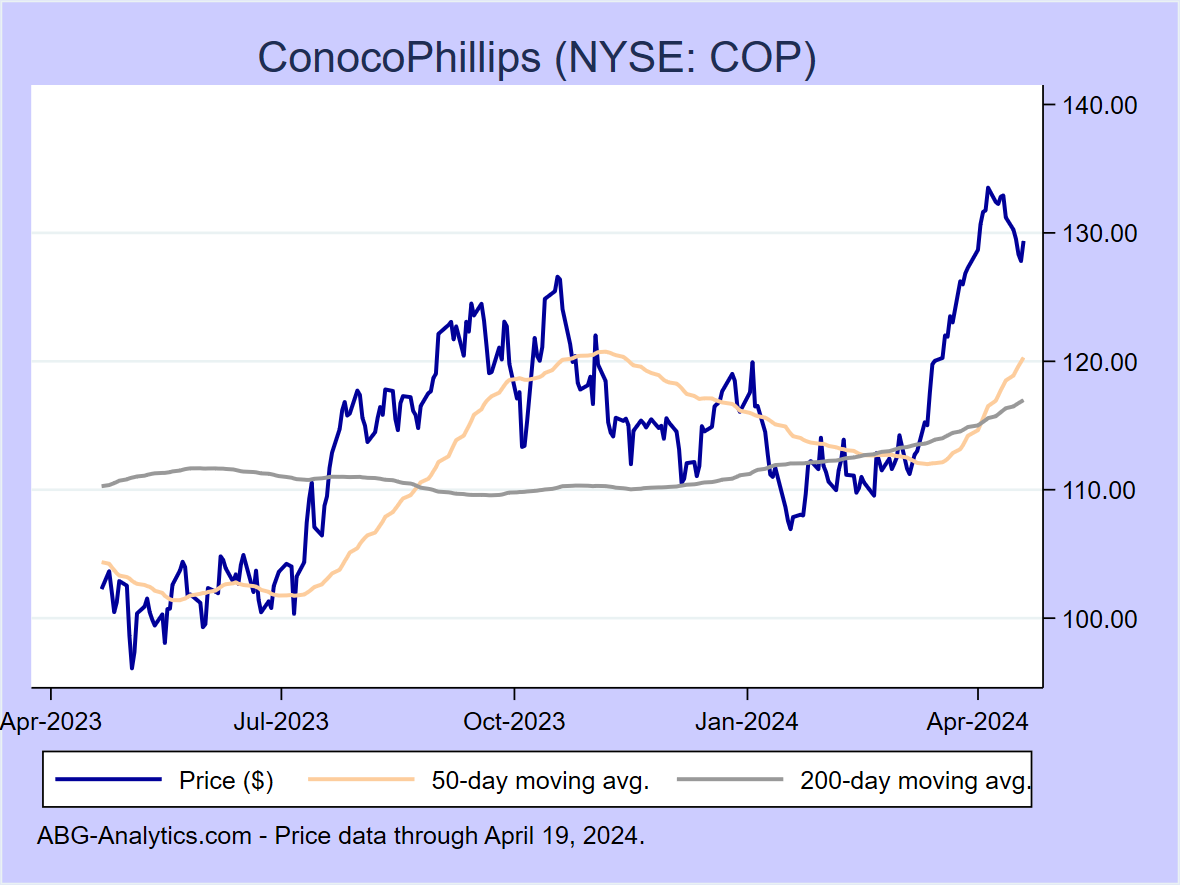

ConocoPhillips (NYSE:COP)

12-month return: 22.9%

12-month return: 22.9%

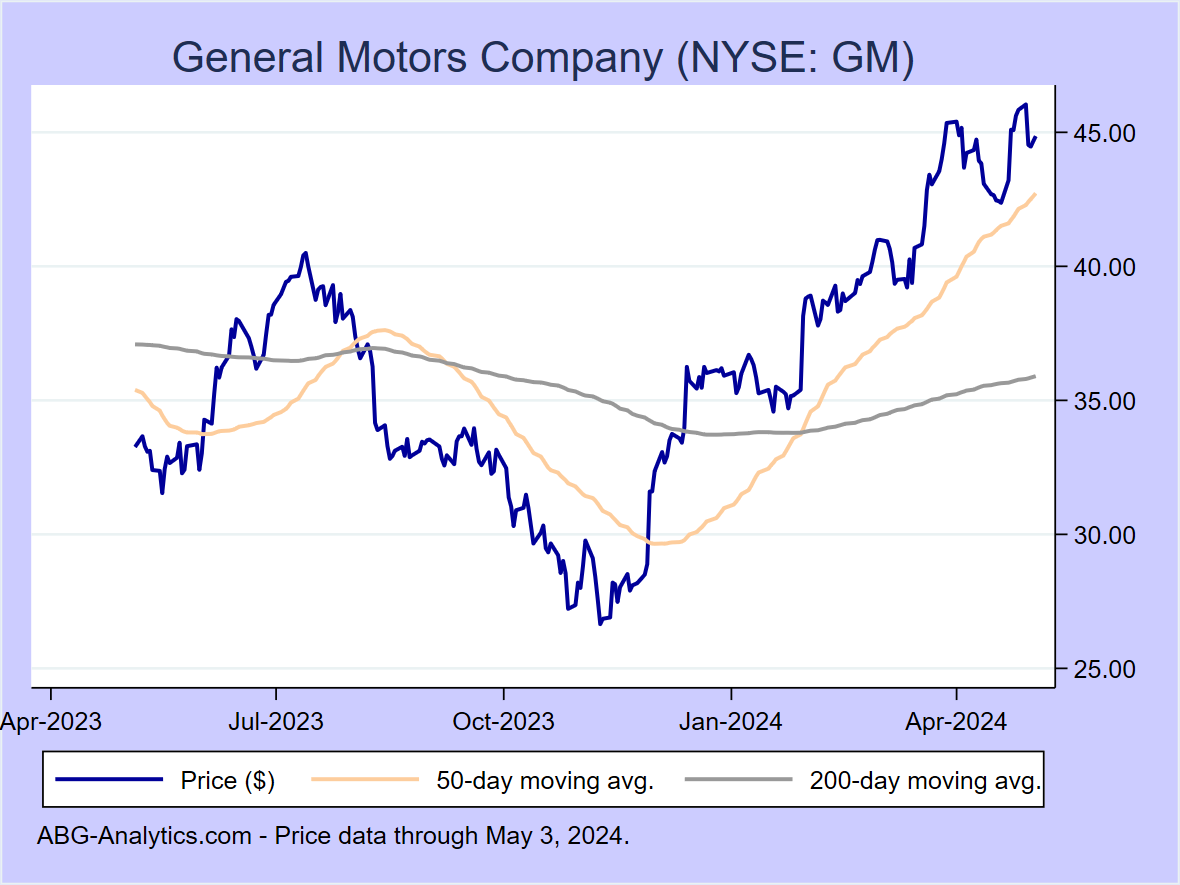

General Motors Company (NYSE:GM)

12-month return: 22.5%

12-month return: 22.5%

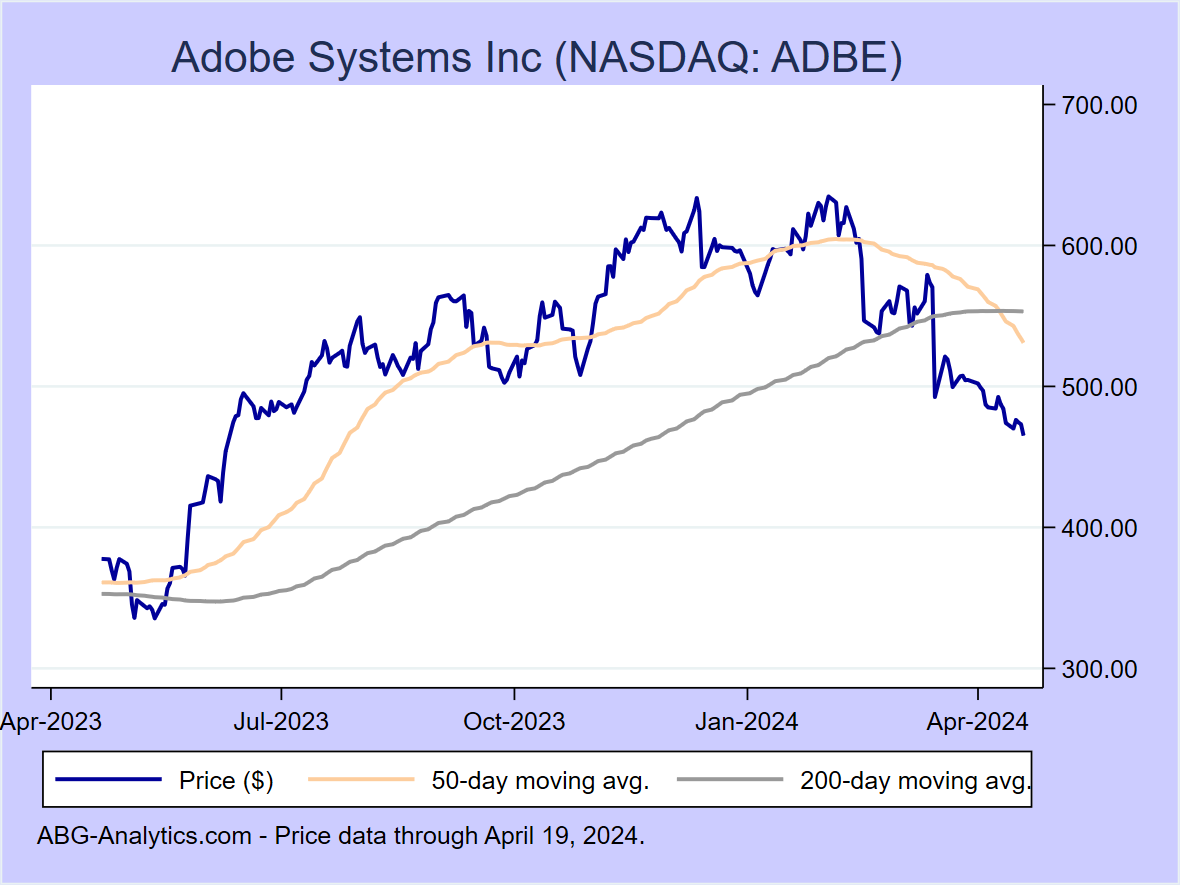

Adobe Systems Inc (NASDAQ:ADBE)

12-month return: 22.3%

12-month return: 22.3%

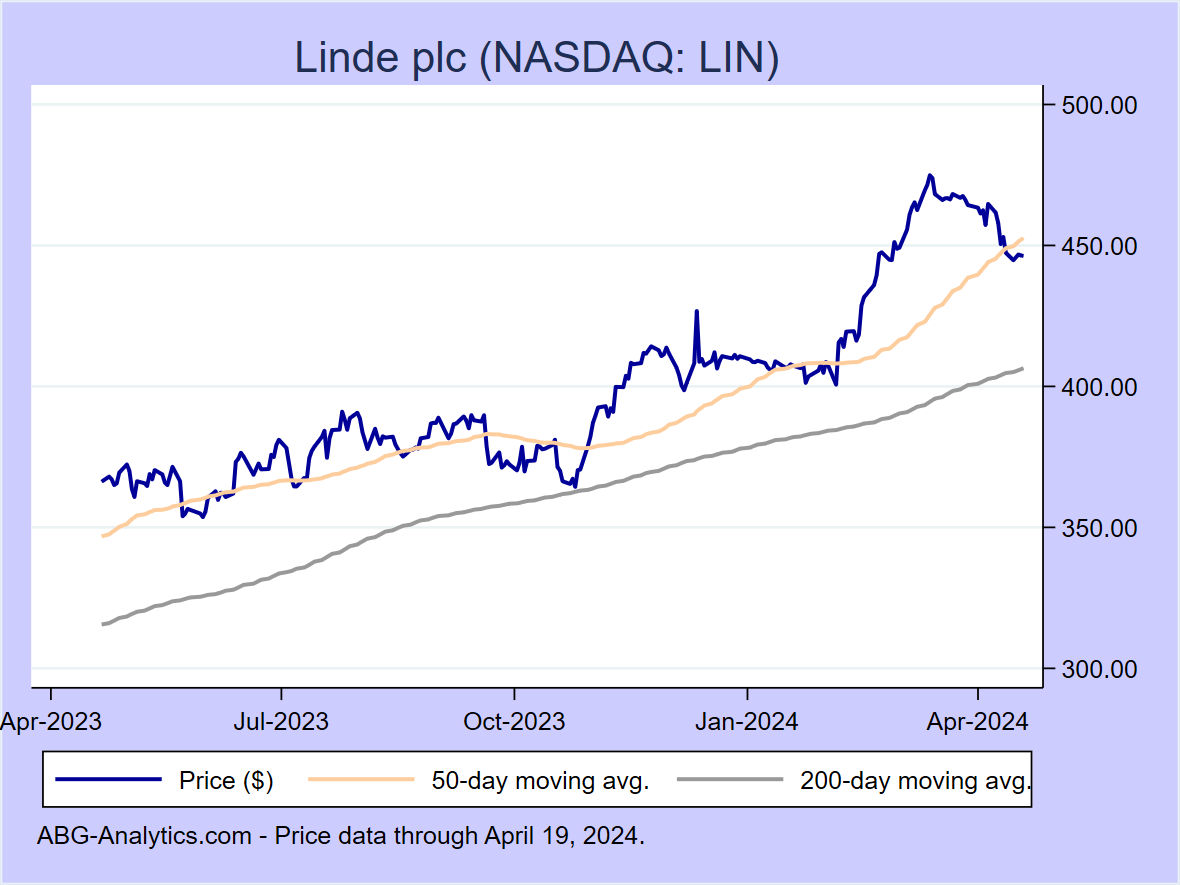

Linde plc (NASDAQ:LIN)

12-month return: 22.2%

12-month return: 22.2%

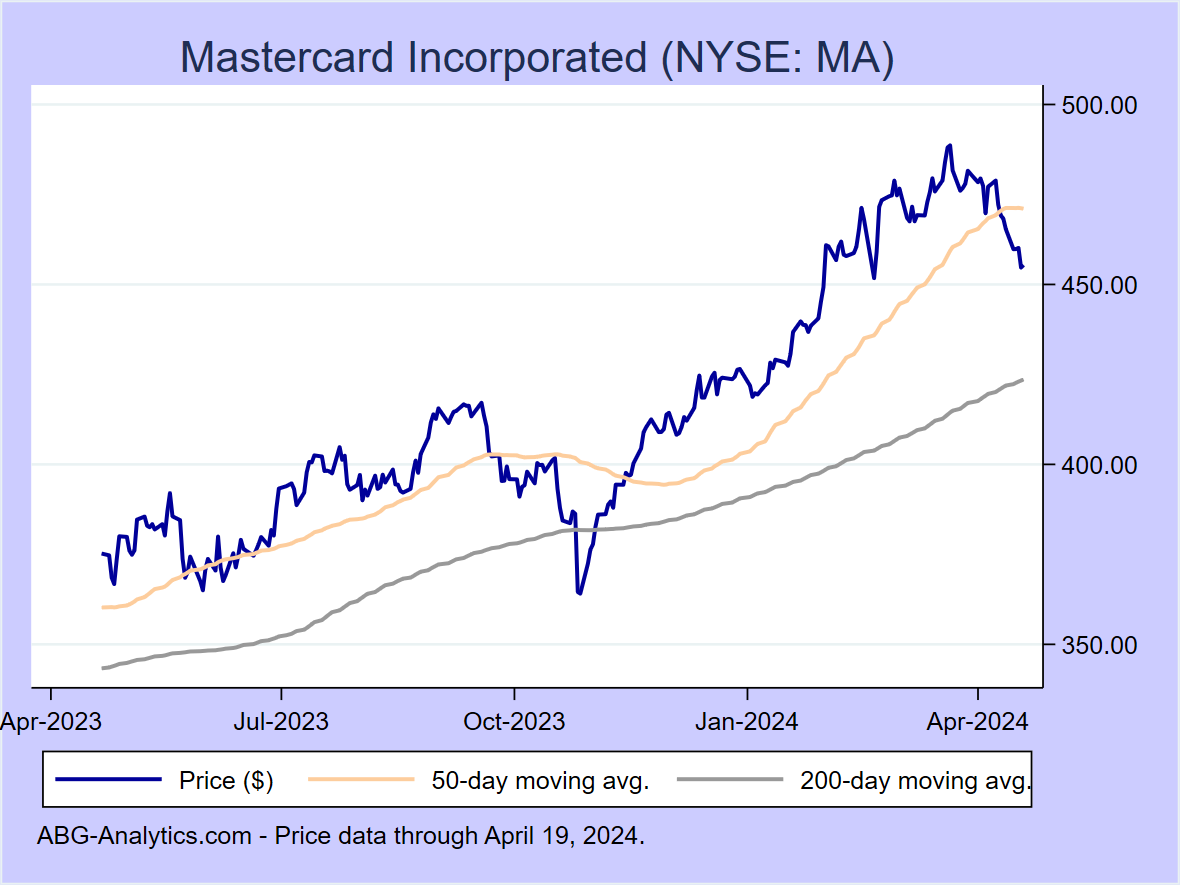

Mastercard Incorporated (NYSE:MA)

12-month return: 22.2%

12-month return: 22.2%

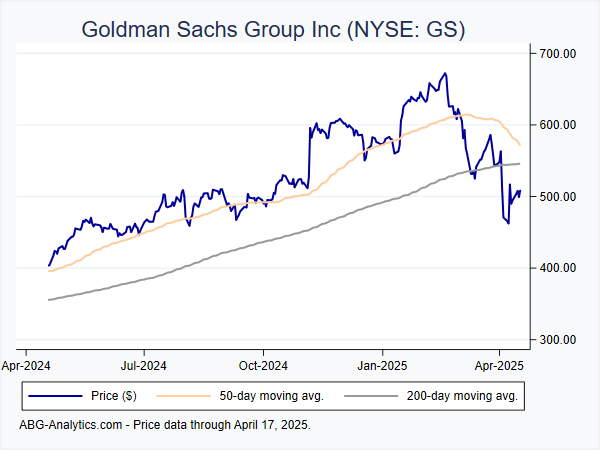

Goldman Sachs Group Inc (NYSE:GS)

12-month return: 19.9%

12-month return: 19.9%

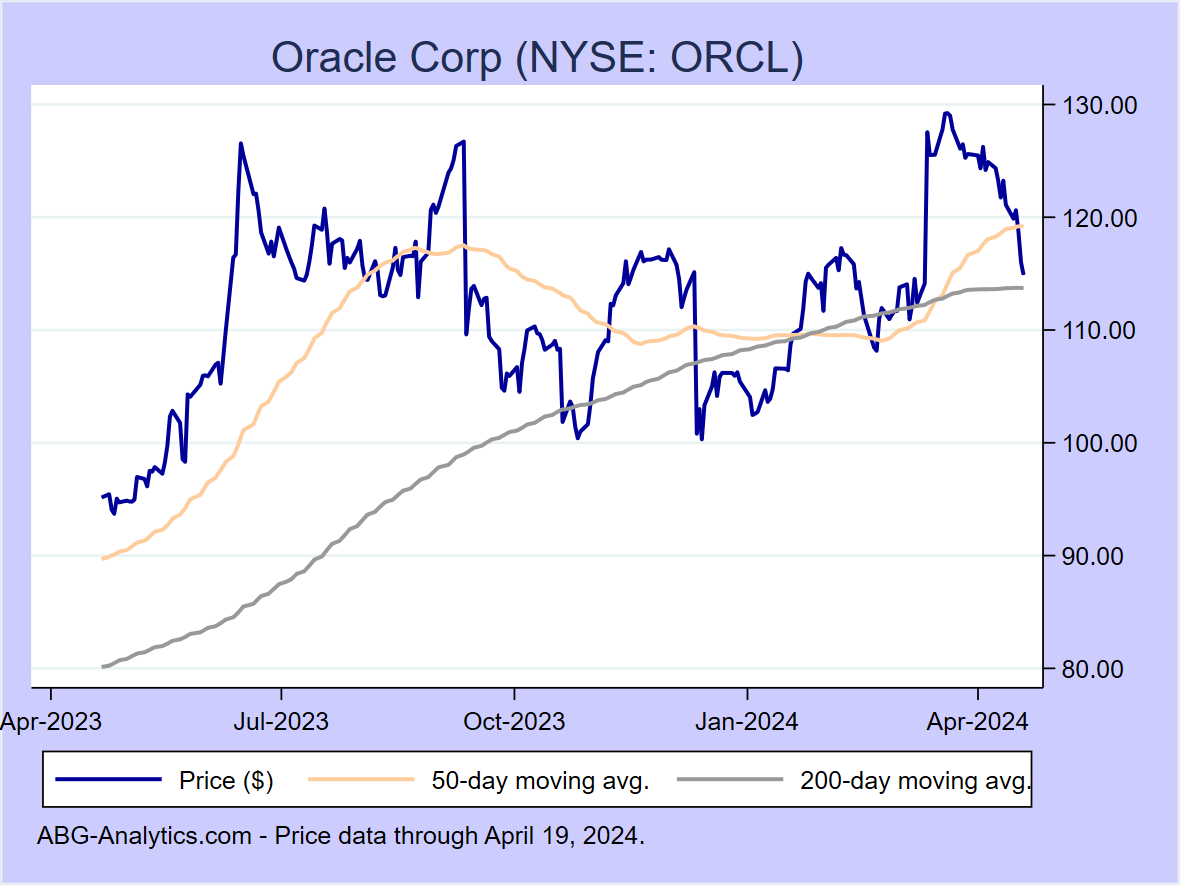

Oracle Corp (NYSE:ORCL)

