Amazon.Com Inc (NASDAQ: AMZN)

RETAIL - Catalog & Mail Order HousesSector: Consumer Discretionary

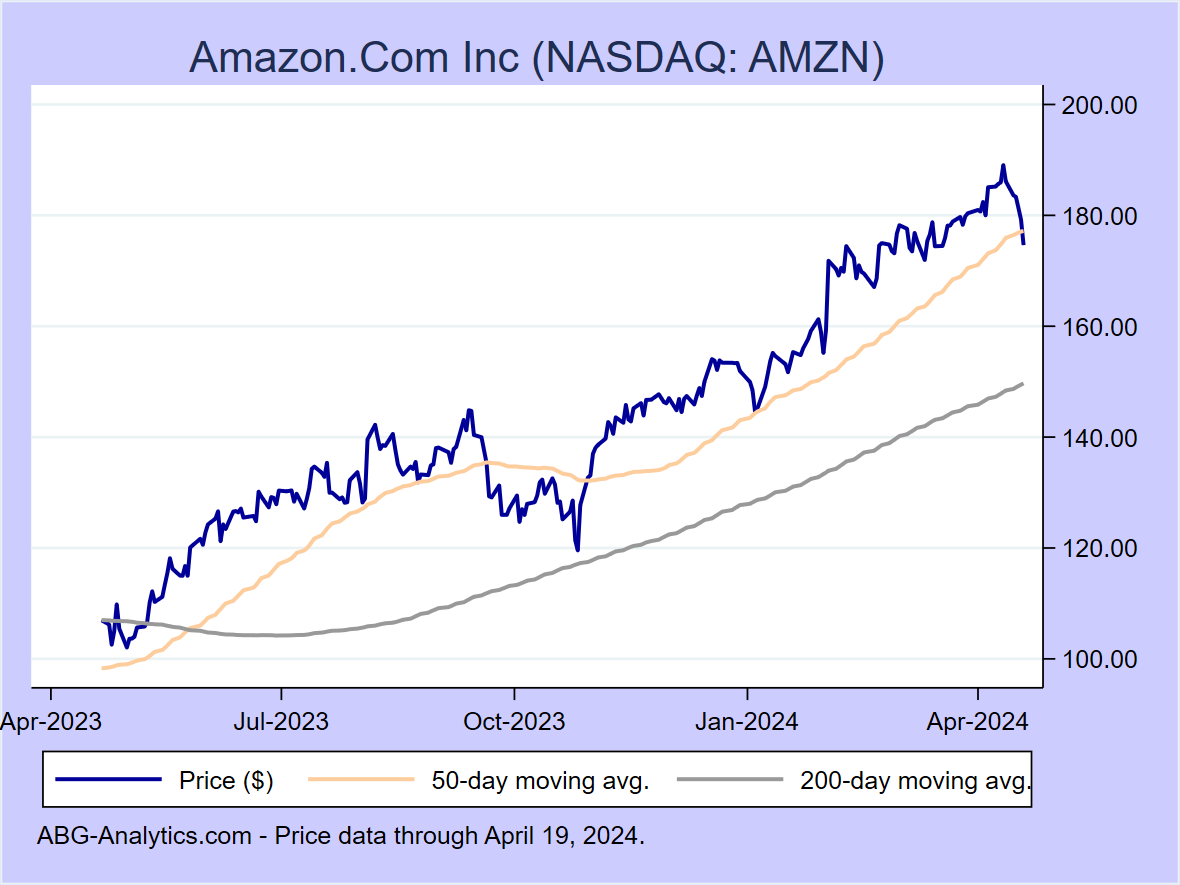

Stock price data as of 04/26/2024

Closing price: 179.62

| Support price level: | $168.10 |

| Resistance price level: | $180.18 |

| Relative strength index (14-day RSI) | 42.0 |

| Beta | 1.64 |

- With a 71.1 percent return in the past year, this stock outperformed 90 percent of stocks in the S&P-100.

- The price of this high-beta stock is expected to increase by 1.64% for every 1% increase in the S&P-500.

- Volatility is forecast to fall over the next month.

- Price crossed above 50-day moving average this week - a bullish signal.

| Low | High | Price as % of Range |

| $102.05 | $189.05 | 91.7% |

| 200 day | 50 day | 20 day | 10 day |

| $150.90 | $177.78 | $181.49 | $178.87 |

| Historical (5 year) |

Last month | Current estimate | Next month forecast |

| 34.8% | 21.4% | 30.4% | 34.3% |

- 8.3% in the next week.

- 19.4% in the next month.

- 57.6% in the next year.

Company news for Amazon.Com Inc

Google Finance |

MarketWatch |

WSJ

Analysis for other Consumer Discretionary stocks