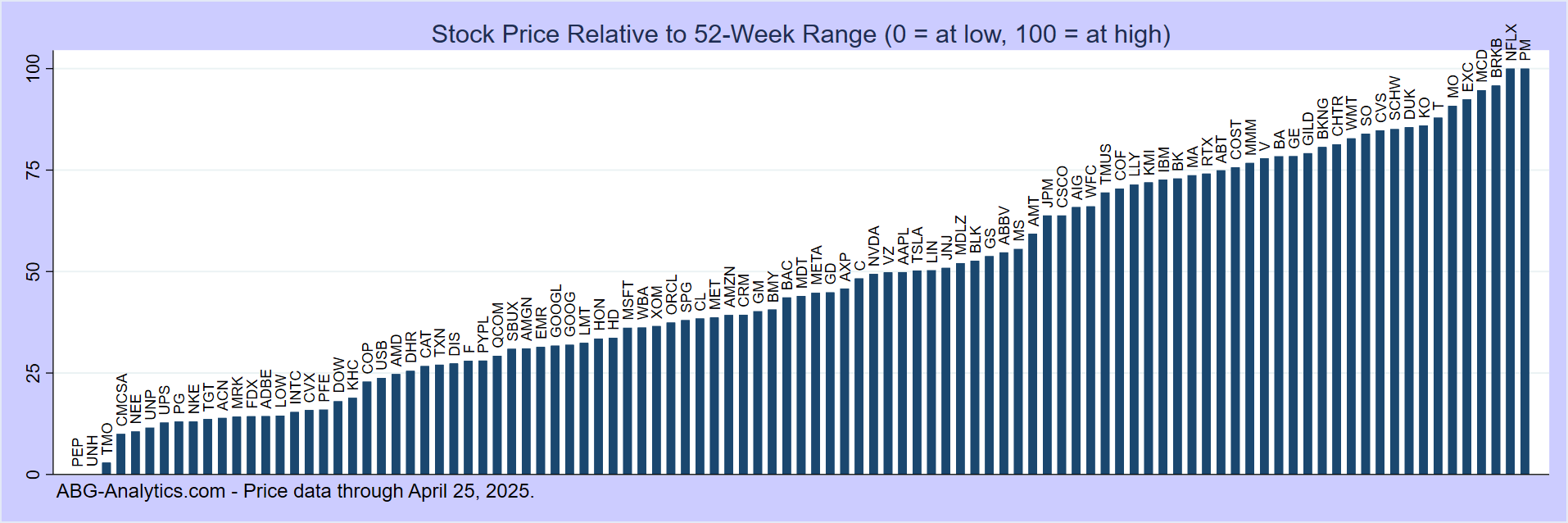

Stocks Trading Near 52-Week Highs and Lows

| Ticker - Company | Closing Price | 52-Week Low | 52-Week High | Price Relative to 52 Week Range (0 to 100%) |

|---|---|---|---|---|

| Apple Inc (NASDAQ:AAPL) | $278.12 | $172.42 | $286.19 | 94% |

| Amgen Inc (NASDAQ:AMGN) | $384.32 | $262.28 | $384.32 | 100% |

| Bank Of America Corp (NYSE:BAC) | $56.53 | $34.39 | $57.25 | 98% |

| Bank of New York Mellon Corporation (NYSE:BK) | $124.32 | $73.31 | $124.59 | 100% |