12-month return: 19.9%

12-month return: 19.9%

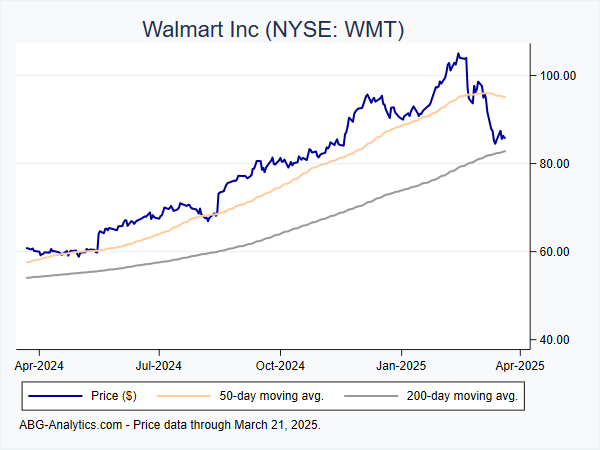

Walmart Inc (NYSE:WMT)

12-month return: 19.1%

12-month return: 19.1%

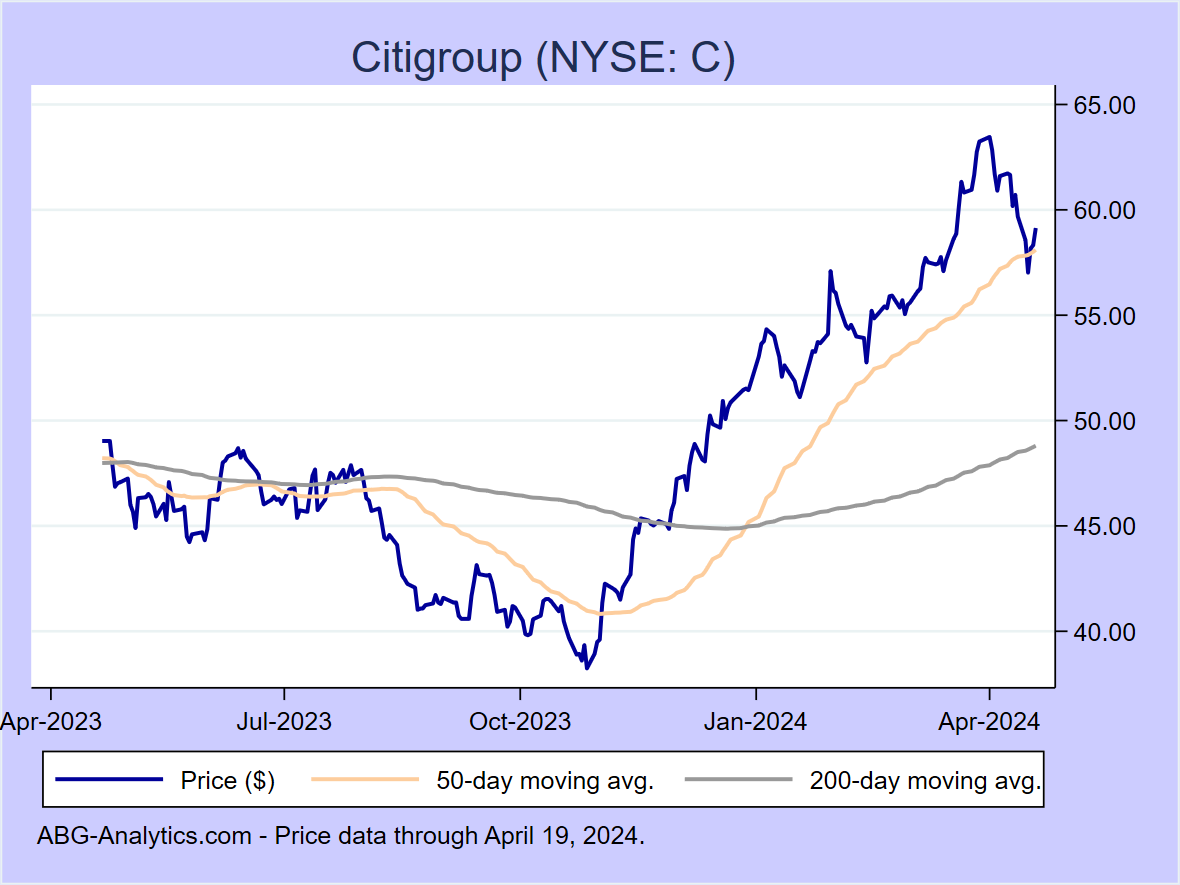

Citigroup (NYSE:C)

12-month return: 17.3%

12-month return: 17.3%

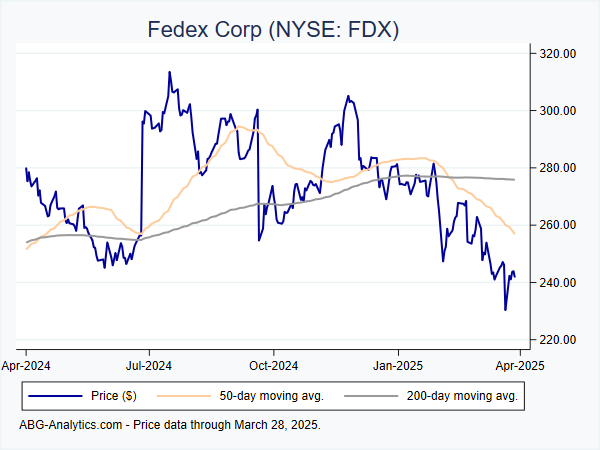

Fedex Corp (NYSE:FDX)

12-month return: 16.3%

12-month return: 16.3%

Visa Inc (NYSE:V)

12-month return: 16.0%

12-month return: 16.0%

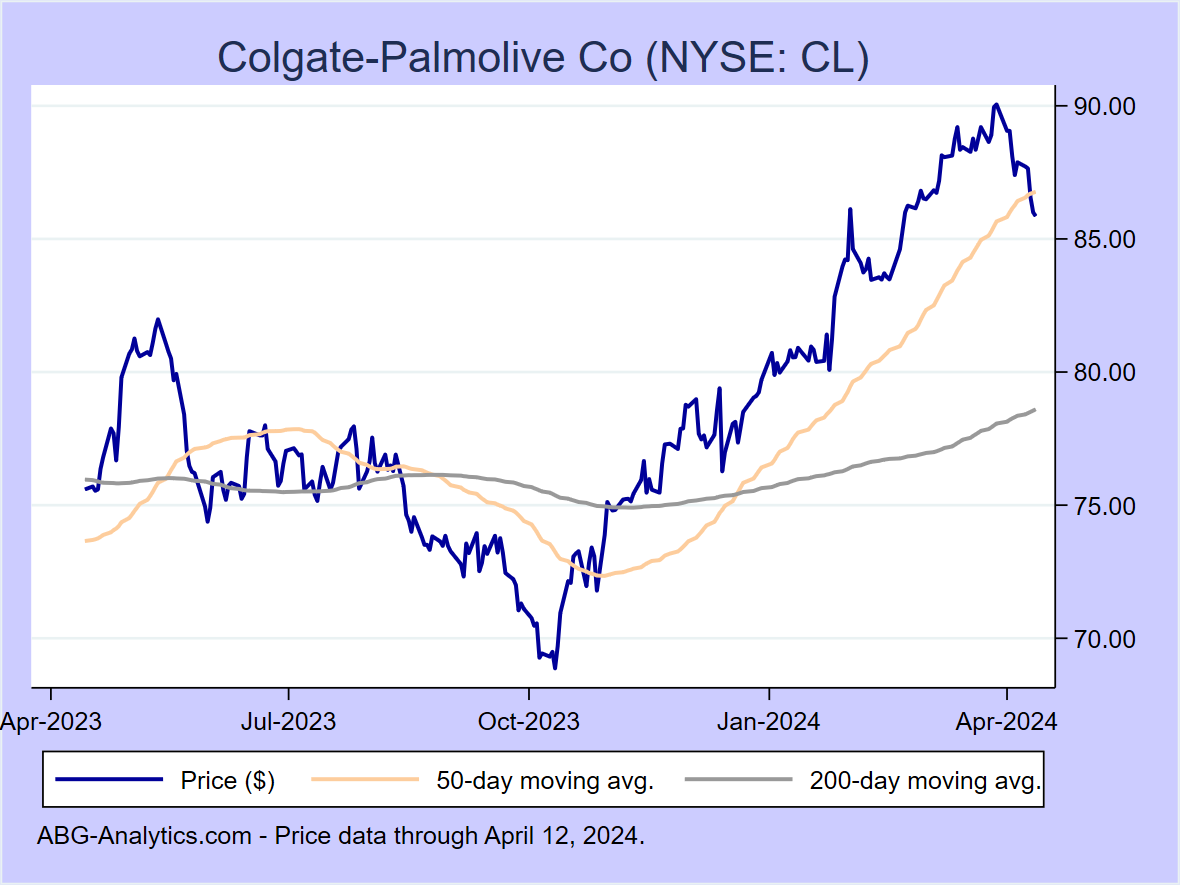

Colgate-Palmolive Co (NYSE:CL)

12-month return: 15.3%

12-month return: 15.3%

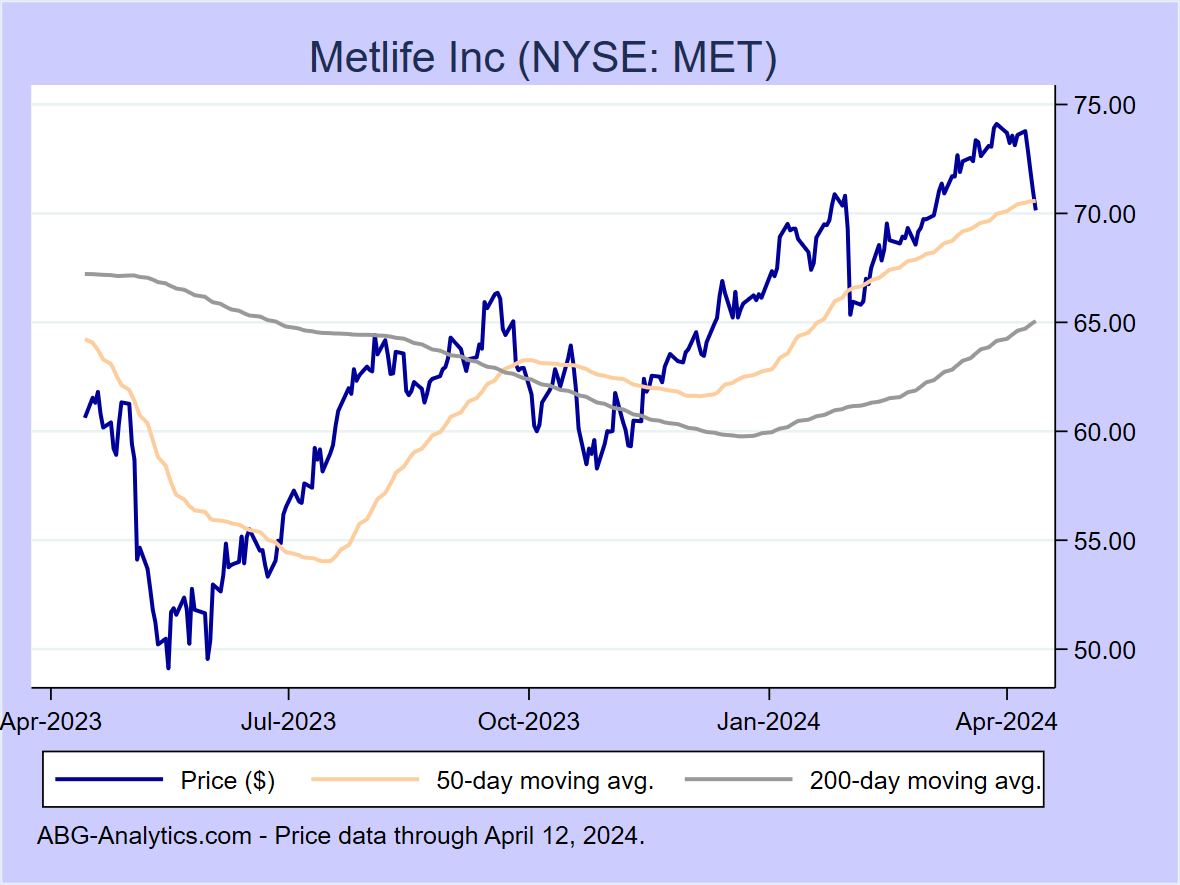

Metlife Inc (NYSE:MET)

12-month return: 15.0%

12-month return: 15.0%

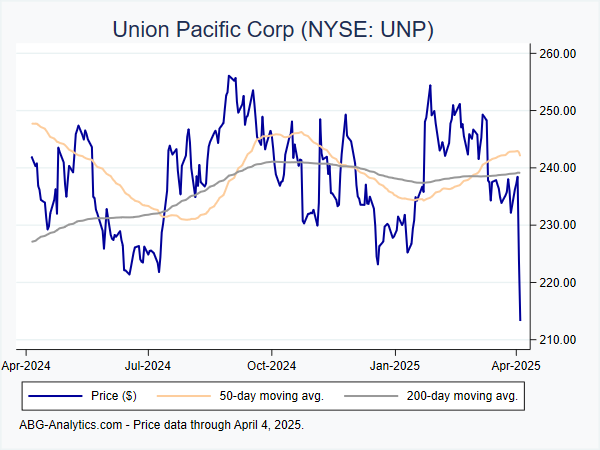

Union Pacific Corp (NYSE:UNP)

12-month return: 14.9%

12-month return: 14.9%

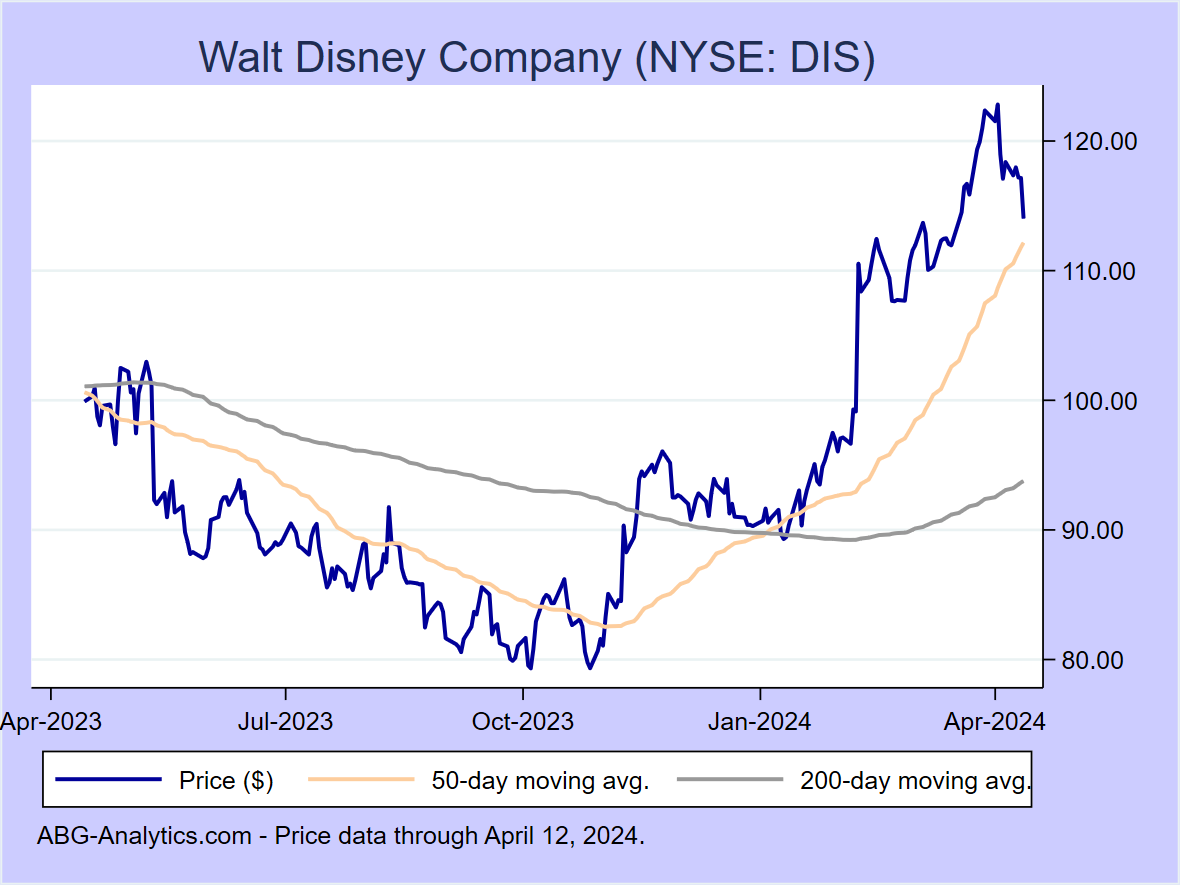

Walt Disney Company (NYSE:DIS)

12-month return: 14.0%

12-month return: 14.0%

Accenture Ltd (NYSE:ACN)

12-month return: 13.2%

12-month return: 13.2%

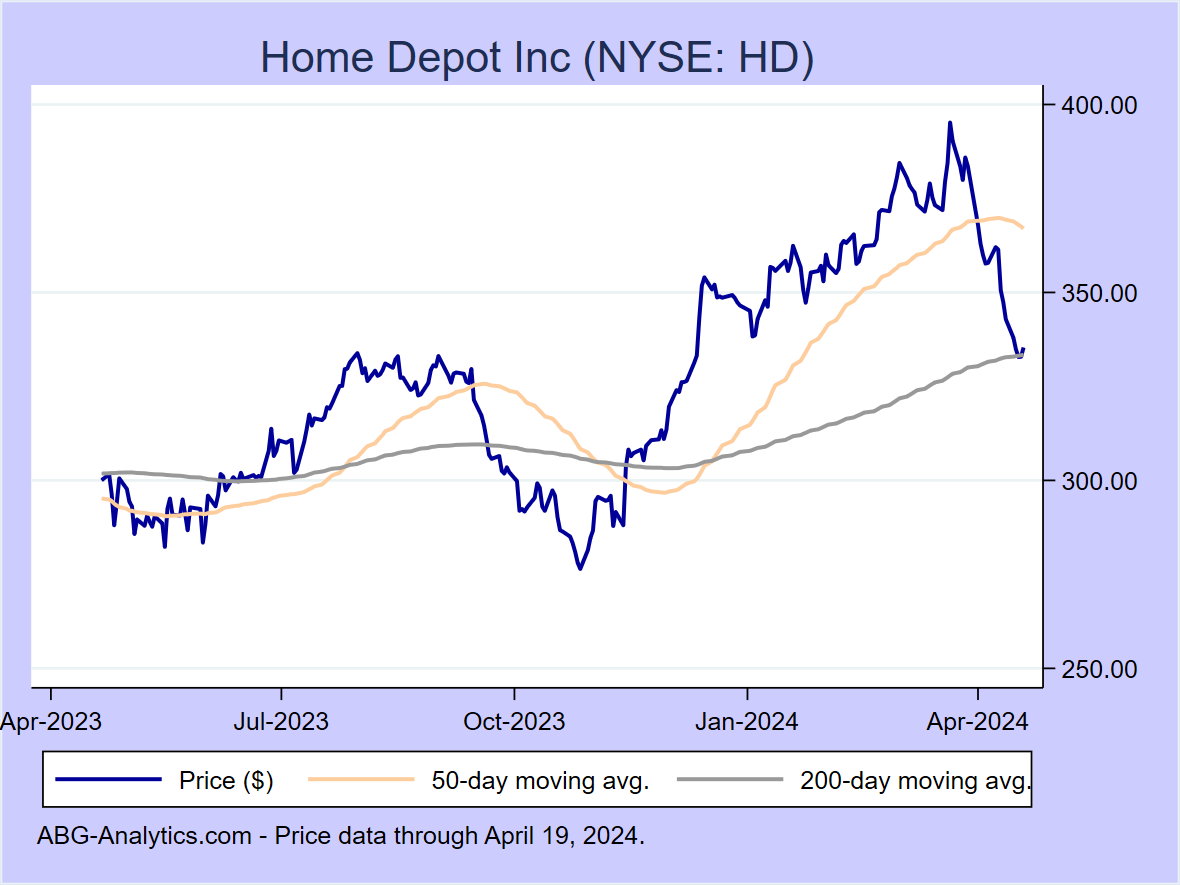

Home Depot Inc (NYSE:HD)

12-month return: 13.0%

12-month return: 13.0%

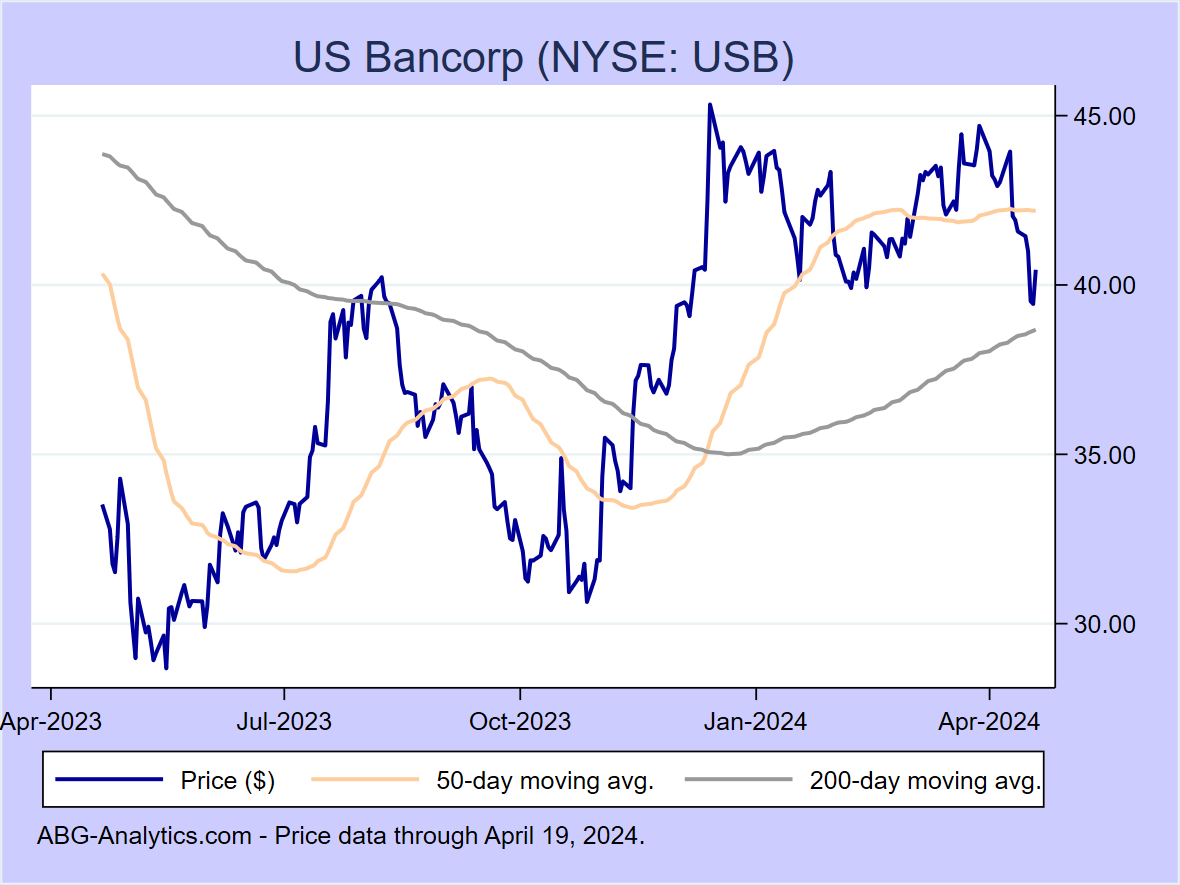

US Bancorp (NYSE:USB)

12-month return: 12.3%

12-month return: 12.3%

Lowes Companies Inc (NYSE:LOW)

12-month return: 10.3%

12-month return: 10.3%

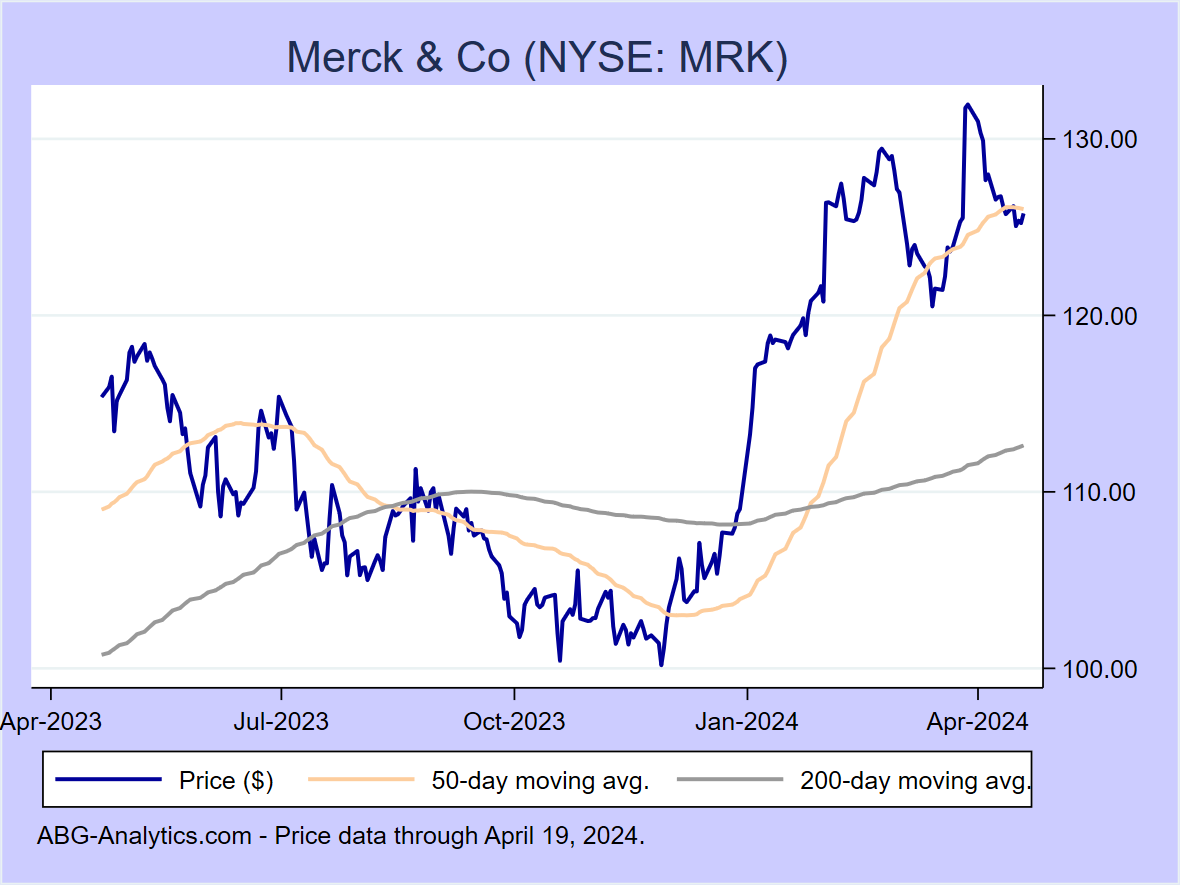

Merck & Co (NYSE:MRK)

12-month return: 10.2%

12-month return: 10.2%

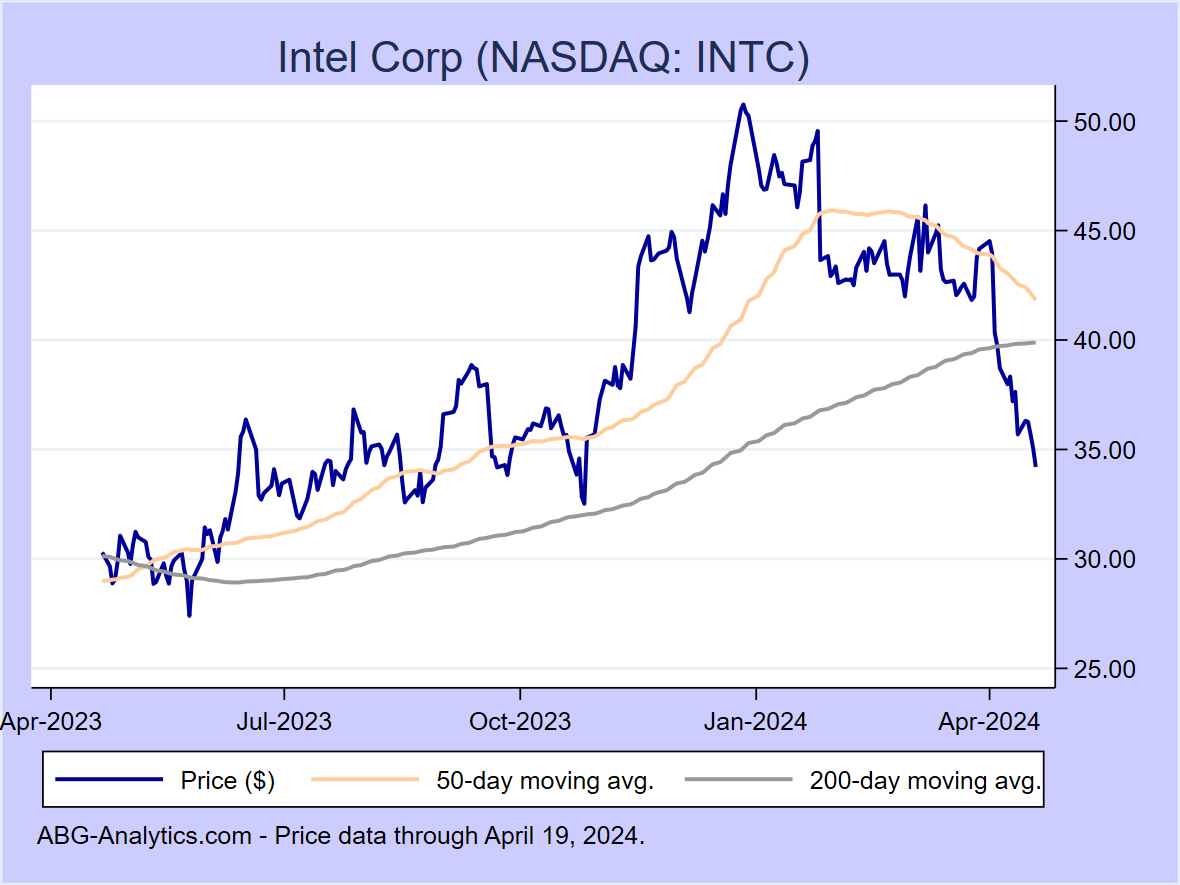

Intel Corp (NASDAQ:INTC)

12-month return: 9.8%

12-month return: 9.8%

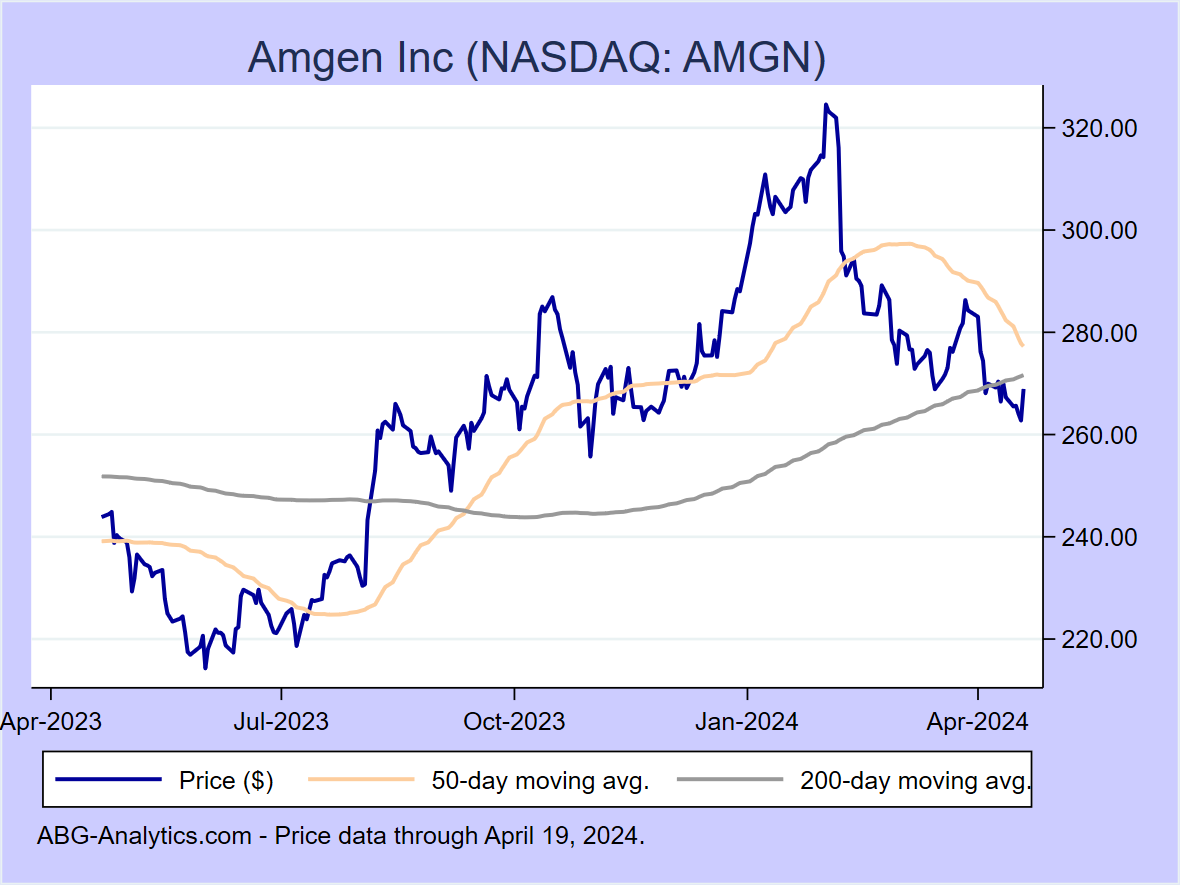

Amgen Inc (NASDAQ:AMGN)

12-month return: 9.2%

12-month return: 9.2%

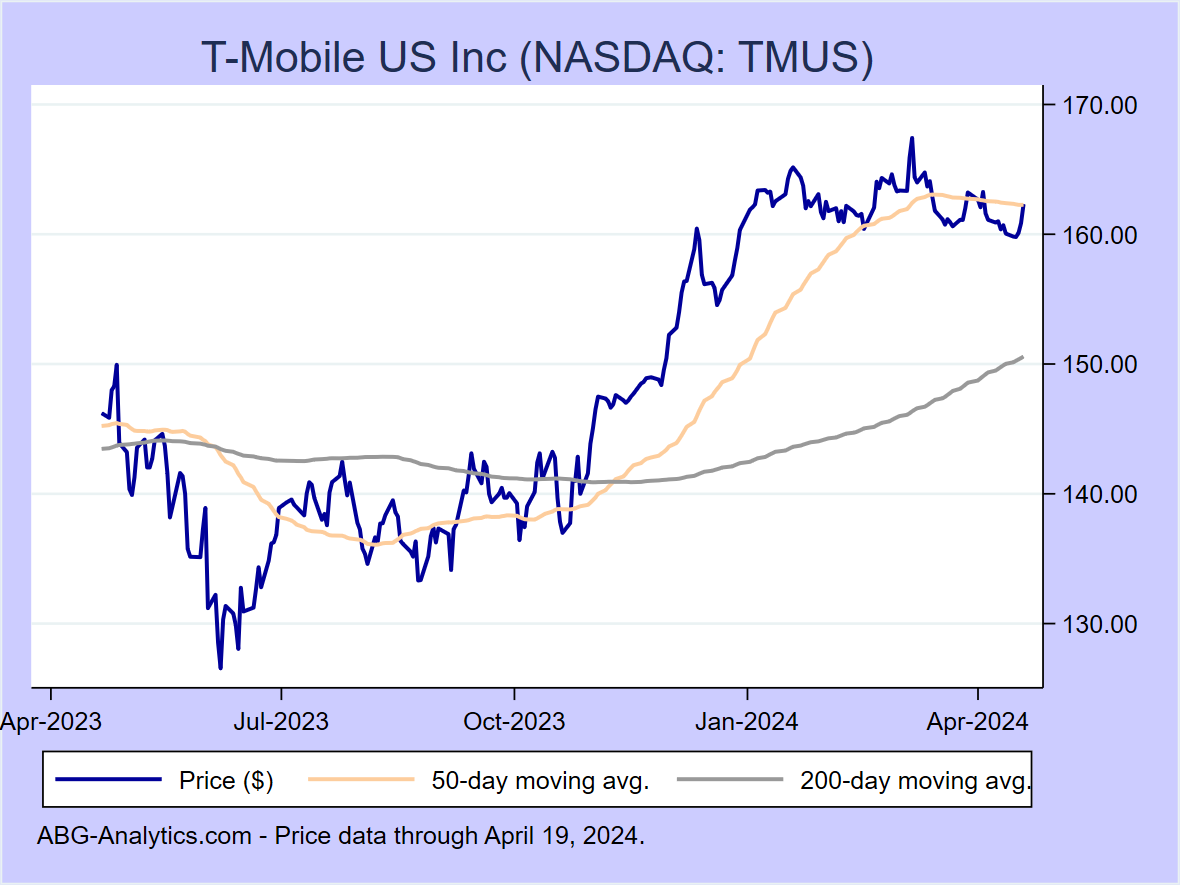

T-Mobile US Inc (NASDAQ:TMUS)

12-month return: 9.1%

12-month return: 9.1%

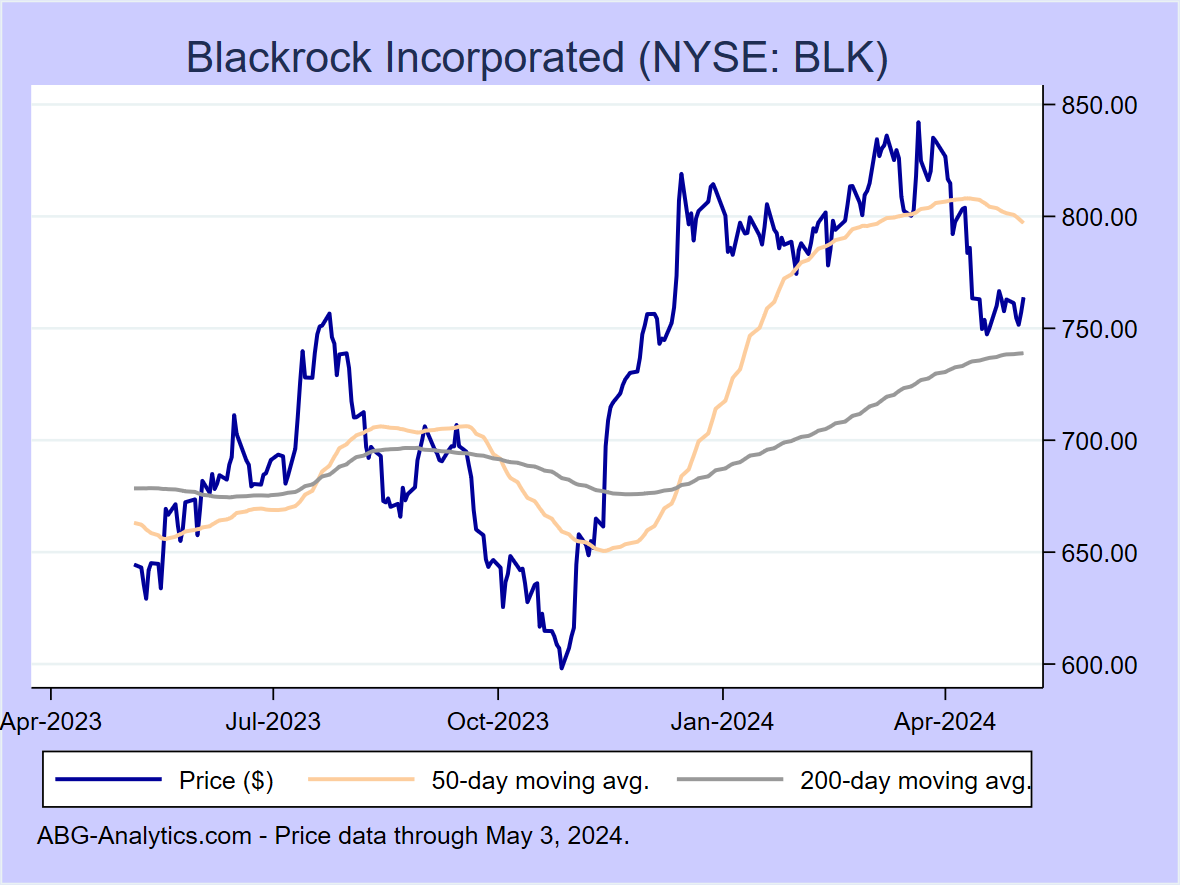

Blackrock Incorporated (NYSE:BLK)

12-month return: 7.9%

12-month return: 7.9%

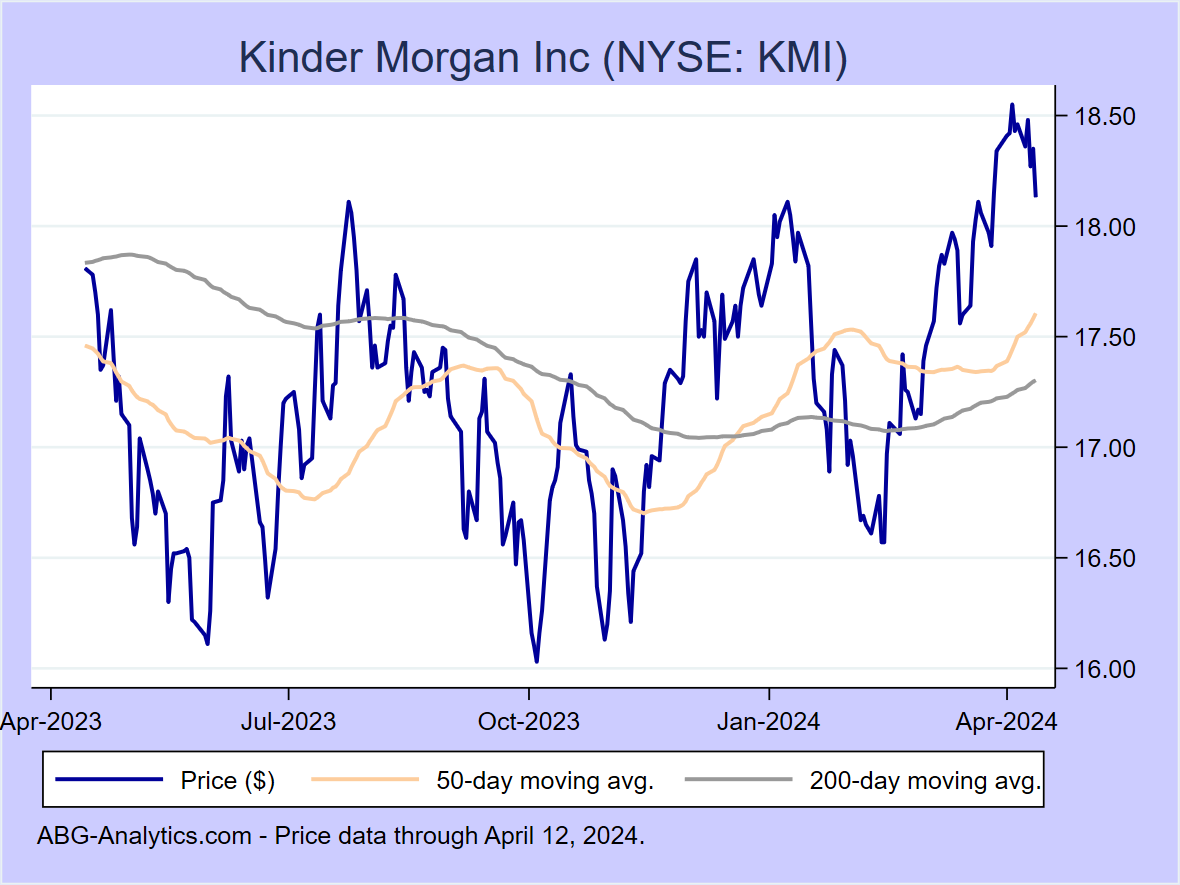

Kinder Morgan Inc (NYSE:KMI)