| Bristol-Myers Squibb Co (NYSE:BMY) | $61.99 | $42.60 | $63.11 | 95% |

| Citigroup (NYSE:C) | $122.69 | $58.13 | $123.30 | 99% |

| Caterpillar Inc (NYSE:CAT) | $726.20 | $273.94 | $726.20 | 100% |

| ConocoPhillips (NYSE:COP) | $107.62 | $82.66 | $107.62 | 100% |

| Cisco Systems Inc (NASDAQ:CSCO) | $84.82 | $53.19 | $84.82 | 100% |

| Chevron Corp (NYSE:CVX) | $180.86 | $133.73 | $181.23 | 99% |

| Emerson Electric Co (NYSE:EMR) | $157.38 | $94.15 | $157.38 | 100% |

| Fedex Corp (NYSE:FDX) | $369.23 | $198.07 | $369.23 | 100% |

| General Dynamics Corp (NYSE:GD) | $360.07 | $241.94 | $368.69 | 94% |

| GE Aerospace (NYSE:GE) | $321.00 | $166.81 | $327.54 | 97% |

| Gilead Sciences Inc (NASDAQ:GILD) | $152.50 | $95.48 | $152.50 | 100% |

| General Motors Company (NYSE:GM) | $84.24 | $42.48 | $86.38 | 96% |

| Honeywell International (NASDAQ:HON) | $238.38 | $171.63 | $238.38 | 100% |

| Johnson & Johnson (NYSE:JNJ) | $239.99 | $146.36 | $239.99 | 100% |

| Kinder Morgan Inc (NYSE:KMI) | $30.50 | $25.21 | $30.50 | 100% |

| Coca-Cola Co (NYSE:KO) | $79.03 | $63.84 | $79.03 | 100% |

| Lockheed Martin Corp (NYSE:LMT) | $623.58 | $410.74 | $636.00 | 95% |

| Lowes Companies Inc (NYSE:LOW) | $278.38 | $210.83 | $278.38 | 100% |

| McDonalds Corp (NYSE:MCD) | $327.16 | $285.55 | $327.16 | 100% |

| Medtronic PLC (NYSE:MDT) | $102.90 | $80.68 | $105.35 | 91% |

| 3M Company (NYSE:MMM) | $172.65 | $126.09 | $173.09 | 99% |

| Merck & Co (NYSE:MRK) | $121.93 | $73.47 | $121.93 | 100% |

| NextEra Energy (NYSE:NEE) | $89.47 | $64.11 | $89.97 | 98% |

| Pepsico Inc (NASDAQ:PEP) | $170.49 | $128.02 | $170.49 | 100% |

| Pfizer Inc (NYSE:PFE) | $27.22 | $21.59 | $27.37 | 98% |

| Philip Morris International (NYSE:PM) | $182.81 | $144.33 | $184.95 | 95% |

| RTX Corporation (NYSE:RTX) | $198.66 | $113.75 | $203.50 | 96% |

| Charles Schwab Corp (NYSE:SCHW) | $105.08 | $69.06 | $105.17 | 100% |

| Simon Property Group (NYSE:SPG) | $199.60 | $140.37 | $199.60 | 100% |

| Texas Instruments Inc (NASDAQ:TXN) | $221.44 | $145.61 | $225.21 | 96% |

| Union Pacific Corp (NYSE:UNP) | $252.62 | $208.27 | $252.62 | 100% |

| US Bancorp (NYSE:USB) | $60.69 | $36.40 | $60.69 | 100% |

| Verizon Communications (NYSE:VZ) | $46.31 | $38.40 | $47.10 | 92% |

| Wells Fargo & Company (NYSE:WFC) | $93.97 | $60.98 | $96.39 | 94% |

| Walmart Inc (NASDAQ:WMT) | $131.18 | $81.79 | $131.18 | 100% |

| Ticker - Company | Closing Price | 52-Week Low | 52-Week High | Price Relative to 52 Week Range (0 to 100%) |

|---|---|---|---|---|

| Adobe Systems Inc (NASDAQ:ADBE) | $268.38 | $268.38 | $464.11 | 0% |

| American Tower Corp (NYSE:AMT) | $171.27 | $168.51 | $232.35 | 5% |

| Salesforce Inc (NYSE:CRM) | $191.35 | $189.97 | $329.85 | 1% |

| Netflix Inc (NASDAQ:NFLX) | $82.20 | $79.94 | $133.91 | 5% |

| PayPal Holdings Inc (NASDAQ:PYPL) | $40.42 | $39.90 | $78.62 | 2% |

Methods

- Stocks are deemed to be near their 52-week high (low) if they are within 3 percent of the high (low) or they achieved a new high (low) within the 5 most recent market days.

- Price relative to 52-week range is calculated as [log(price)-log(low price)]/[log(high price)-log(low price)]*100%. Thus a stock with a current price of $4 with a 52-week high of $8 and a 52-week low of $2 will have price relative to range of 50%.