12-month return: 7.0%

12-month return: 7.0%

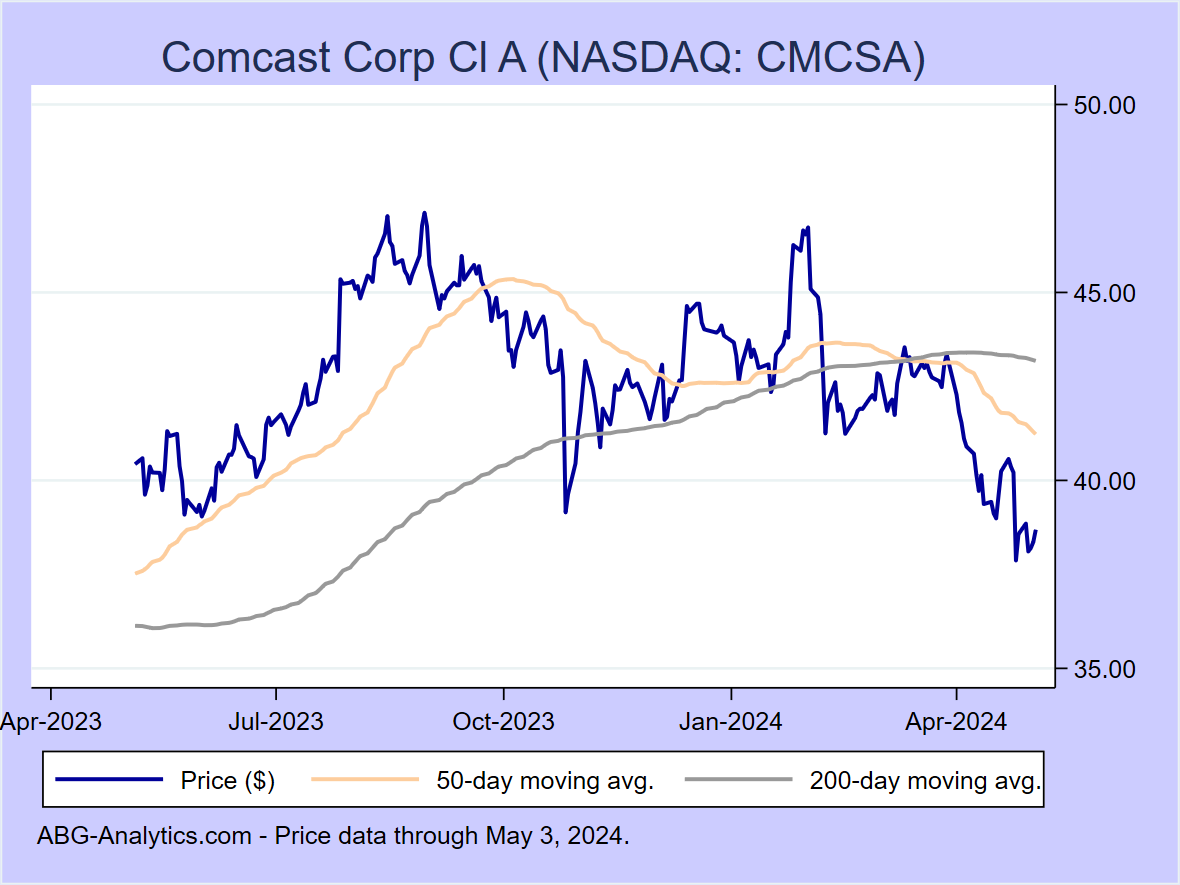

Comcast Corp Cl A (NASDAQ:CMCSA)

12-month return: 5.2%

12-month return: 5.2%

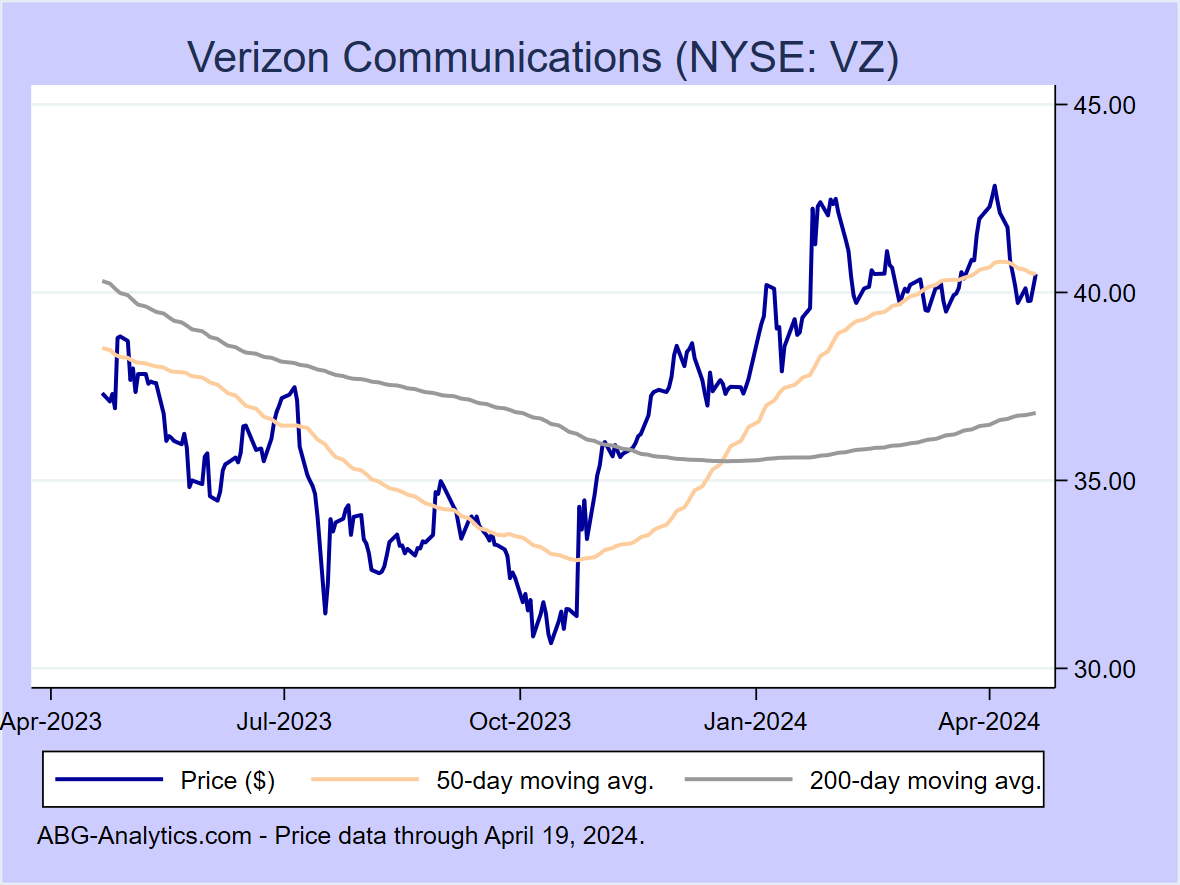

Verizon Communications (NYSE:VZ)

12-month return: 4.9%

12-month return: 4.9%

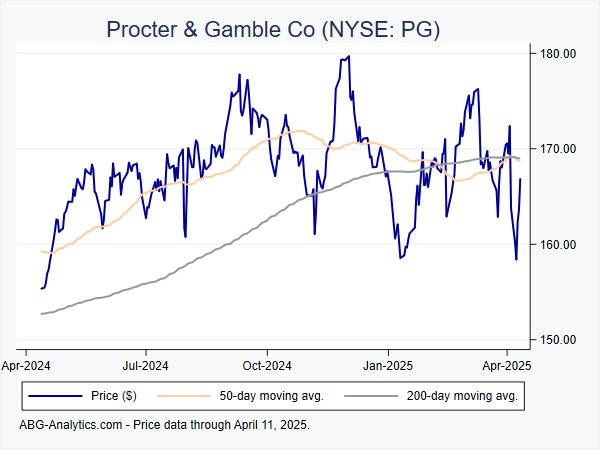

Procter & Gamble Co (NYSE:PG)

12-month return: 4.6%

12-month return: 4.6%

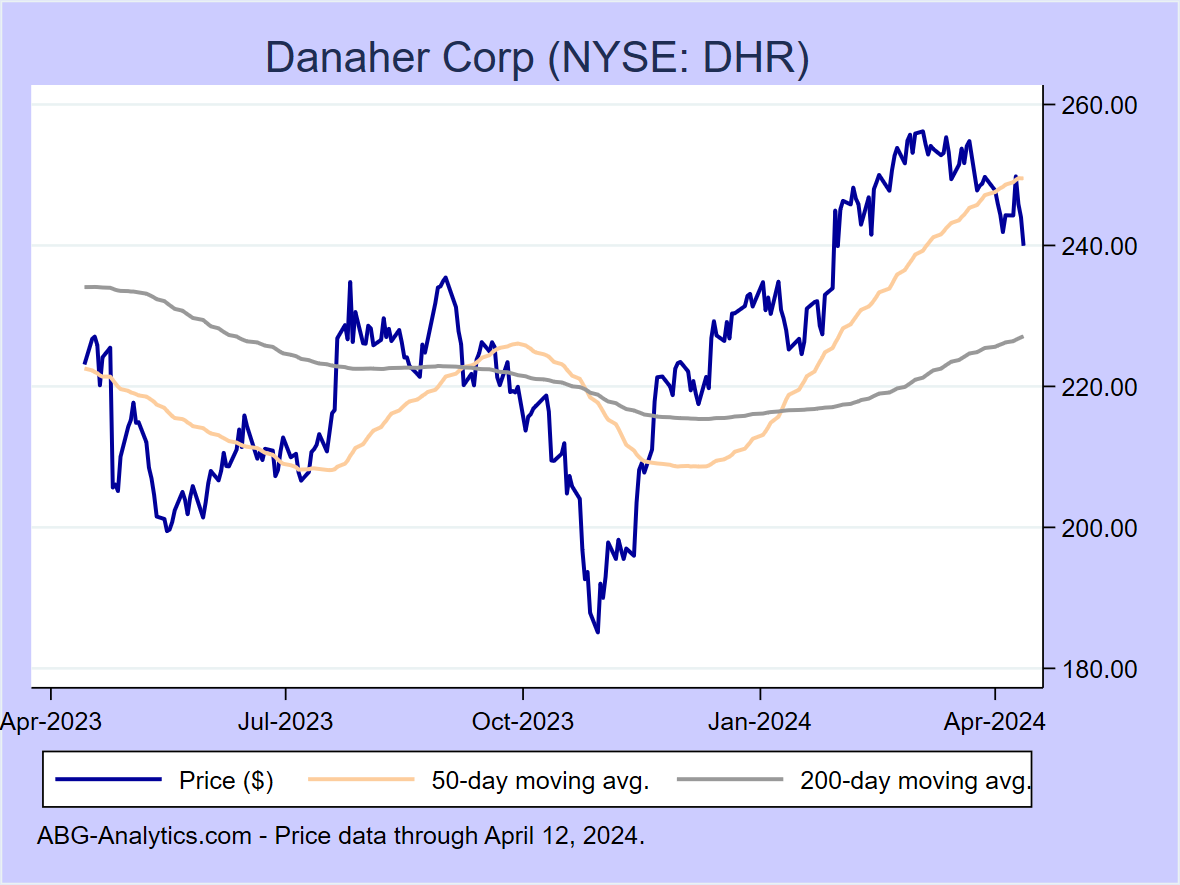

Danaher Corp (NYSE:DHR)

12-month return: 4.3%

12-month return: 4.3%

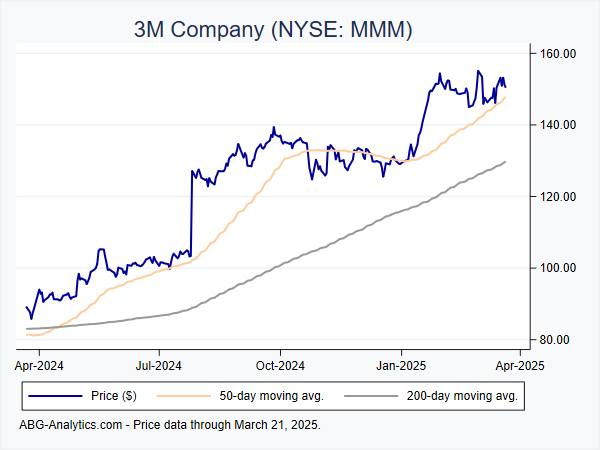

3M Company (NYSE:MMM)

12-month return: 4.0%

12-month return: 4.0%

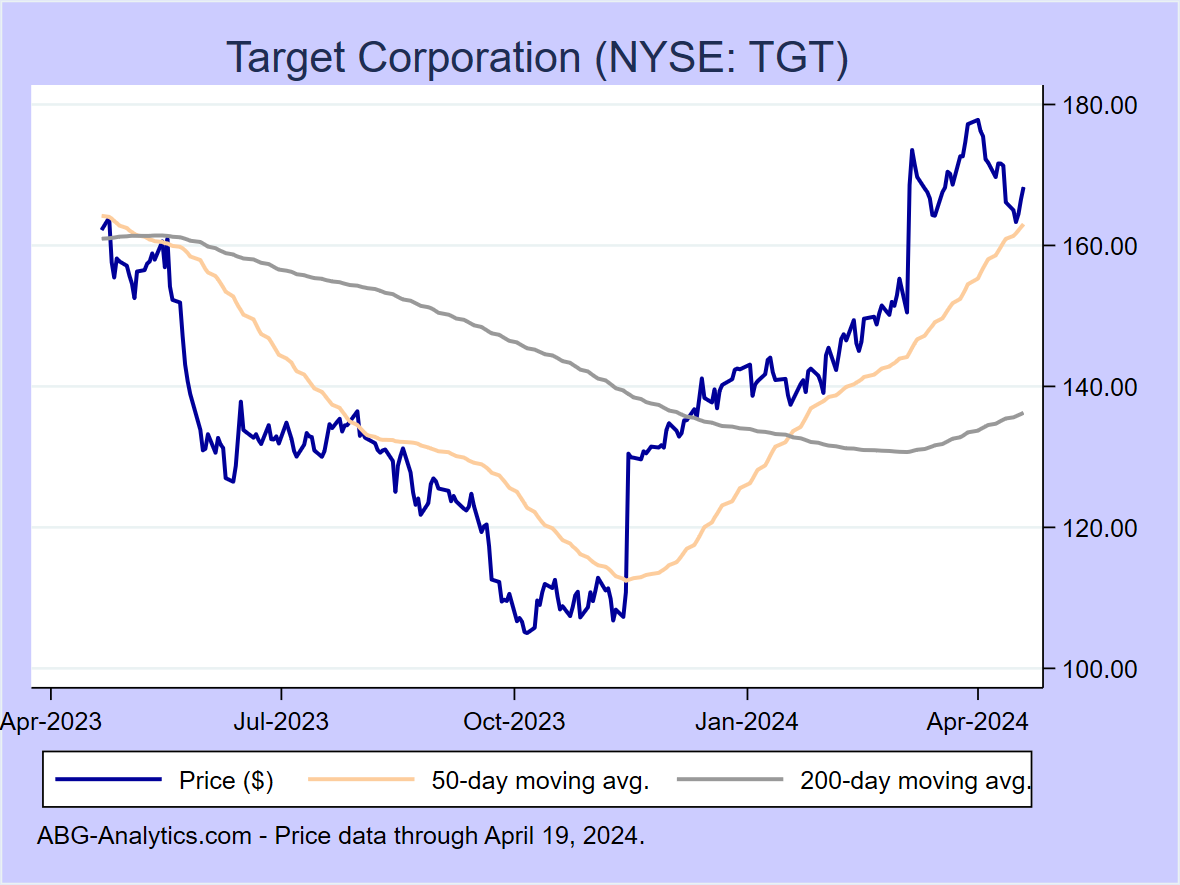

Target Corporation (NYSE:TGT)

12-month return: 3.6%

12-month return: 3.6%

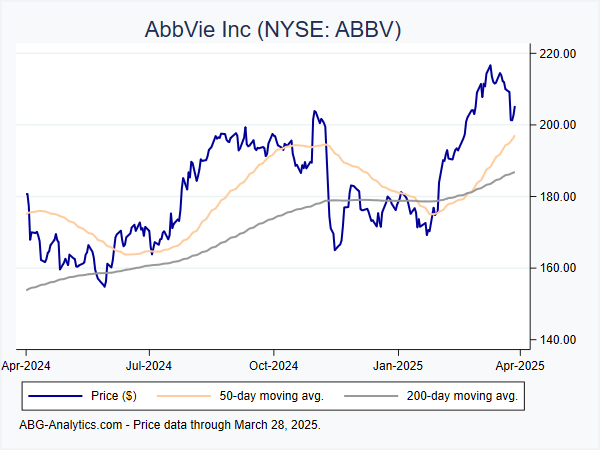

AbbVie Inc (NYSE:ABBV)

12-month return: 3.2%

12-month return: 3.2%

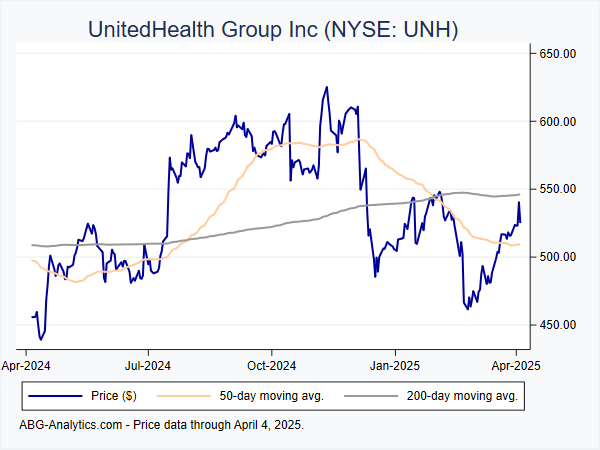

UnitedHealth Group Inc (NYSE:UNH)

12-month return: 3.1%

12-month return: 3.1%

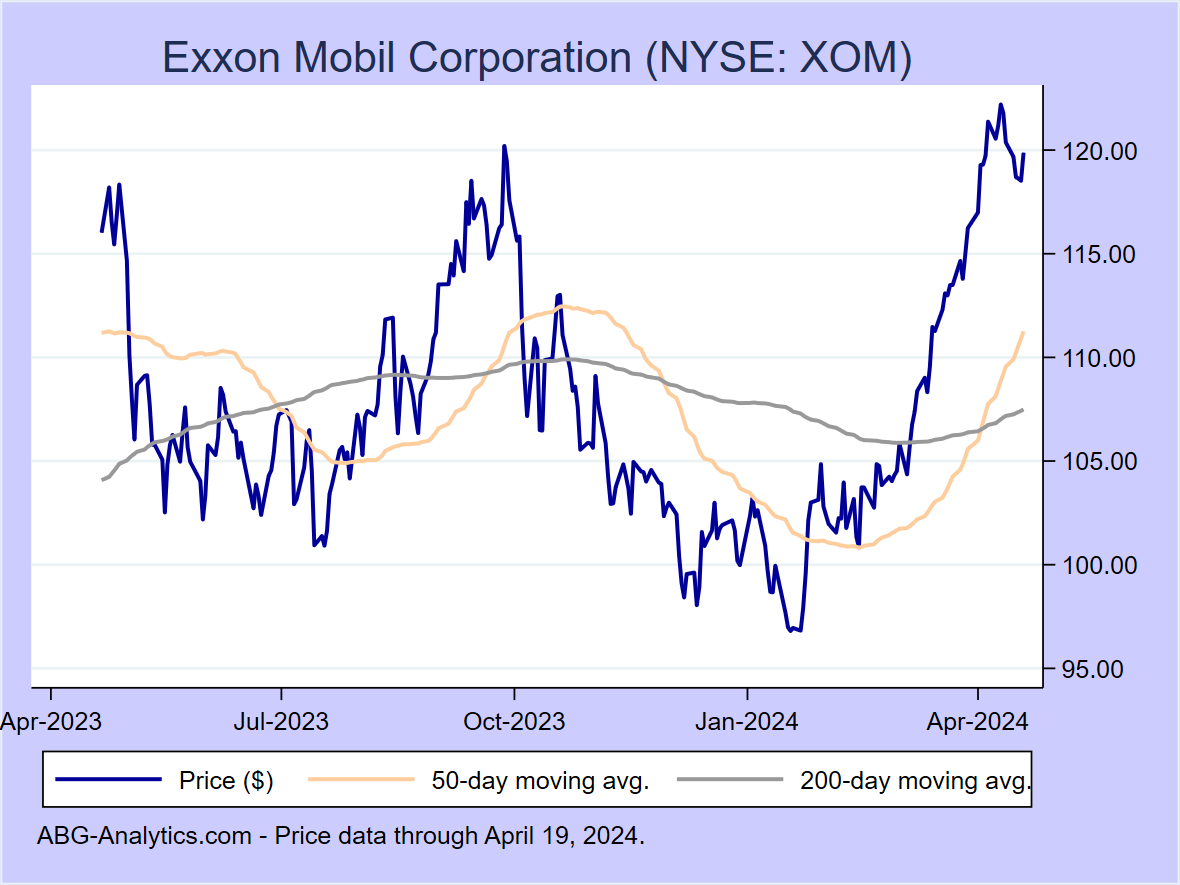

Exxon Mobil Corporation (NYSE:XOM)

12-month return: 2.8%

12-month return: 2.8%

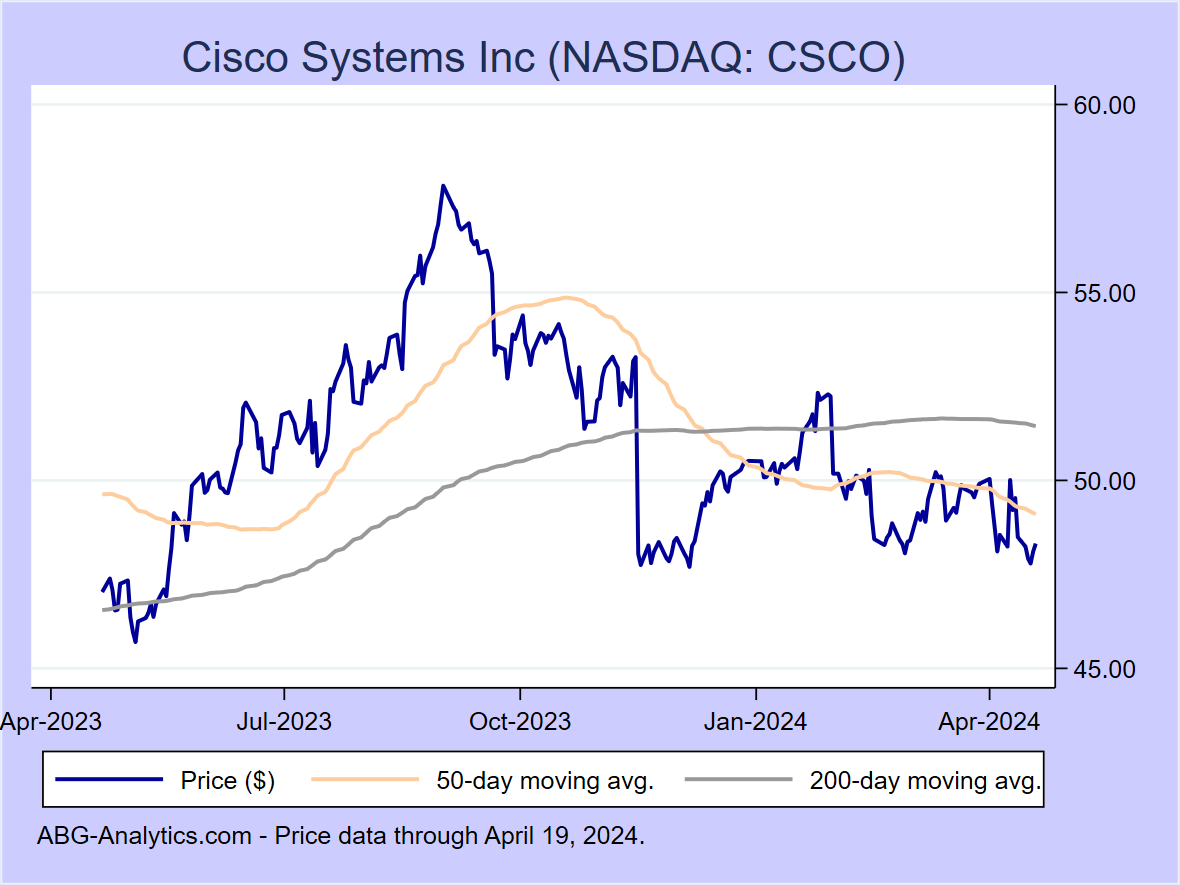

Cisco Systems Inc (NASDAQ:CSCO)

12-month return: 0.6%

12-month return: 0.6%

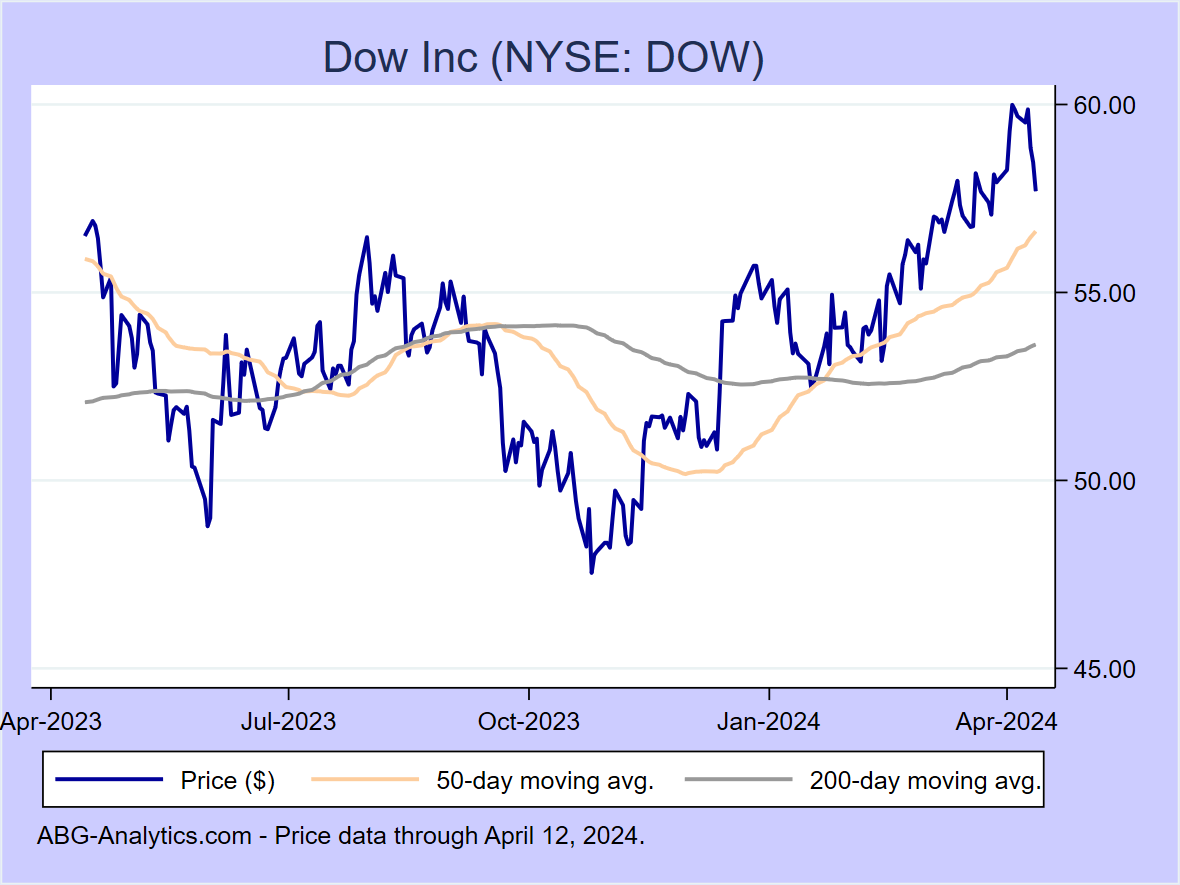

Dow Inc (NYSE:DOW)

12-month return: 0.4%

12-month return: 0.4%

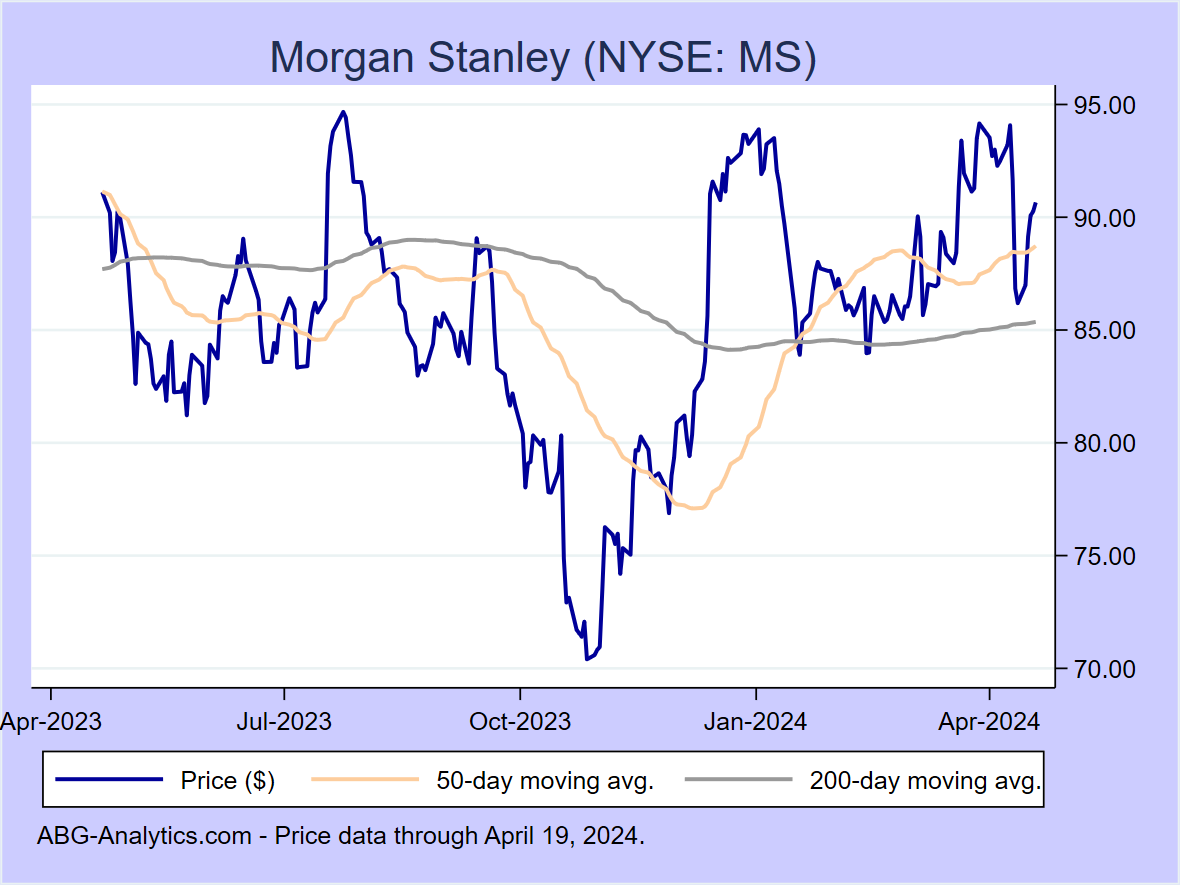

Morgan Stanley (NYSE:MS)

12-month return: 0.2%

12-month return: 0.2%

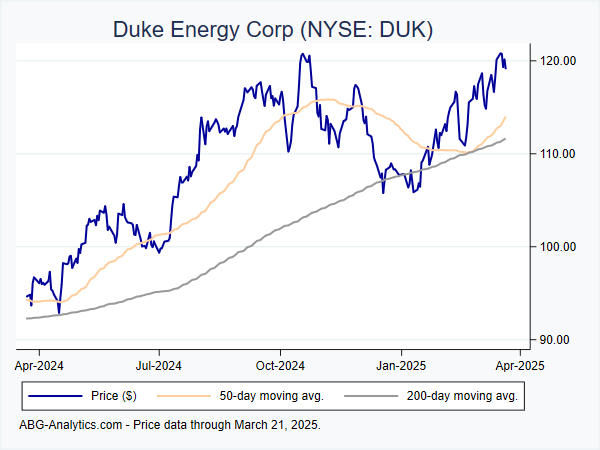

Duke Energy Corp (NYSE:DUK)

12-month return: -0.2%

12-month return: -0.2%

Ford Motor Co (NYSE:F)

12-month return: -0.7%

12-month return: -0.7%

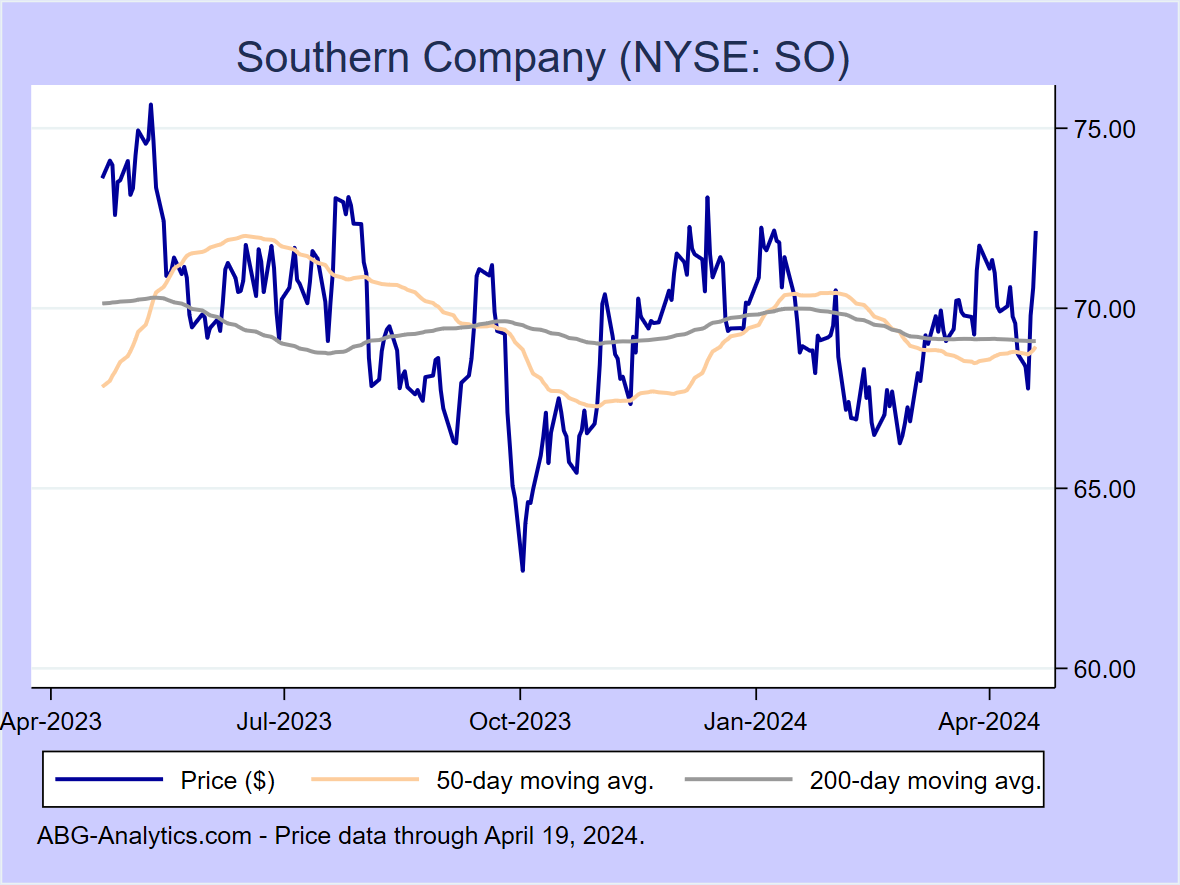

Southern Company (NYSE:SO)

12-month return: -0.9%

12-month return: -0.9%

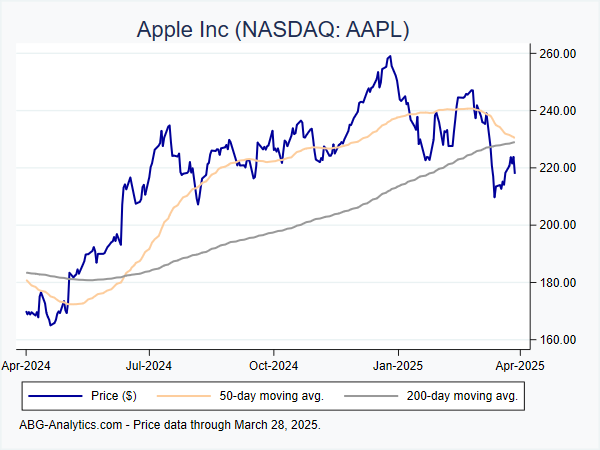

Apple Inc (NASDAQ:AAPL)

12-month return: -1.6%

12-month return: -1.6%

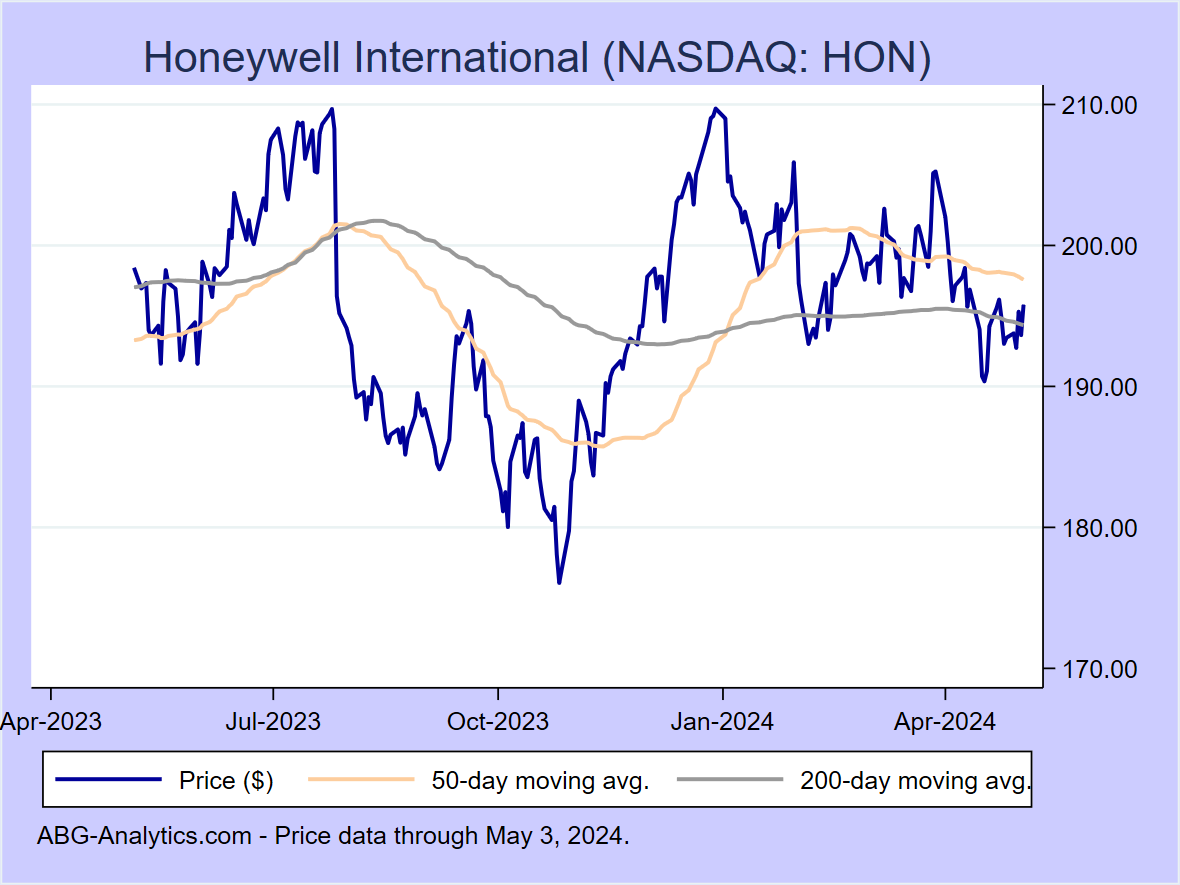

Honeywell International (NASDAQ:HON)

12-month return: -1.8%

12-month return: -1.8%

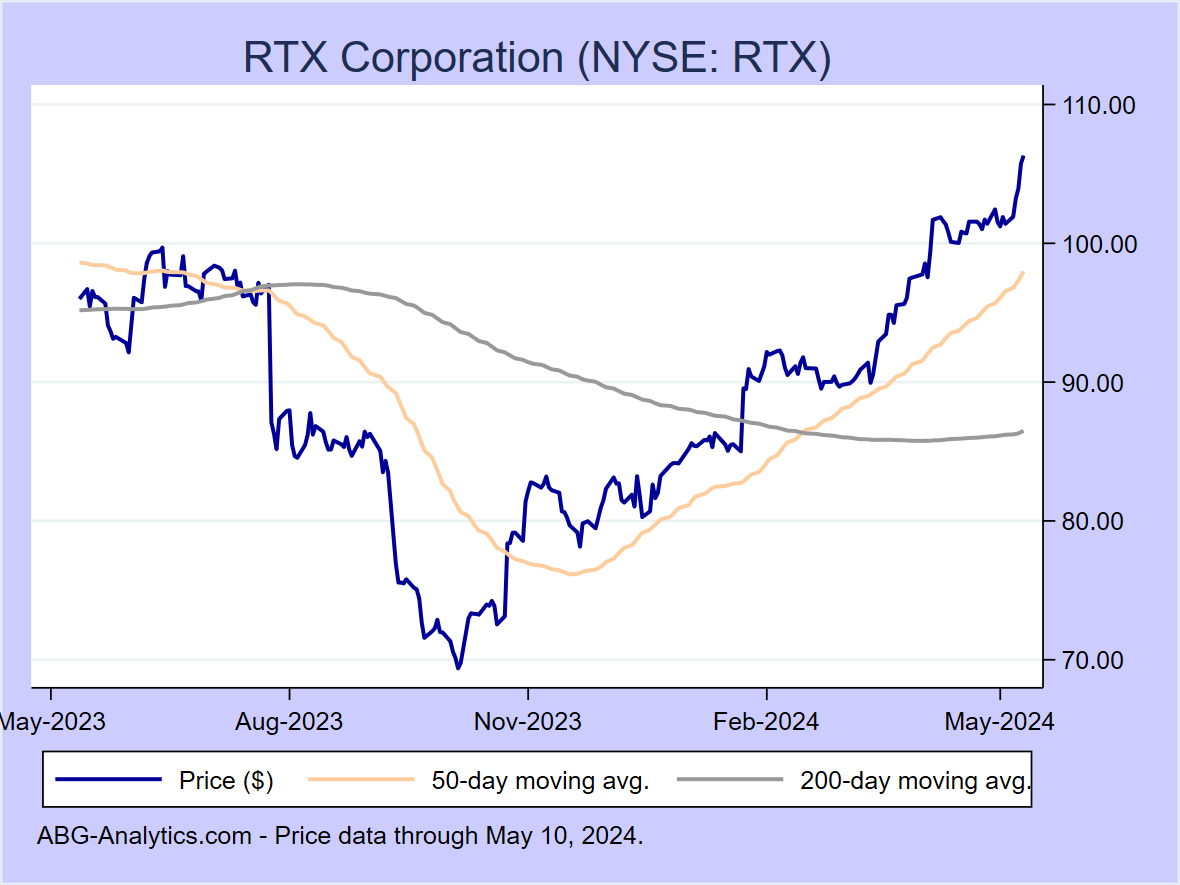

RTX Corporation (NYSE:RTX)

12-month return: -2.4%

12-month return: -2.4%

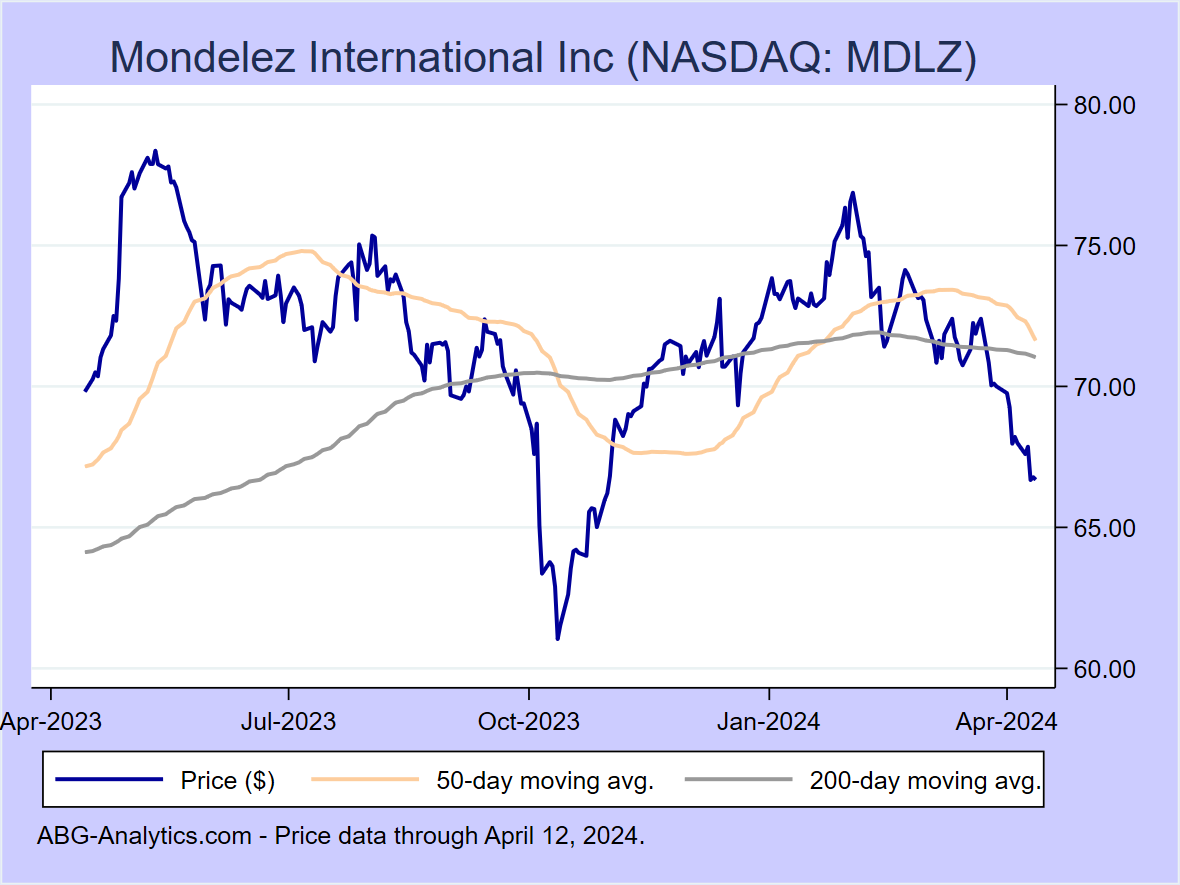

Mondelez International Inc (NASDAQ:MDLZ)

12-month return: -3.2%

12-month return: -3.2%

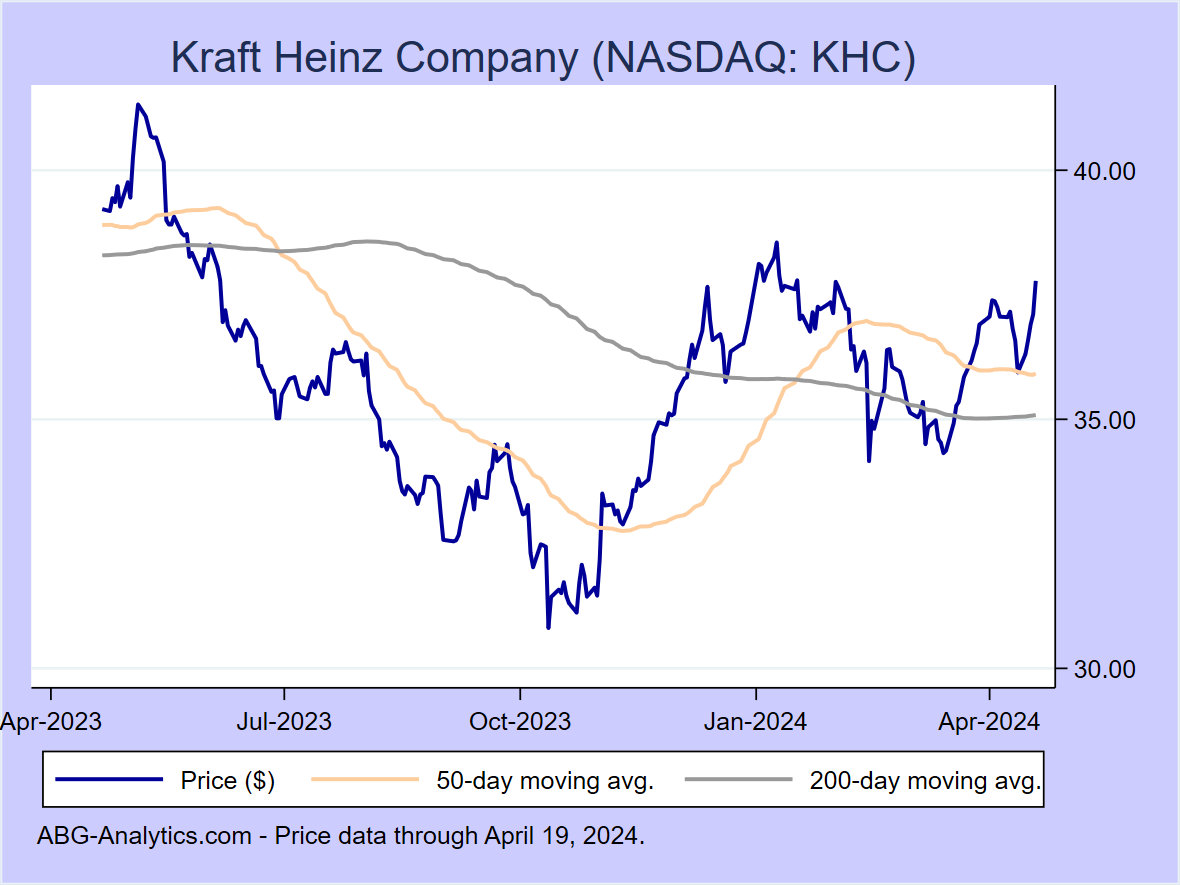

Kraft Heinz Company (NASDAQ:KHC)

12-month return: -4.3%

12-month return: -4.3%

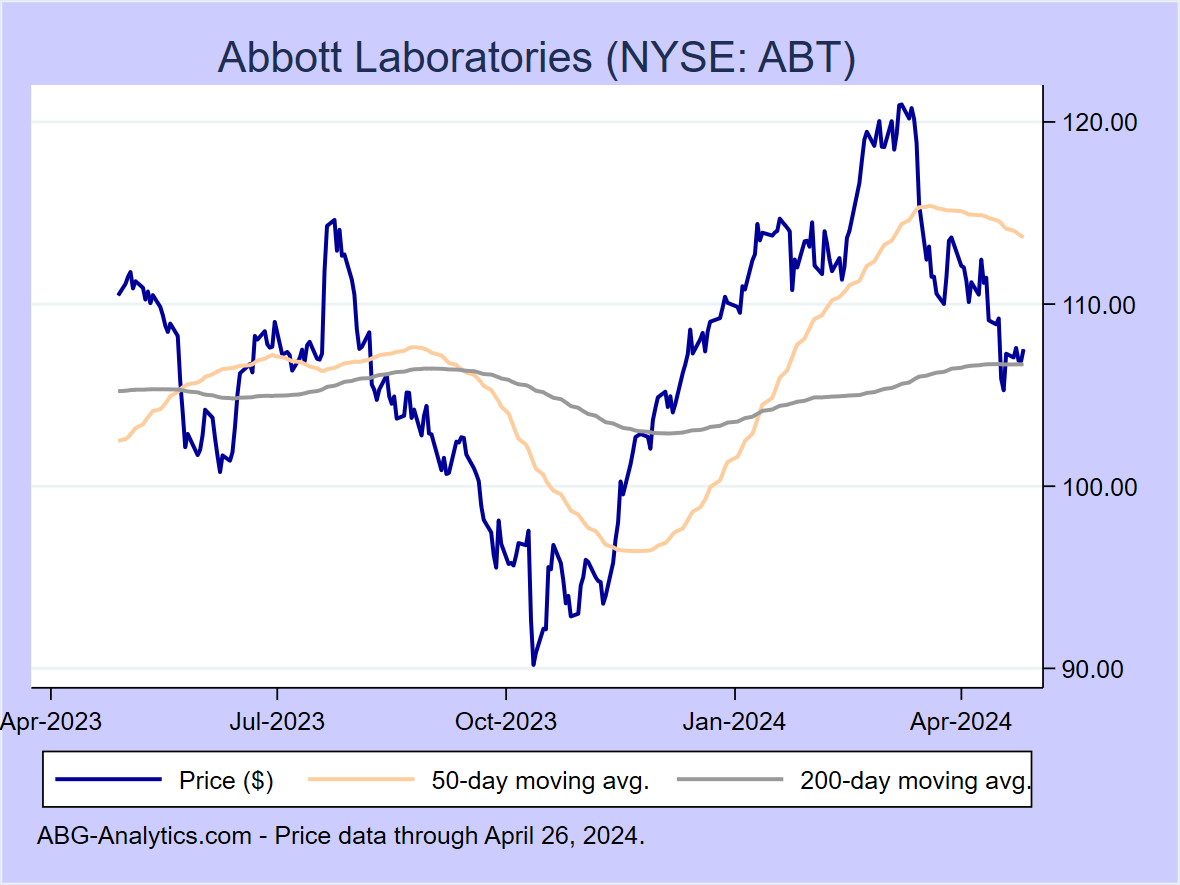

Abbott Laboratories (NYSE:ABT)

12-month return: -4.5%

12-month return: -4.5%

Coca-Cola Co (NYSE:KO)

12-month return: -5.5%

12-month return: -5.5%

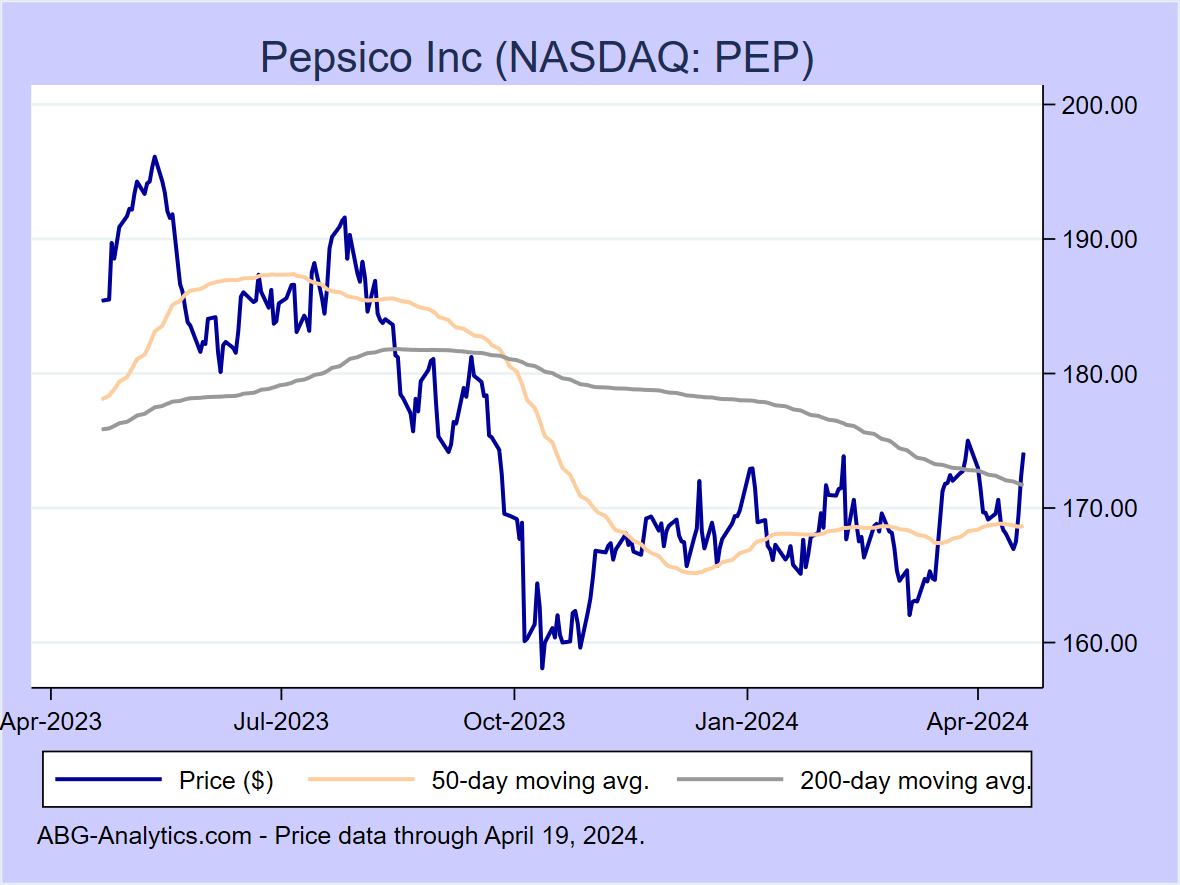

Pepsico Inc (NASDAQ:PEP)

12-month return: -5.7%

12-month return: -5.7%

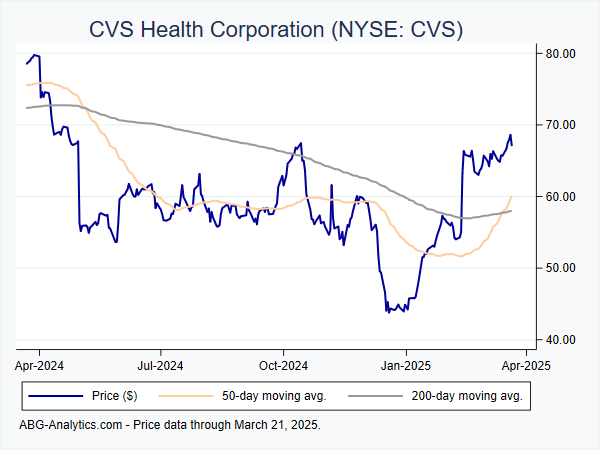

CVS Health Corporation (NYSE:CVS)

12-month return: -6.0%

12-month return: -6.0%

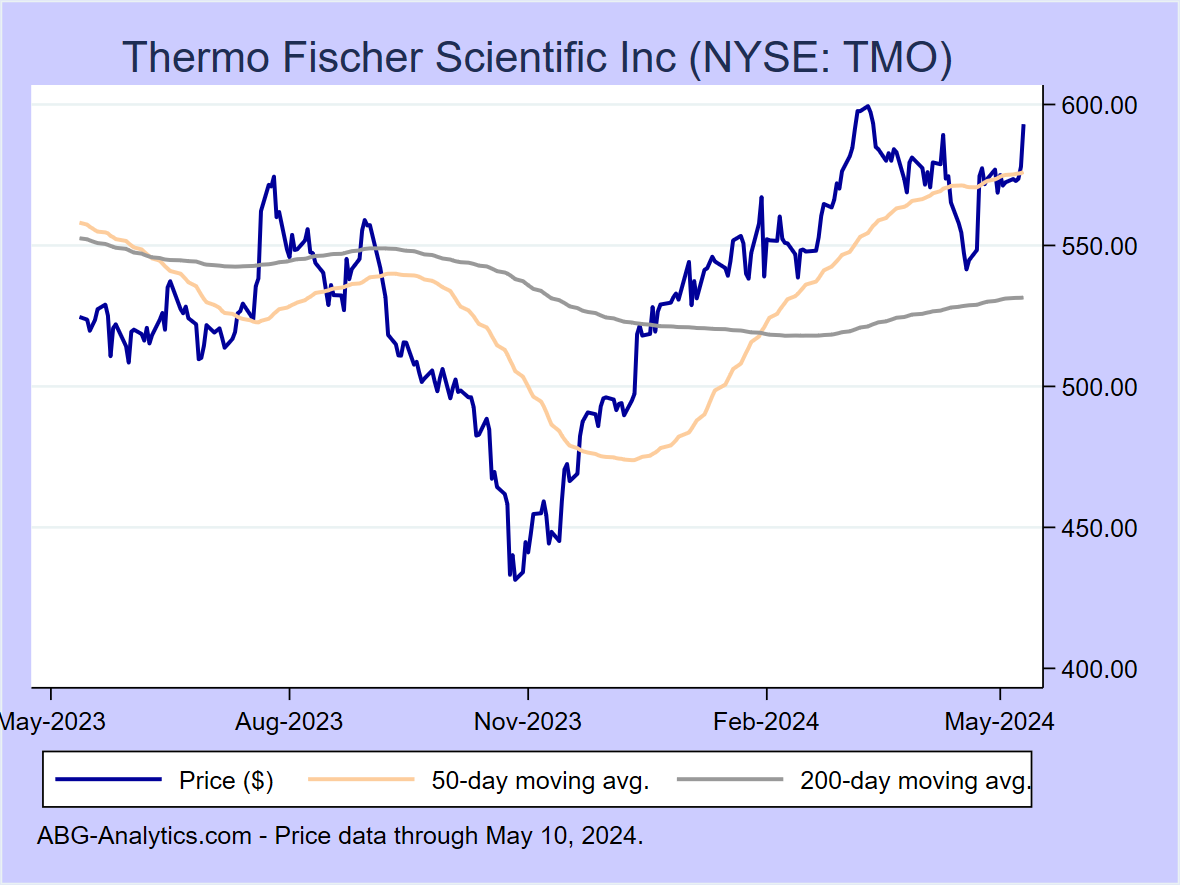

Thermo Fischer Scientific Inc (NYSE:TMO)

12-month return: -6.1%

12-month return: -6.1%

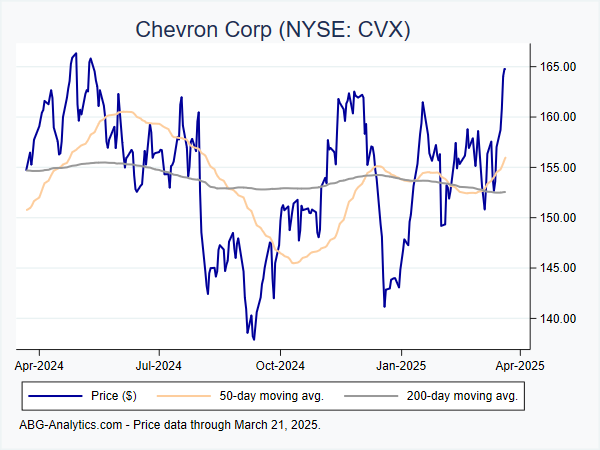

Chevron Corp (NYSE:CVX)

12-month return: -6.3%

12-month return: -6.3%

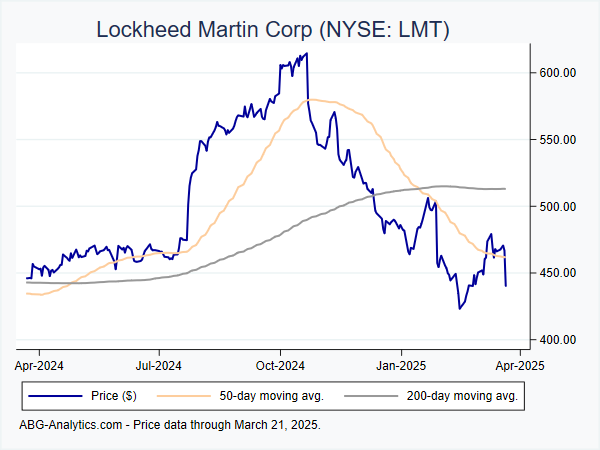

Lockheed Martin Corp (NYSE:LMT)

12-month return: -6.3%

12-month return: -6.3%

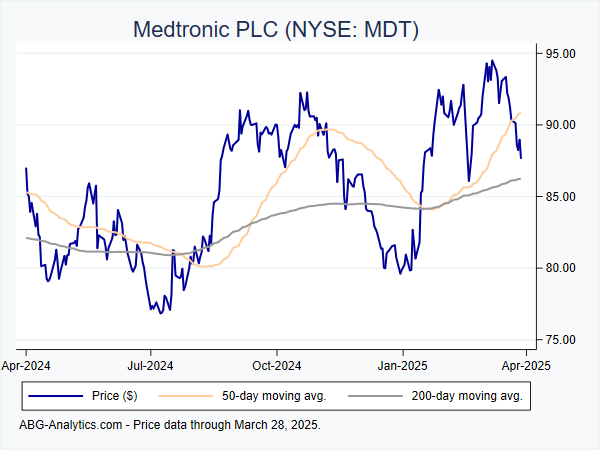

Medtronic PLC (NYSE:MDT)

12-month return: -6.4%

12-month return: -6.4%

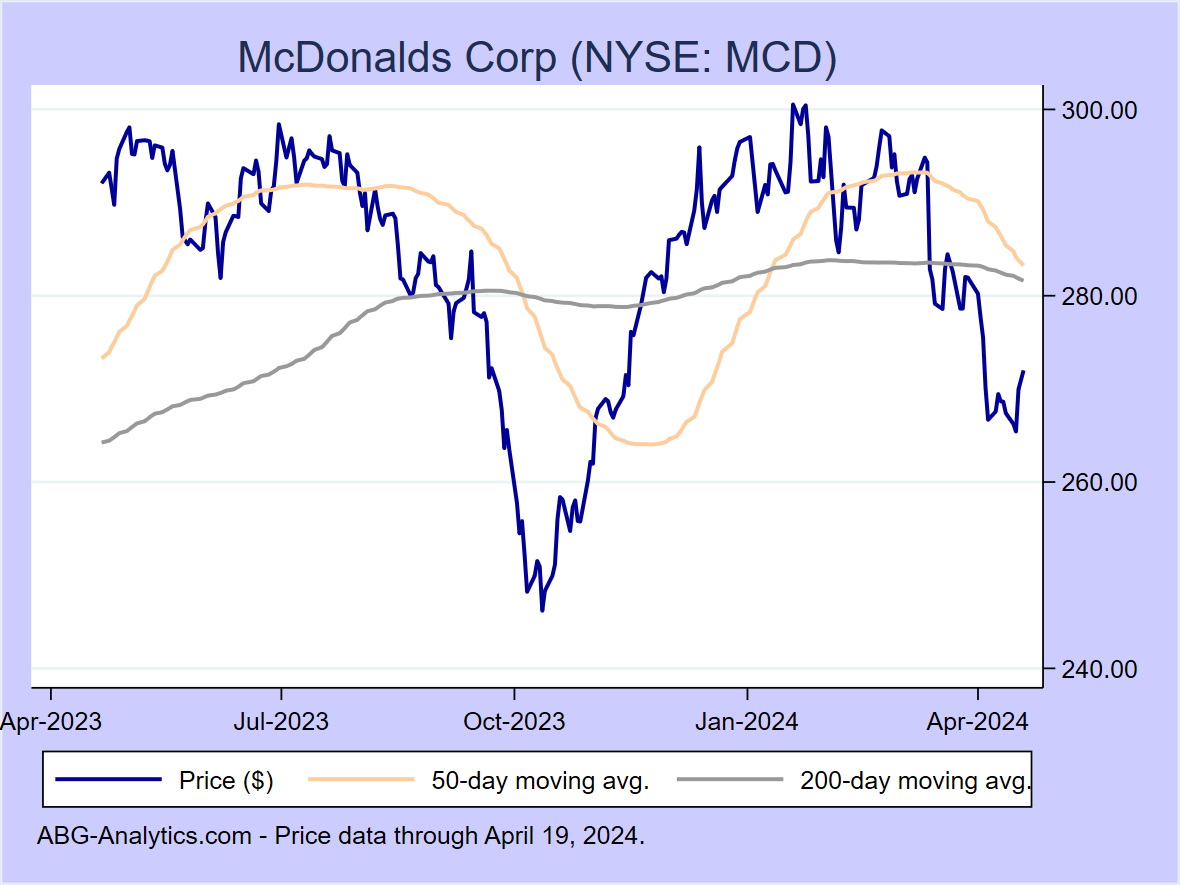

McDonalds Corp (NYSE:MCD)

12-month return: -6.6%

12-month return: -6.6%

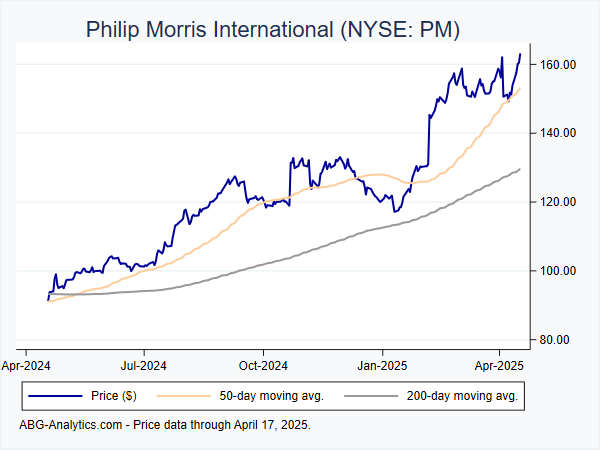

Philip Morris International (NYSE:PM)

12-month return: -7.6%

12-month return: -7.6%

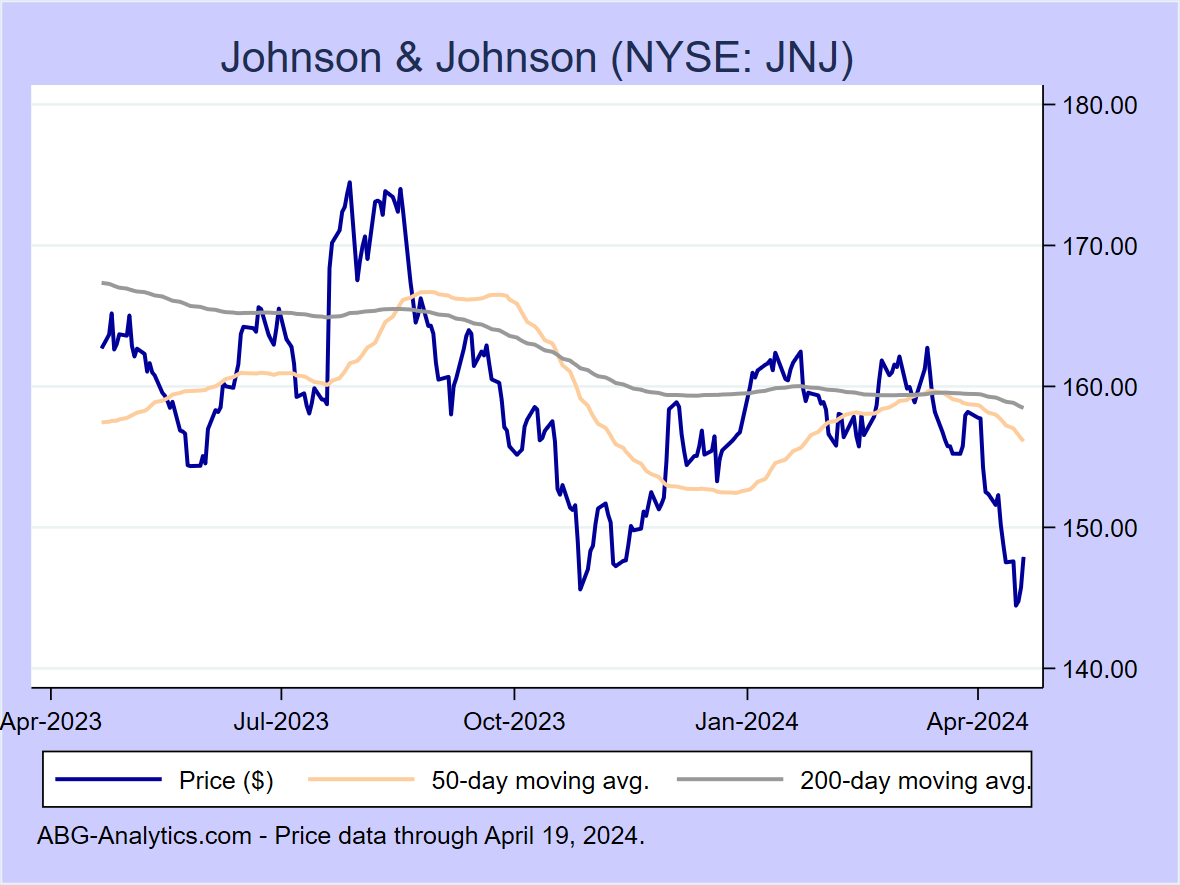

Johnson & Johnson (NYSE:JNJ)

12-month return: -9.0%

12-month return: -9.0%

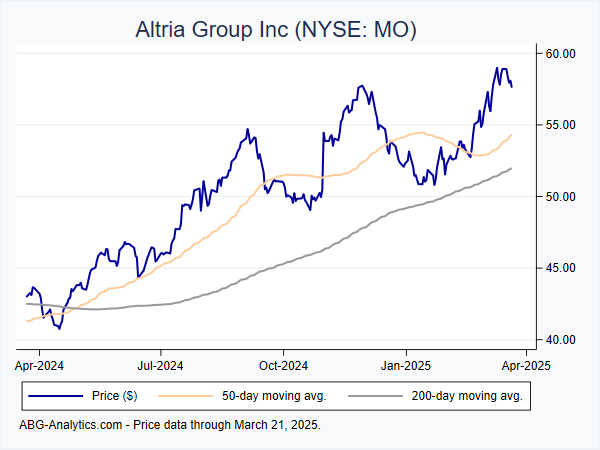

Altria Group Inc (NYSE:MO)

12-month return: -9.4%

12-month return: -9.4%

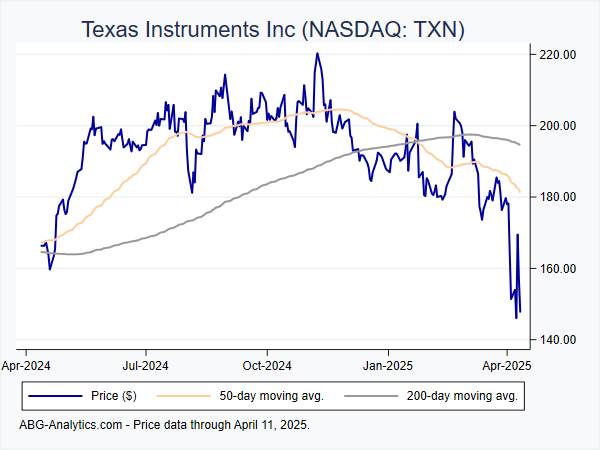

Texas Instruments Inc (NASDAQ:TXN)

12-month return: -9.8%

12-month return: -9.8%

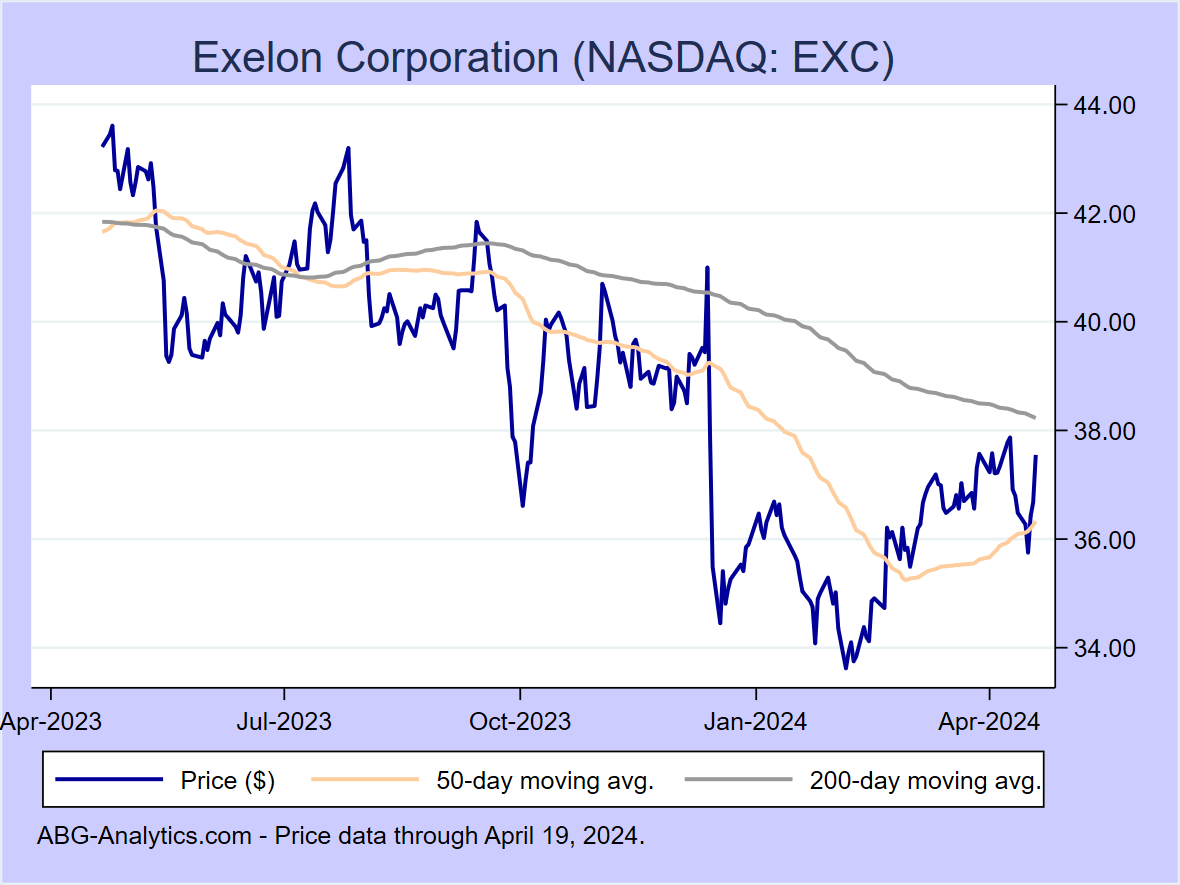

Exelon Corporation (NASDAQ:EXC)

12-month return: -12.8%

12-month return: -12.8%

AT&T Inc (NYSE:T)

12-month return: -16.2%

12-month return: -16.2%

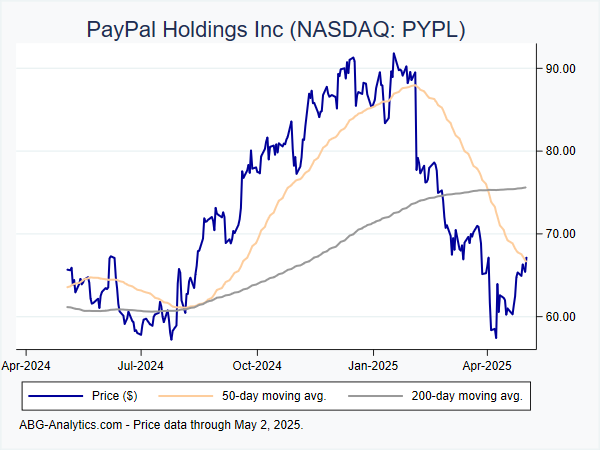

PayPal Holdings Inc (NASDAQ:PYPL)

12-month return: -17.3%

12-month return: -17.3%

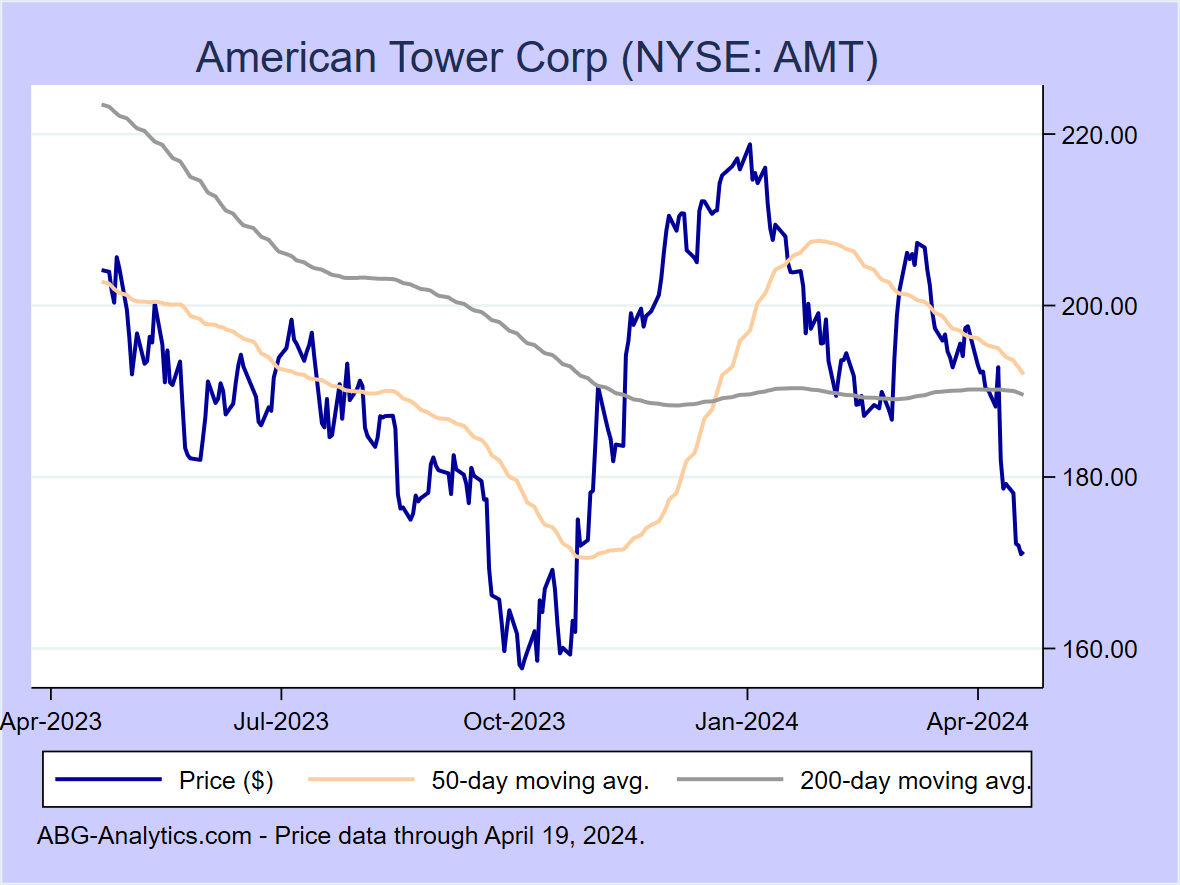

American Tower Corp (NYSE:AMT)

12-month return: -17.7%

12-month return: -17.7%

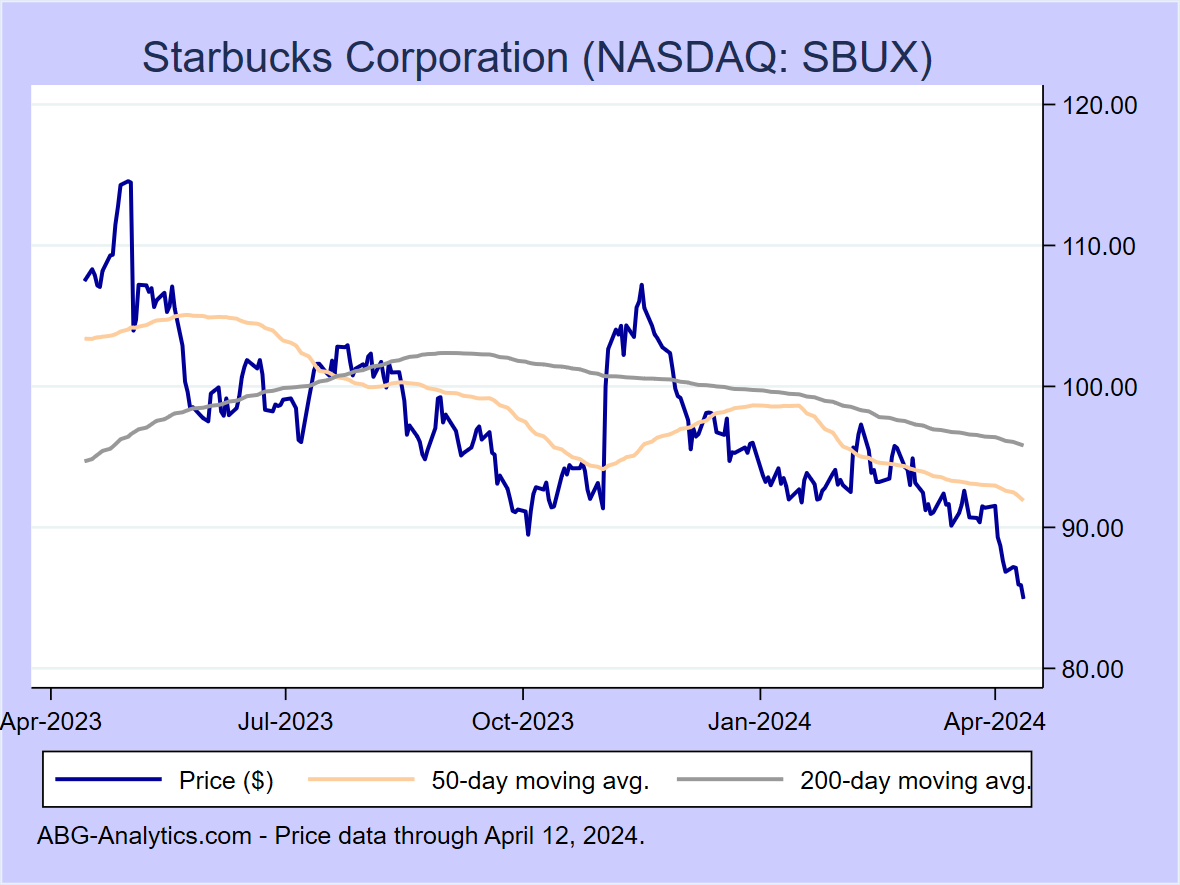

Starbucks Corporation (NASDAQ:SBUX)

12-month return: -18.2%

12-month return: -18.2%

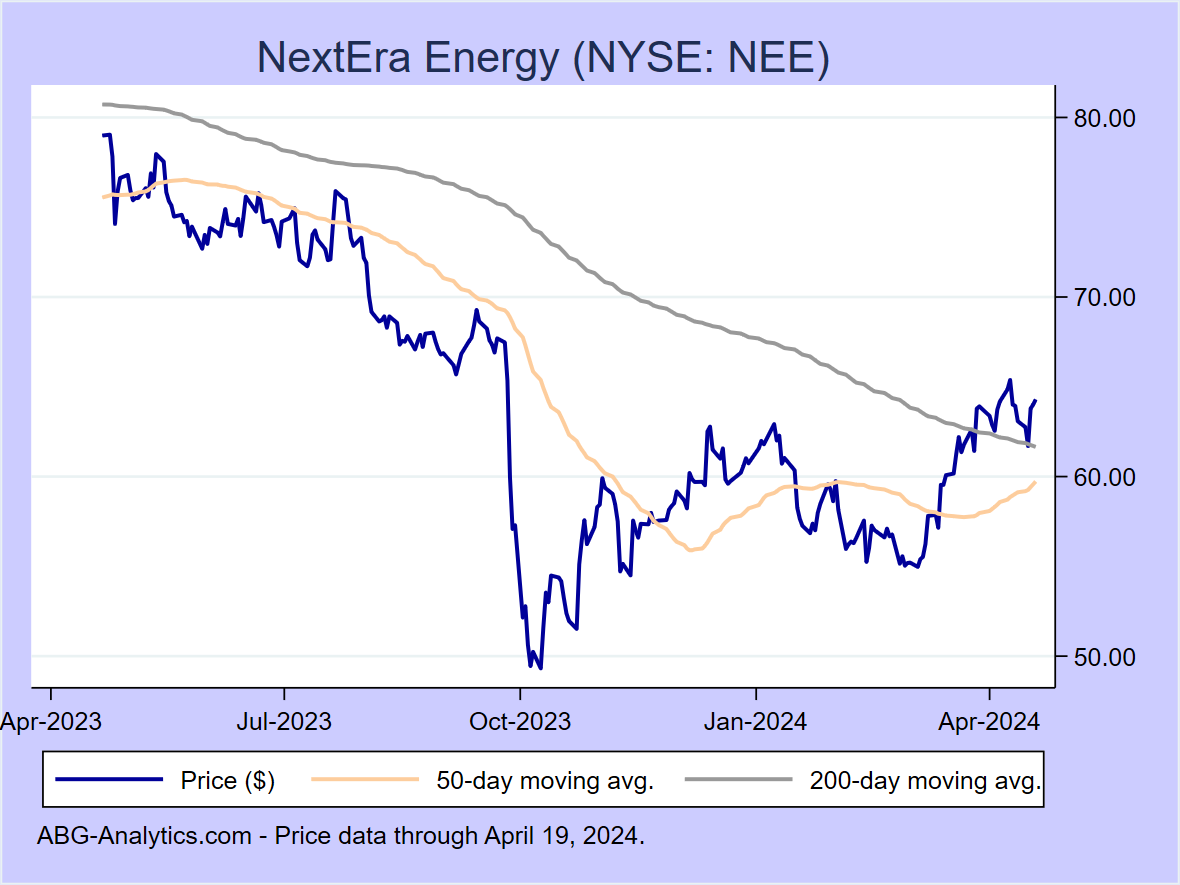

NextEra Energy (NYSE:NEE)

12-month return: -18.5%

12-month return: -18.5%

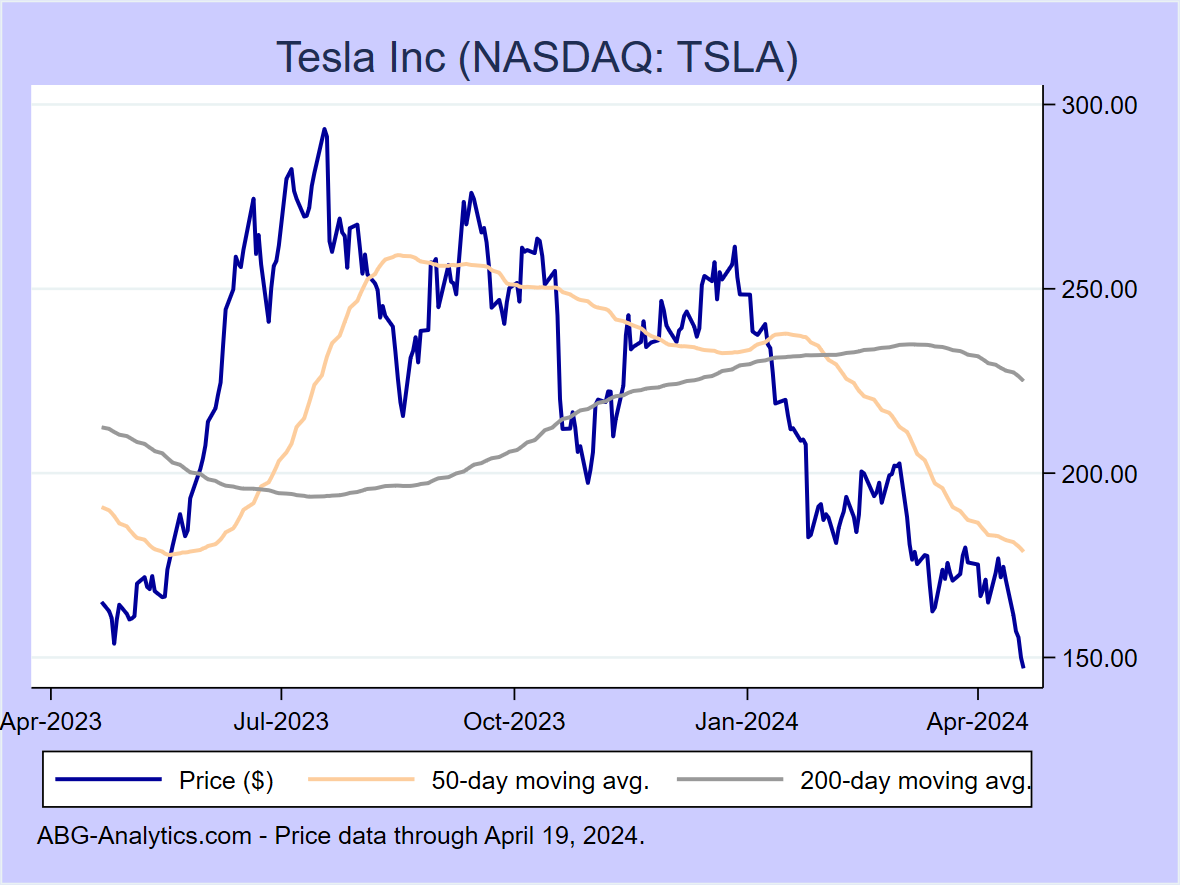

Tesla Inc (NASDAQ:TSLA)

12-month return: -18.6%

12-month return: -18.6%

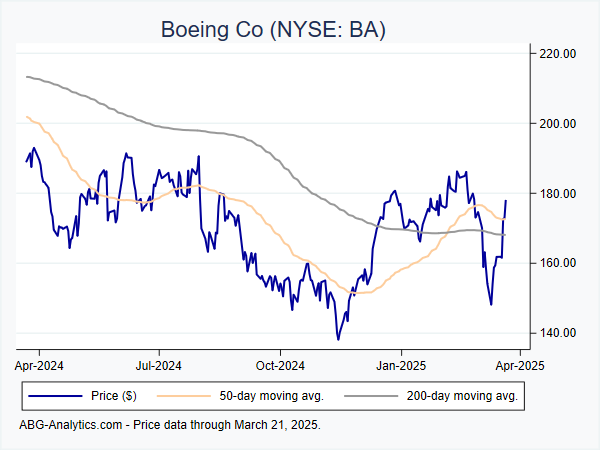

Boeing Co (NYSE:BA)

12-month return: -18.6%

12-month return: -18.6%

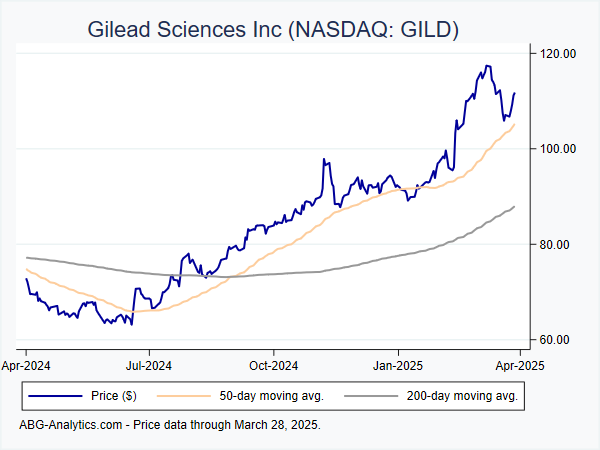

Gilead Sciences Inc (NASDAQ:GILD)

12-month return: -20.6%

12-month return: -20.6%

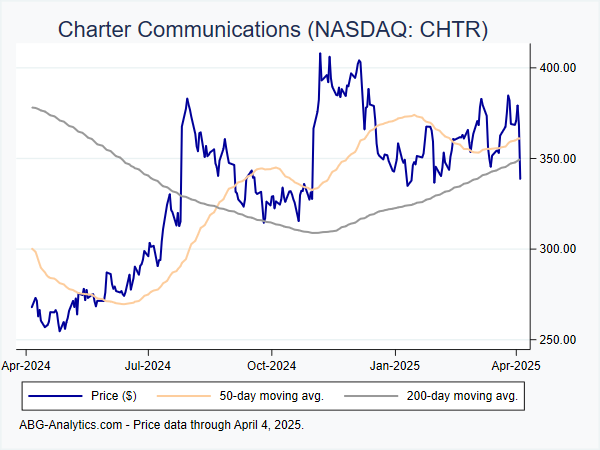

Charter Communications (NASDAQ:CHTR)

12-month return: -22.8%

12-month return: -22.8%

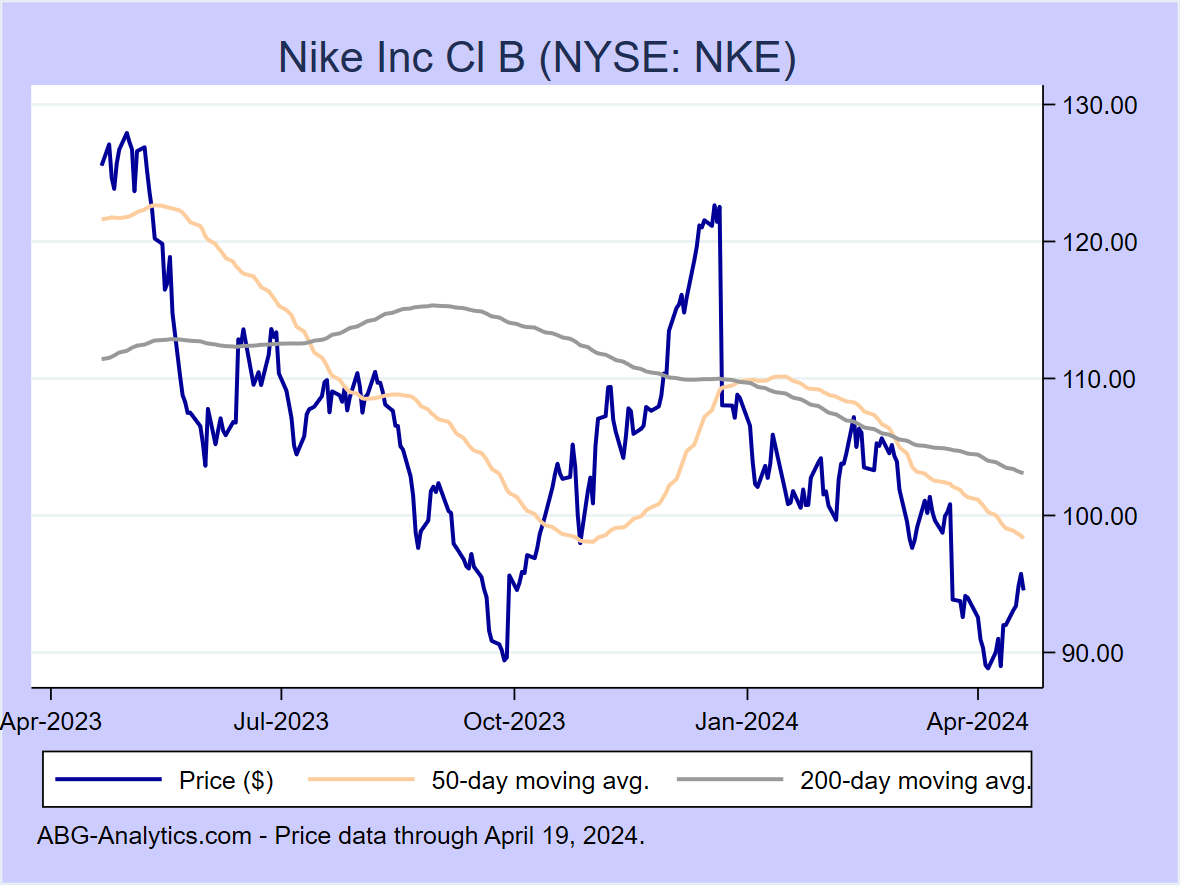

Nike Inc Cl B (NYSE:NKE)

12-month return: -24.8%

12-month return: -24.8%

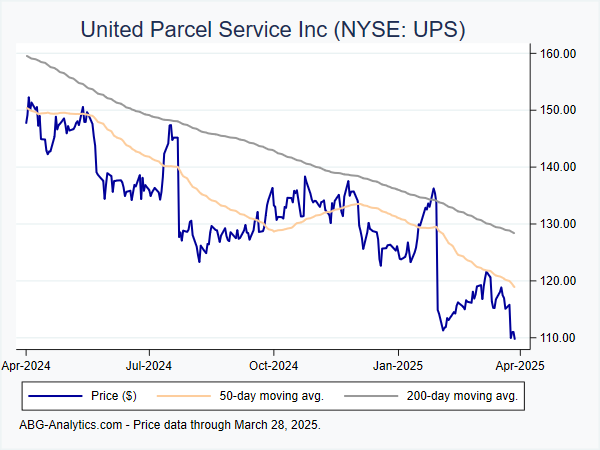

United Parcel Service Inc (NYSE:UPS)

12-month return: -27.2%

12-month return: -27.2%

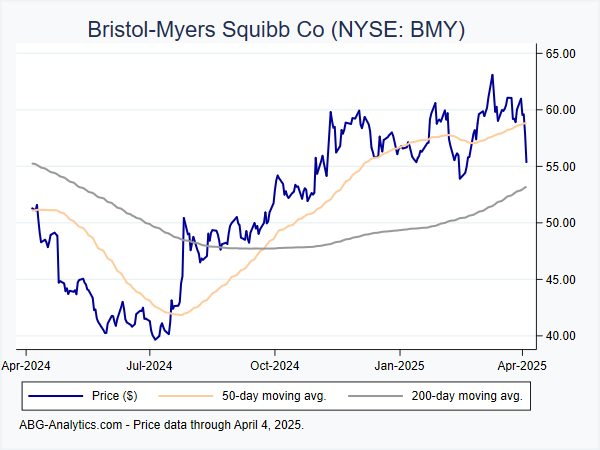

Bristol-Myers Squibb Co (NYSE:BMY)

12-month return: -30.0%

12-month return: -30.0%

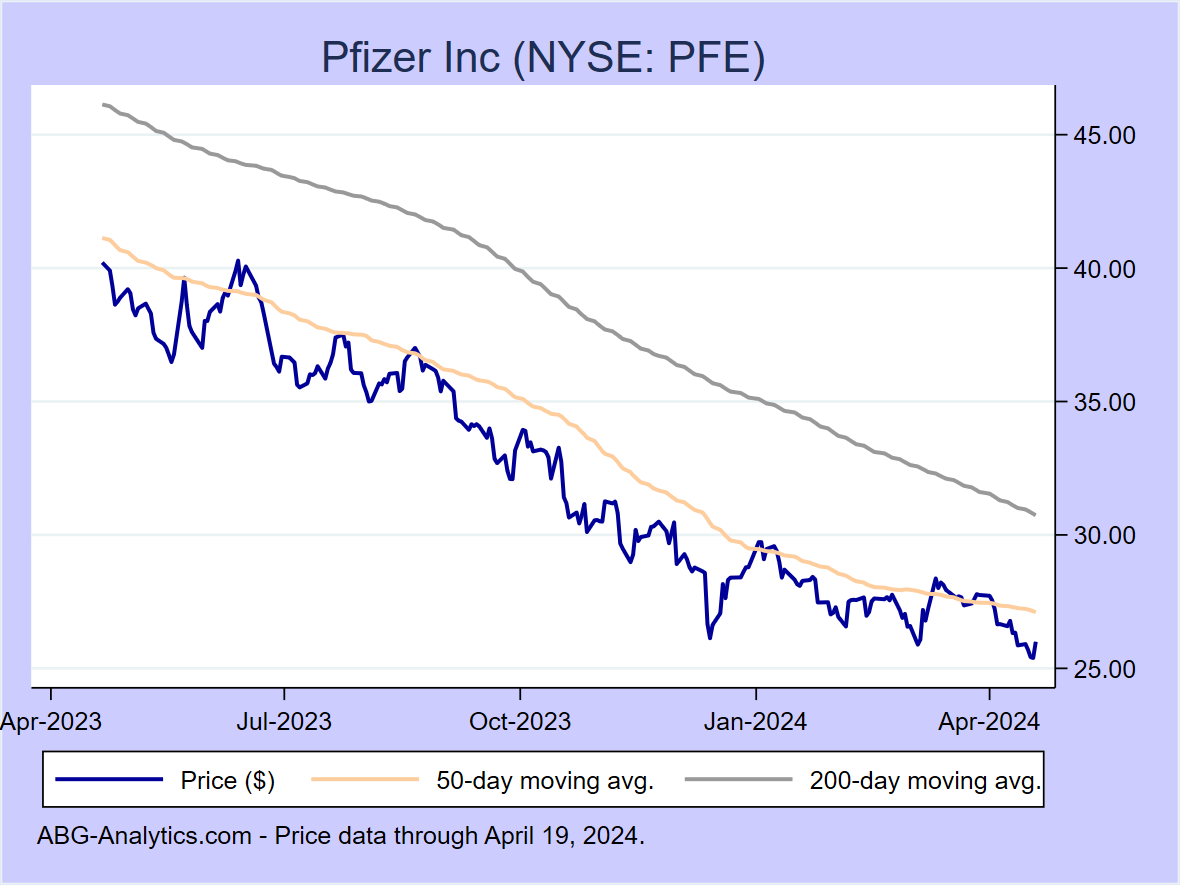

Pfizer Inc (NYSE:PFE)

12-month return: -35.4%

12-month return: -35.4%

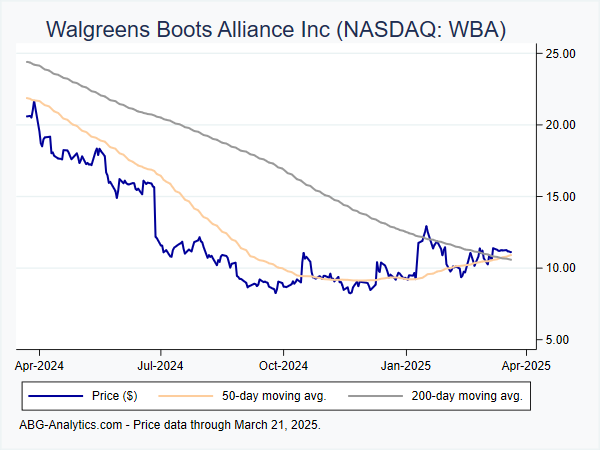

Walgreens Boots Alliance Inc (NASDAQ:WBA)

12-month return: -47.6%

12-month return: -47.6%